Intercorporate Investments

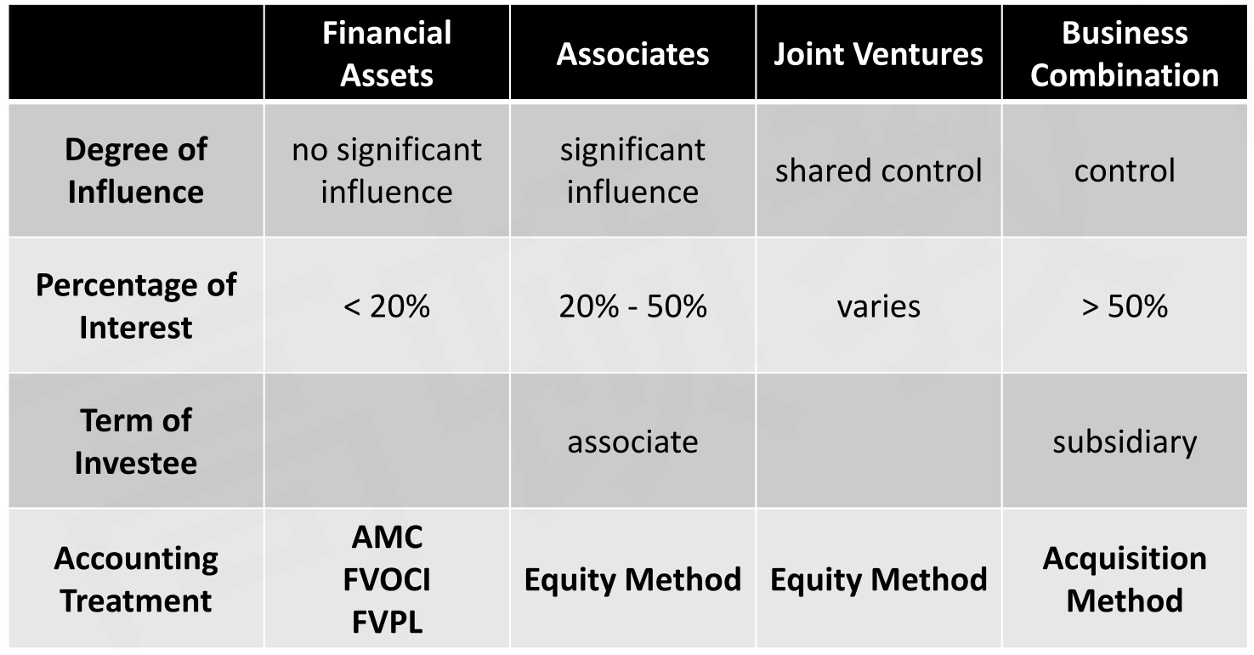

Categorization of Investment

- Investments in marketable debt and equity securities can be categorized as

- Investments in financial assets对金融资产投资, in which the investor has no significant influence and control over the operations of the investee

- Investments in associates对联营企业投资, in which the investor can exert significant influence (but not control) over the investee

- Joint ventures对合营企业投资, where control is shared by two or more entities

- Business combinations对子公司投资, including investments in subsidiaries子公司 which the investor obtains a controlling interest over the investment

- Percentage of ownership is typically used to determine the appropriate category根据股份判断

- Lack of influence is generally presumed when the investor holds less than a 20% equity interest

- Significant influence is generally presumed between 20% and 50%

- Control is presumed when the percentage of ownership exceeds 50%

- The distinction between investments in financial assets, investments in associates, and business combinations is based on the degree of influence or control根据实质判断, rather than purely on the percent holding

- The ownership percentage is only a guideline

Investments In Financial Assets

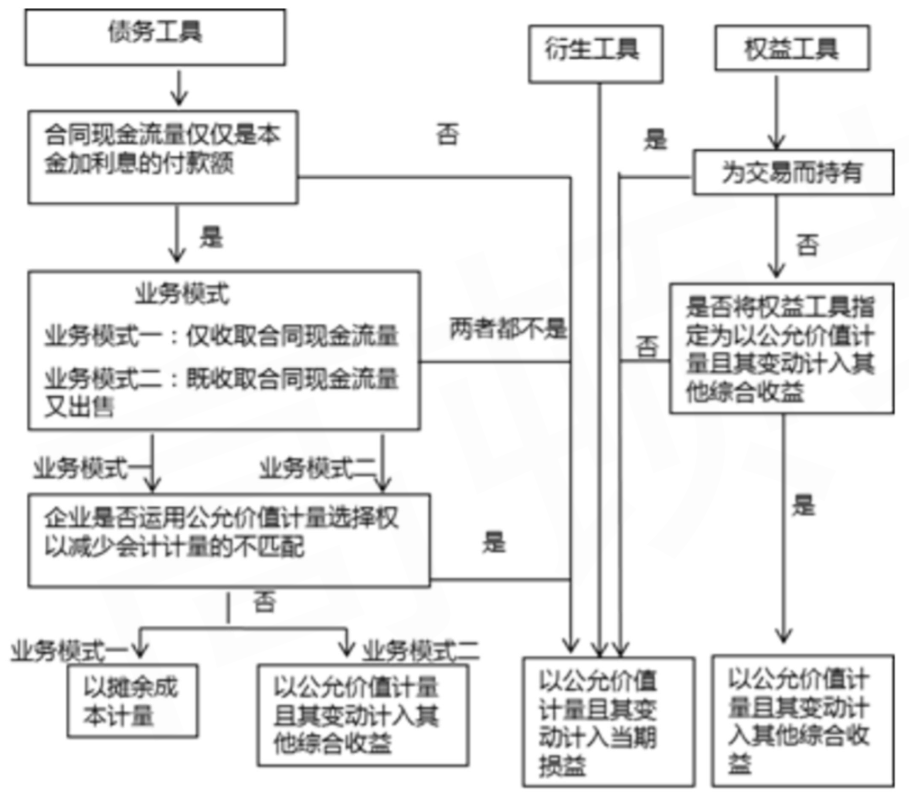

Classification o Financial Assets

- Two Criteria for Financial Assets Classification

- Cash flow characteristic test合同现金流是否为本金+利息: Whether the contractual cash flows are solely payments of principal and interest on principal

- Business model test收购金融资产的目的: A business model refers to how an entity manages its financial assets in order to generate cash flows

Collecting contractual cash flows为了获取合同现金流

Selling financial assets为了出售

Both两者都有

- Basic Principles

- Financial assets that meet the following two criteria are generally measured at amortized cost(AMC)

The contractual cash flows are solely payments of principal and interest on principal合同现金流为本金+利息

The financial assets are being held to collect contractual cash flows为了获取合同现金流 - If the financial asset meets the first criteria above (cash flow characteristic test合同现金流为本金+利息), but may be sold, a "hold-to-collect and sell两者都有" business model, it maybe measured at fair value through other comprehensive income (FVOCI)

- All other remaining financial assets are classified into fair value through profit or loss (FVPL)

- Financial assets that meet the following two criteria are generally measured at amortized cost(AMC)

- Supplement

- Derivatives are measured at FVPL (except for hedging instruments)

Embedded derivatives are not separated from the hybrid contract if the asset falls within the scope of this standard, and the asset as a whole is measured at FVPL - Designated as FVPL强行指定为FVPL

Management may choose "FVPL option" to avoid an accounting mismatch为了避免会计错配而强行指定, which refers to an inconsistency resulting from different measurement bases for assets and liabilities - designated as FVOCI强行指定为FVOCI

Management may designate non-tradable equity investment as measured at FVOCI

Only the dividend income is recognized in profit or loss分红时会影响利润表PL,此外只影响其它综合收益OCI

- Derivatives are measured at FVPL (except for hedging instruments)

- Summary

- Debt instruments are measured at AMC, FVOCI, or FVPL depending upon the business model

- Equity instruments are measured at FVPL,or FVOCI

Measurement of Financial Assets

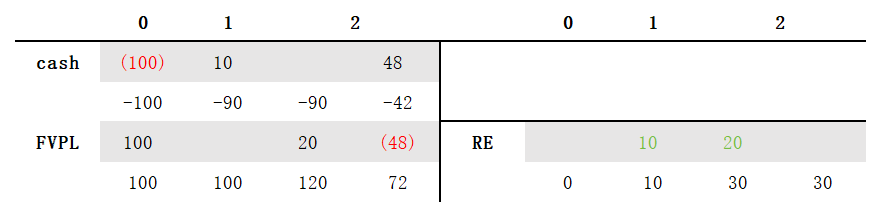

- 权益投资: T0时以价格10元买入10股,T1时每股分红1元,T2时以价格12元卖出4股

- 当为FVPL

分红10元计入利润表-投资收益,使得RE增加10

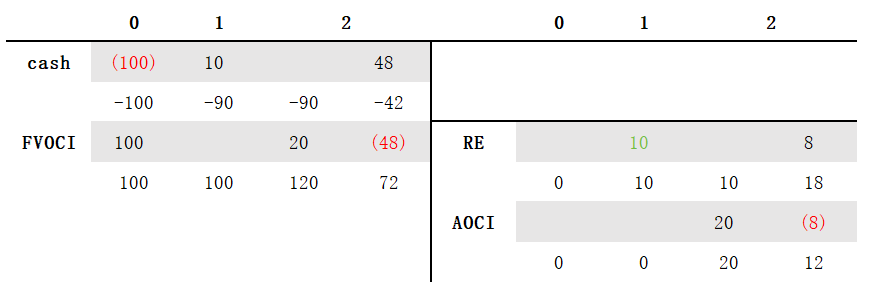

浮盈20元计入利润表-公允价值变动,使得RE增加20 - 当为FVOCI

分红10元计入利润表-投资收益,使得RE增加10

浮盈20元计入AOCI,不影响利润表

出售时相应份额AOCI转入RE,不影响利润表

- 当为FVPL

- 债权投资: 买入面值1000、期限3年、票息率10%、价格951.96的债券(即实际利率12%)

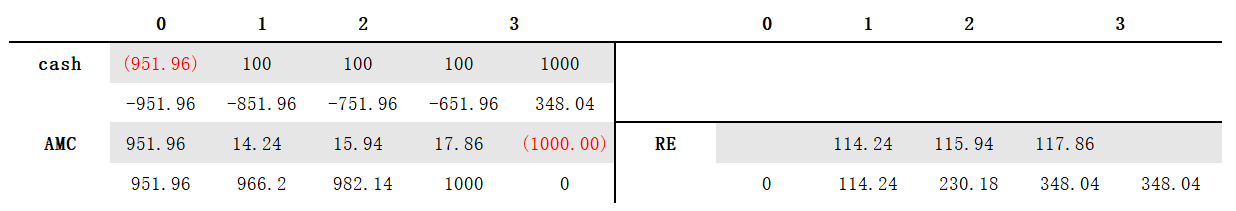

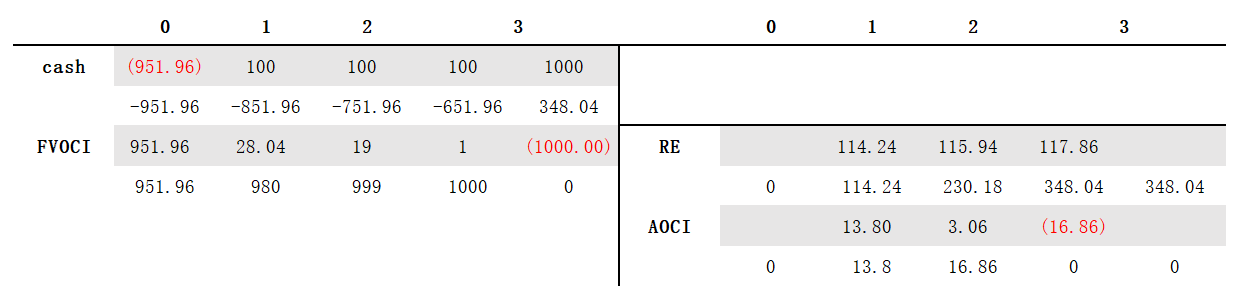

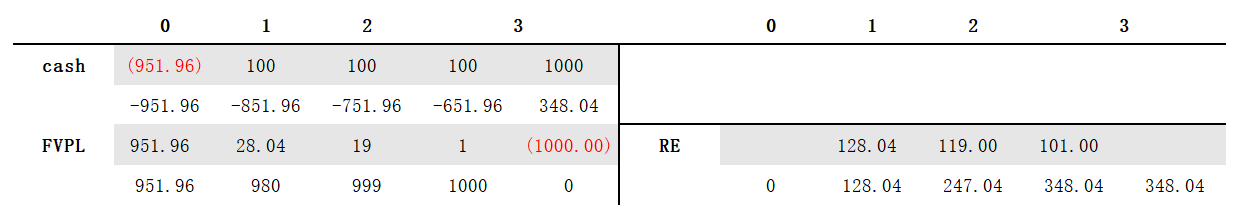

- 当为AMC

AMC的值等于净现值

RE变动值等于上一期净现值乘实际利率 - 当为FVOCI(假设之后市场价分别980、999、1000)

RE变动值等于上一期净现值乘实际利率

FVOCI的值永远等于市场价值,与RE的差异部分计入AOCI - 当为FVPL

FVPL的值永远等于市场价值,通过RE直接配平

- 无论作为哪个分类,对利润表的总影响都一样

- 当为AMC

- Impairment of financial assets

- The new standard moves the recognition criteria from an "incurred loss"model to an "expected loss" model根据预期提前减值,谨慎性准则

- Under the new criteria, there is an earlier recognition of impairment: 12-month expected losses for performing assets and life-time expected losses for non-performing assets, to be capital upfront

Reclassification of Financial Assets

- Reclassification of equity instruments is not permitted股权资产都不能重分类

- An entity's equity initial classification of FVPL and FVOCI is irrevocable

- Reclassification of debt instruments is only permitted if the business model for the financial assets (objective for holding the financial assets) has changed in a way that significantly affects operations债权资产的模式改变才能重分类

- Changes to the business model will require judgment and are expected to be very infrequent虽然允许但很少见

- When reclassification is deemed appropriate, there is no restatement不追溯调整 of prior periods at the reclassification date重分类后下一个会计周期第一天才是重分类日

Investments In Associates

Basic Principles

Associates Confirmation

- Under both IFRS and US GAAP, when a company(investor) holds 20% to 50% of the voting rights of an associate (investee), either directly or indirectly (i.e.,through subsidiaries), it is presumed that the company has (or can exercise) significant influence, but not control, over the investee's business activities

- The determination of significant influence under IFRS also includes currently exercisable or convertible warrants, call options, or convertible securities that the investor owns考虑短期可行权资产的影响

- Under US GAAP, the determination of an investor's voting stock interest is based only on the voting shares outstanding at the time of the purchase不考虑短期可行权资产的影响

- Evidences of Significant Influence

- The ability to exert significant influence means that the financial and operating performance of the investee is partly influenced by management decisions and operational skills of the investor

- The accounting standards note that significant influence may be evidenced by:

Representation on the board of directors参与董事会

Participation in the policy-making process影响决策

Material transactions between the investor and the investee有关联方交易

Interchange of managerial personnel影响人事任命

Technological dependency提供关键技术

Equity method

- One-line consolidation

- The investor's proportionate ownership interest in the net assets of the investee is disclosed as a single line item (equity investment in associate) on its balance sheet被融合成一个项目反映在投资方资产负债表

"Equity investments" are classified as non-current assets on the balance sheet - The investor's share of the revenues and expenses of the investee is disclosed as a single line item(equity income in associate) on its income statement被融合成一个项目反映在投资方资产利润表

"Equity income" is usually separated from operating income

- The investor's proportionate ownership interest in the net assets of the investee is disclosed as a single line item (equity investment in associate) on its balance sheet被融合成一个项目反映在投资方资产负债表

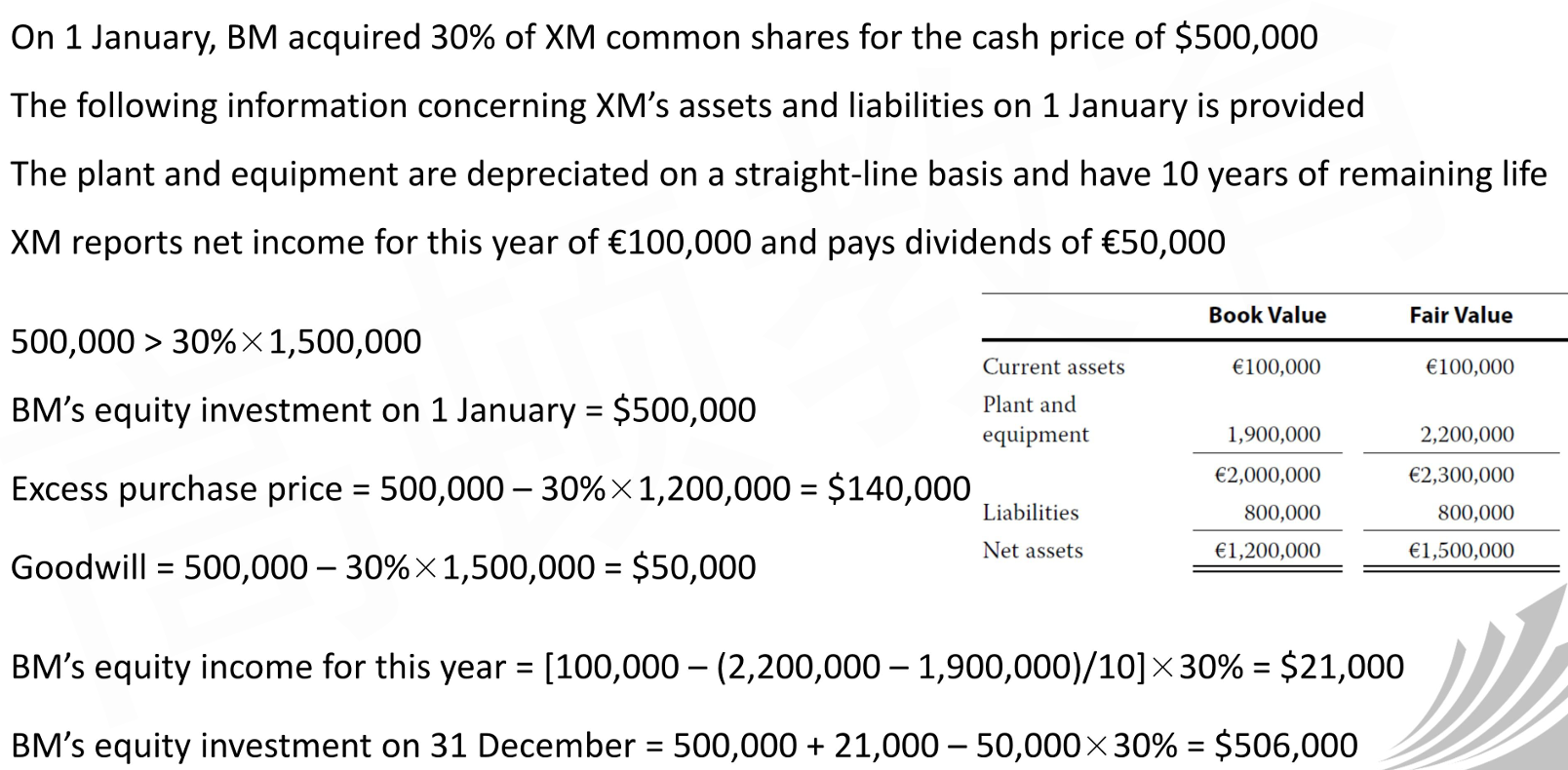

- Basic Principles

- Under the equity method of accounting, the equity investment is initially recorded on the investor's balance sheet at cost出资额就是长期股权投资额

- In subsequent periods, the carrying amount of the investment is adjusted to recognize the investor's proportionate share of the investee's earnings or losses, and these earnings or losses are reported in income根据持股比例确认被投资公司的净利润到投资公司资产负债表与利润表

- Dividends or other distributions received from the investee are treated as a return of capital and reduce the carrying amount of the investment and are not reported in the investor's profit or loss若存在现金分红,分红部分的值从长期股权投资结转到现金,且这部分不会反映在投资方利润表

- Losses from Associates

- The recorded investment value can decline as a result of investee losses

- If the investment value is reduced to zero, the investor usually discontinues the equity method and does not record further losses长期股权投资最多减到0,不够的部分计入备查账簿表示还没减,这部分也不反应在利润表

- If the investee subsequently reports profits, the equity method is resumed after the investor's share of the profits equals the share of losses not recognized during the suspension of the equity method如果被投资方盈利,先弥补备查账簿,再反映到长期股权投资

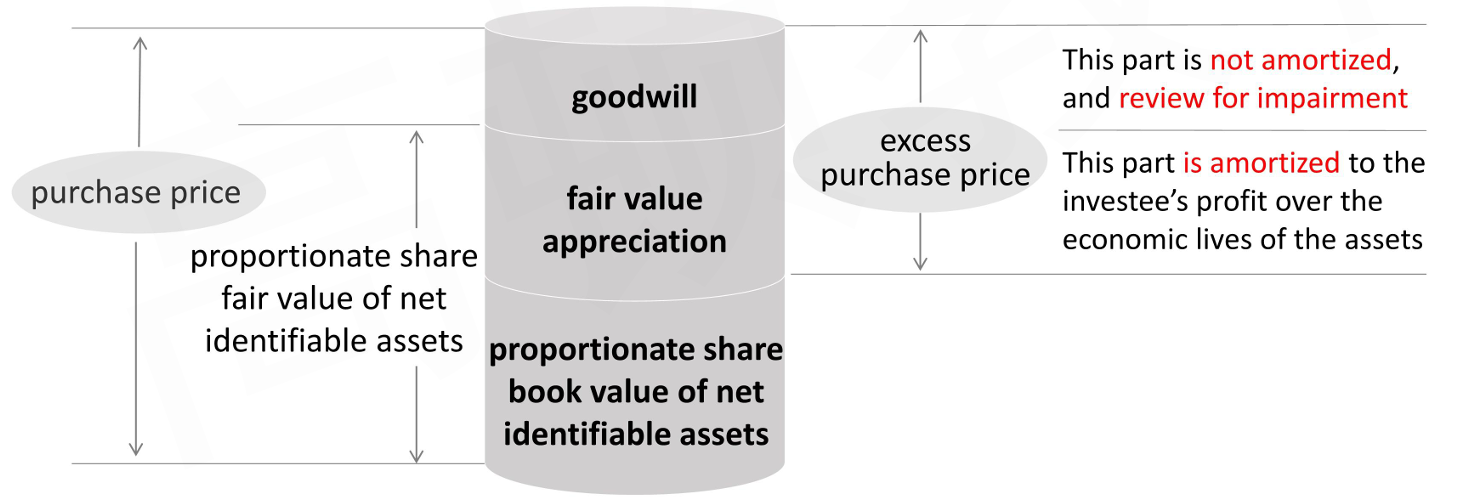

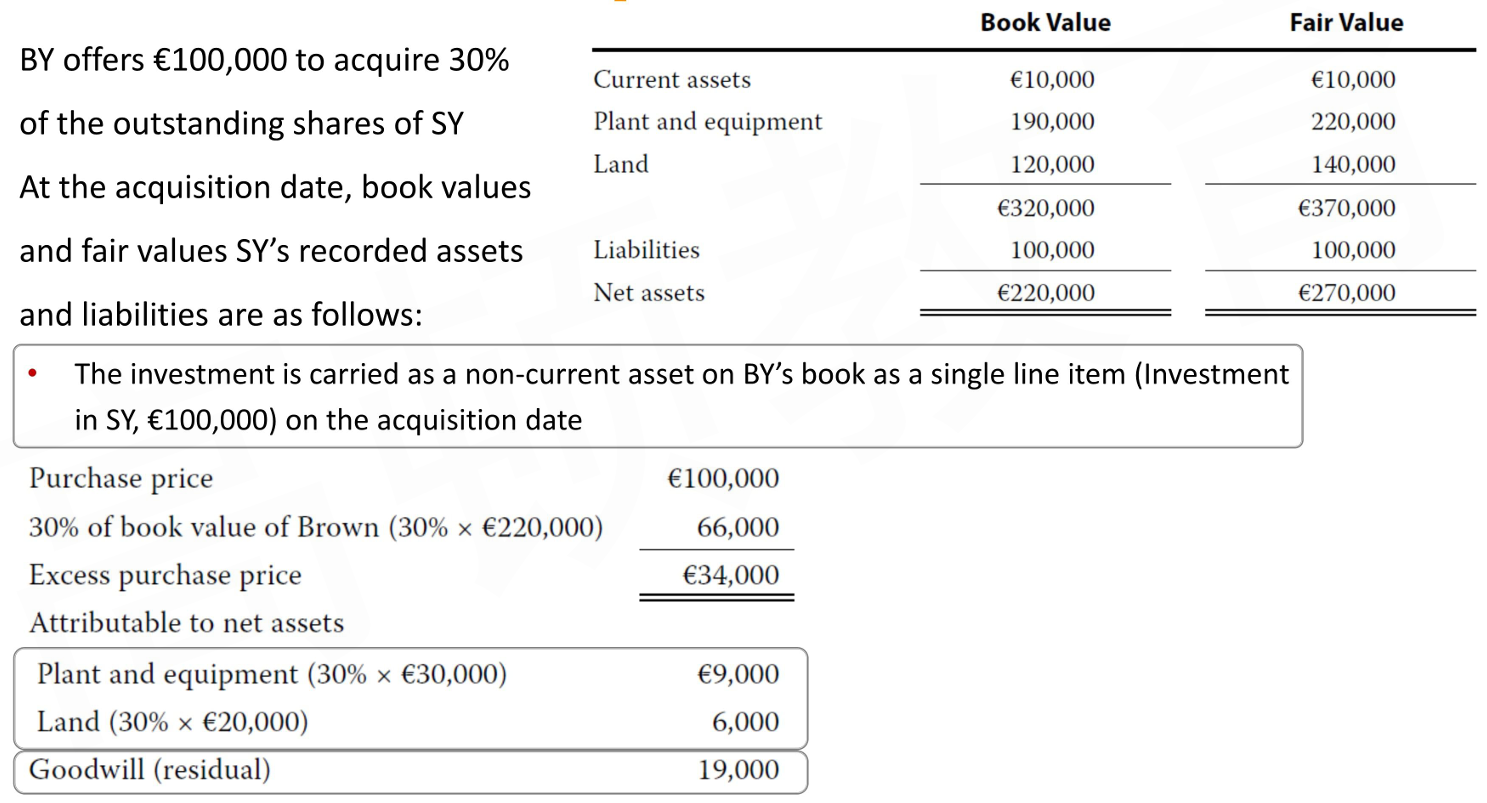

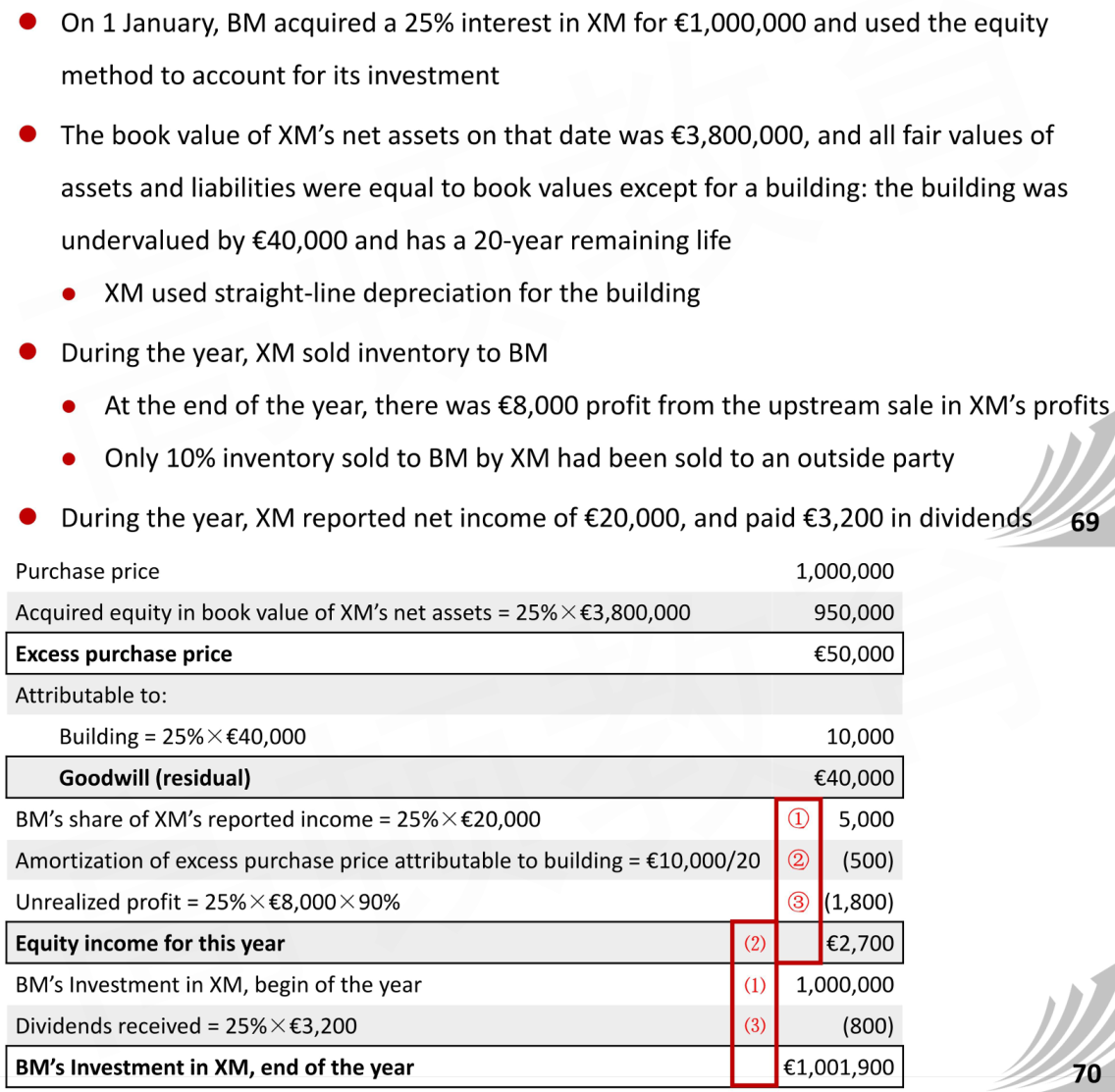

Excess Purchase Price

- The acquisition cost (purchase price) of the investment is often greater than the investor's proportionate share of the book value of the investee's (associate's) net identifiable assets可辨认净资产账面价值份额

- Goodwill

- The difference between the cost of the acquisition and investor's share of the fair value of the net identifiable assets is treated as goodwill

- Goodwill is not amortized不摊销 because it is considered to have an indefinite life, and it is reviewed for impairment能减值 on a regular basis,and written down for any identified impairment

- Goodwill is included in the carrying amount of the investment(instead of being separately recognized 商誉属于长期股权投资,而不是单独列出), because investment is reported as a single line item on the investor's balance sheet

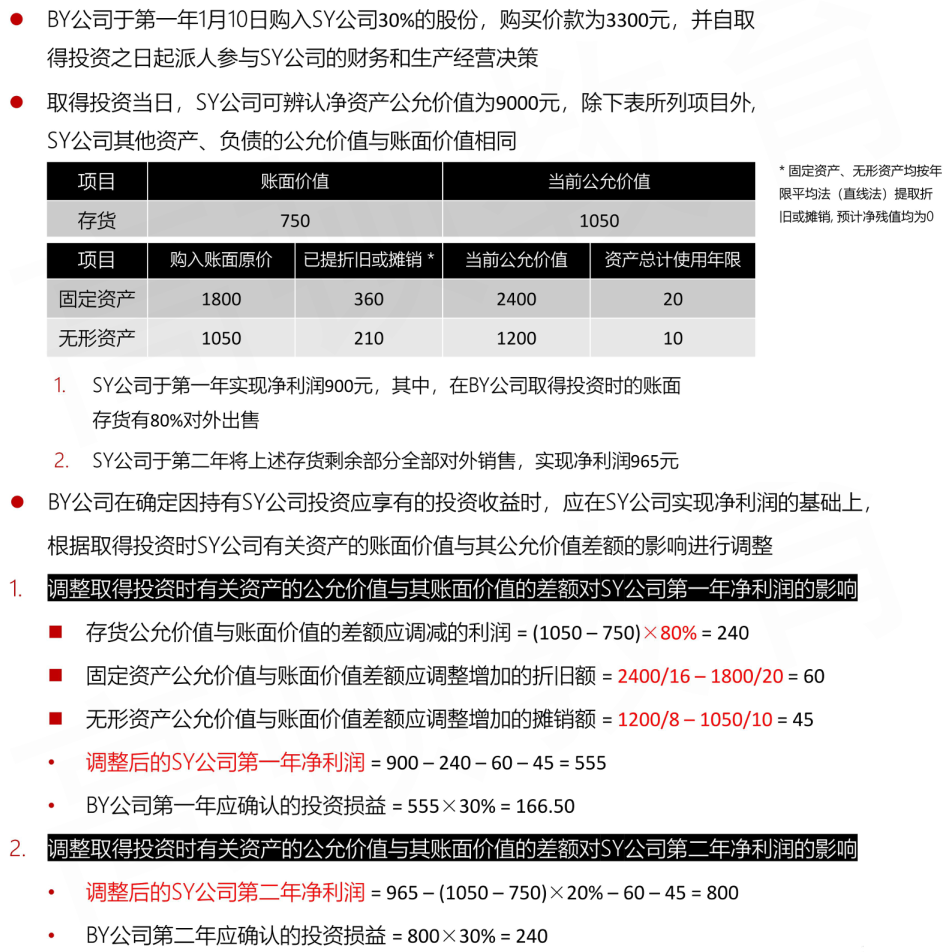

- Amortization of Fair Value Appreciation

- The excess purchase price allocated to the assets and liabilities that are expensed (such as inventory) or periodically depreciated or amortized(such as PPE) is accounted for in a manner that is consistent with the accounting treatment for the specific asset or liability to which it is assigned被收购方资产怎么折旧,收购方长期股权投资中对应资产就怎么折旧

- Investor must directly record these adjustment effects by reducing the carrying amount of the investment on its balance sheet and by reducing the investee's profit recognized on its income statement以公允价值调整被收购方资产负债表、利润表后,再合入收购方报表

- Over time, as the differences are amortized, the balance in the investment account will come closer to representing the ownership percentage of the book value of the net assets of the associate最终账面价值与公允价值的差额消失,长期股权投资最终反映账面价值

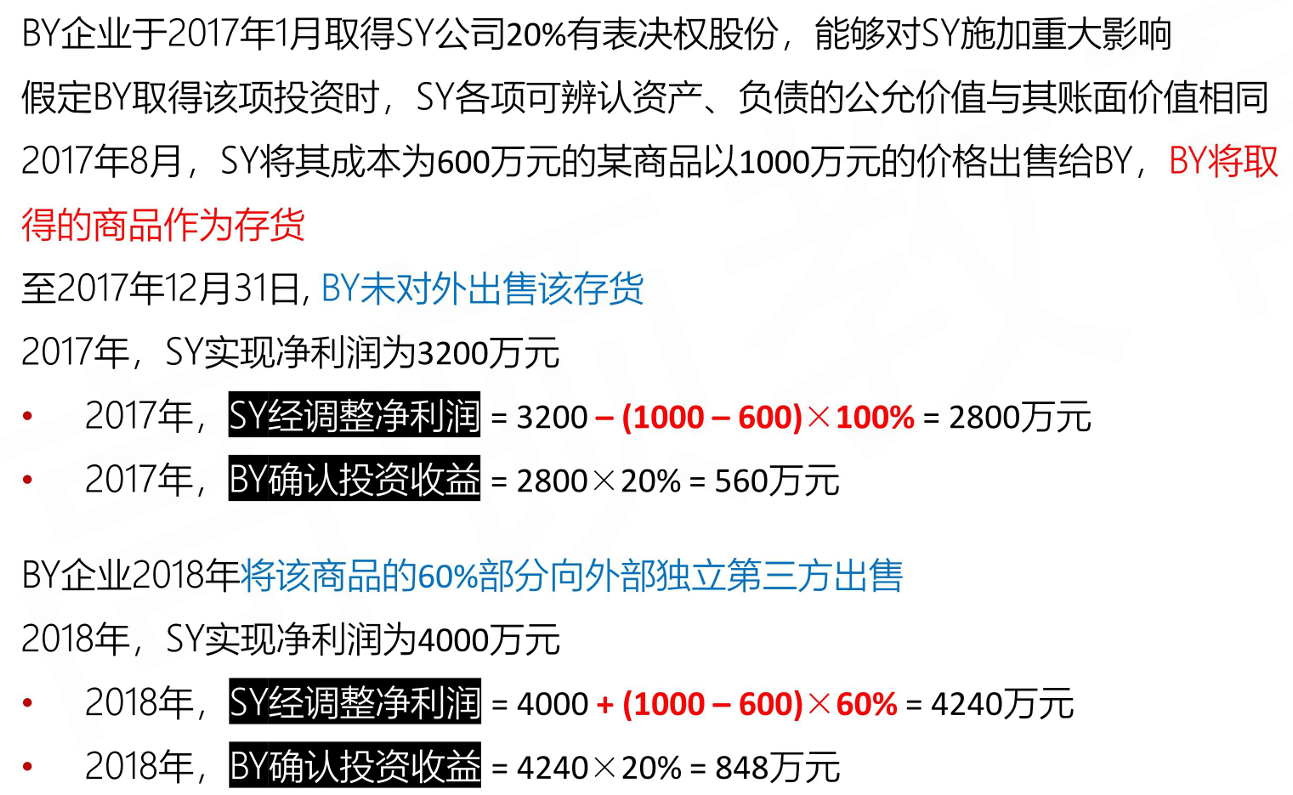

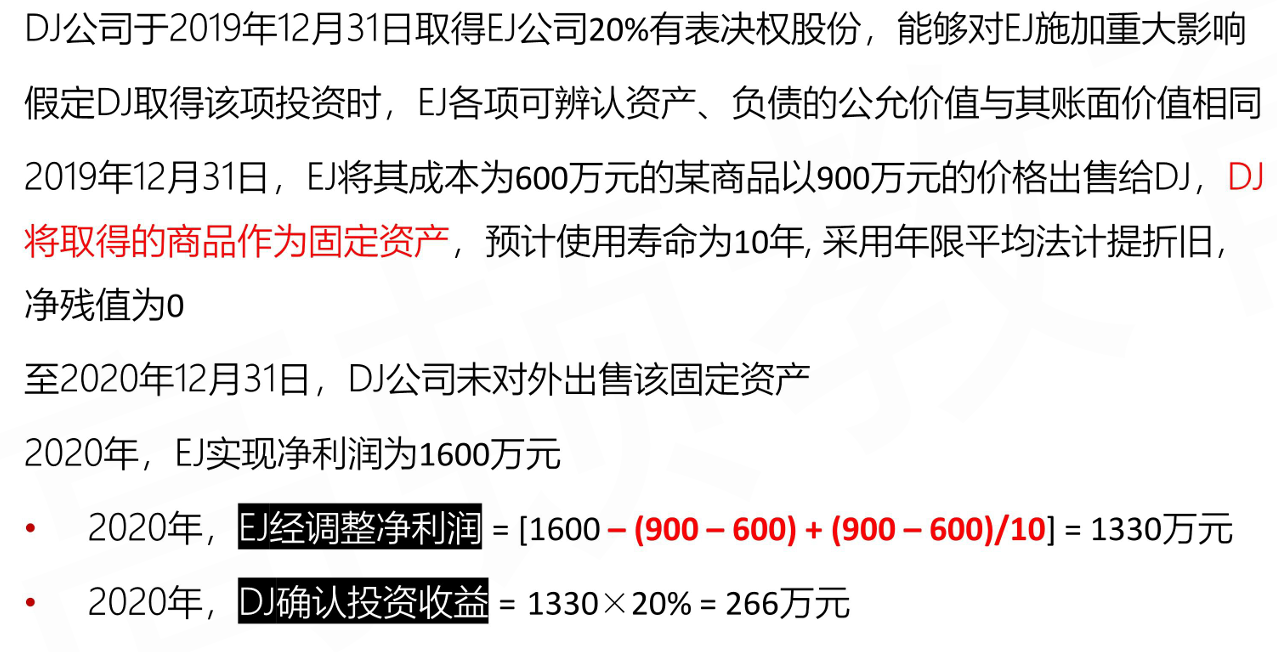

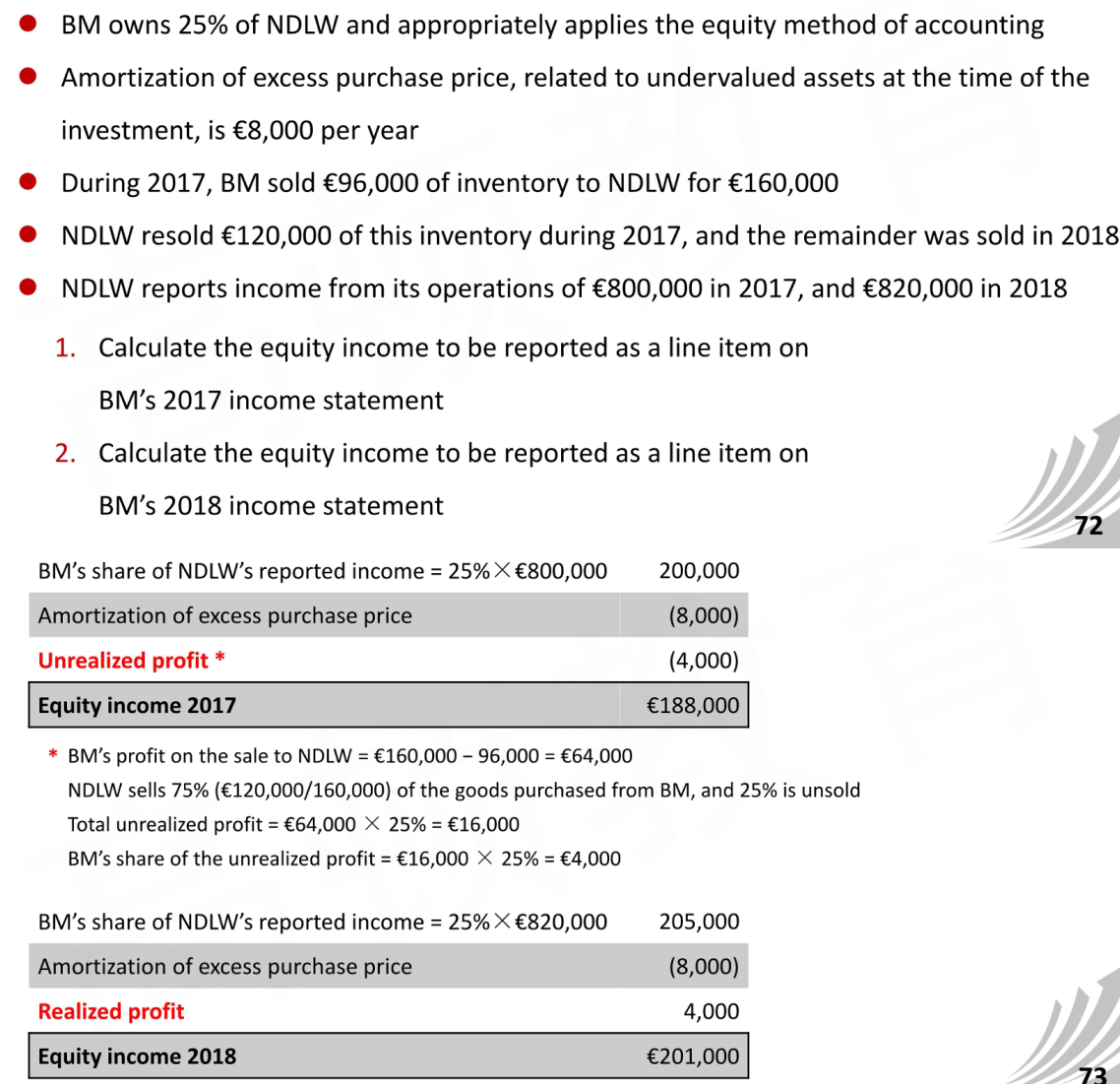

Transactions with Associates

- General Principles for Transactions with Associates

- Because an investor company can influence the terms and timing of transactions with its associates, profits from such transactions cannot be realized until confirmed through sale to third parties or use可能给投资方或被投资方虚增利润,这部分利润只有在与第三方交易后才能实现

- Accordingly, the investor company's share of any unrealized profit must be deferred by reducing the amount recorded under the equity method合入时需要减去虚增的这部分

- In the subsequent period(s) when this deferred profit is considered confirmed, it is added to the equity income当利润实现后再加回来

- Transactions between the two affiliates may be upstream (associate to investor) or downstream (investor to associate)

- Upstream Transaction

- In an upstream sale, the profit on the intercompany transaction is recorded on the associate's income (profit or loss) statement

- The investor's share of the unrealized profit is thus included in equity income on the investor's income statement

- Both IFRS and US GAAP require that the unearned profits be eliminated to the extent of the investor's interest in the associate消除掉被投资方的未实现利润再合入投资方报表

- Downstream Transaction

- In a downstream sale, the profit is recorded on the investor's income statement

- Both IFRS and US GAAP require that the unearned profits be eliminated to the extent of the investor's interest in the associate

Other Issues

Impairment for Equity Investment

- Both IFRS and US GAAP require periodic reviews of equity method investments for impairment

- If the fair value of the investment is below its carrying value and this decline is deemed to be other than temporary, an impairment loss must be recognized

- The impairment loss is recognized on the income statement, and the carrying amount of the investment on the balance sheet is either reduced directly(IFRS, GAAP) or through the use of an allowance account (IFRS)

- US GAAP prohibit the reversal of impairment losses, IFRS permits the reversal

- IFRS

- Under IFRS, there must be objective evidence客观证据 of impairment as a result of events that occurred after the initial recognition of the investment, and that loss event has an impact on the investment's future cash flows, which can be reliably estimated

- The entire carrying amount of the investment is tested for impairment by comparing its recoverable amount with its carrying amount

- Recoverable amount of an asset is the higher of its value less costs to sell and its value in use

- Because goodwill is included in the carrying amount of the investment and is not separately recognized, it is not separately tested for impairment商誉属于长期股权投资,不需要单独减值

- US GAAP

- If the fair value of the investment declines below its carrying value and the decline is determined to be permanent, US GAAP requires an impairment loss to be recognized on the income statement and the carrying value of the investment on the balance sheet is reduced to its fair value

Fair Value Option

- Both IFRS and US GAAP require that the election to use the fair value option occur at the time of initial recognition and is irrevocable可以在获得长期股权投资时选择用公允价值计量,选择后不可逆转为权益法

- Subsequent to initial recognition, the investment is reported at fair value with unrealized gains and losses arising from changes in fair value, as well as any interest and dividends received included in the investor's profit or loss类似FVPL

- Under the fair value method, the investment account on the investor's balance sheet does not reflect the investor's proportionate share of the investee's profit or loss, dividends, or other distributions

- In addition, the excess of cost over the fair value of the investee's identifiable net assets is not amortized, nor is goodwill created不需要摊销,不形成商誉

- Both IFRS and US GAAP give the investor the option to account for their equity method investment at fair value

- Under US GAAP, this option is available to all entities

- Under IFRS, its use is restricted to venture capital organizations, mutual funds, unit trusts, and similar entities,including investment-linked insurance funds

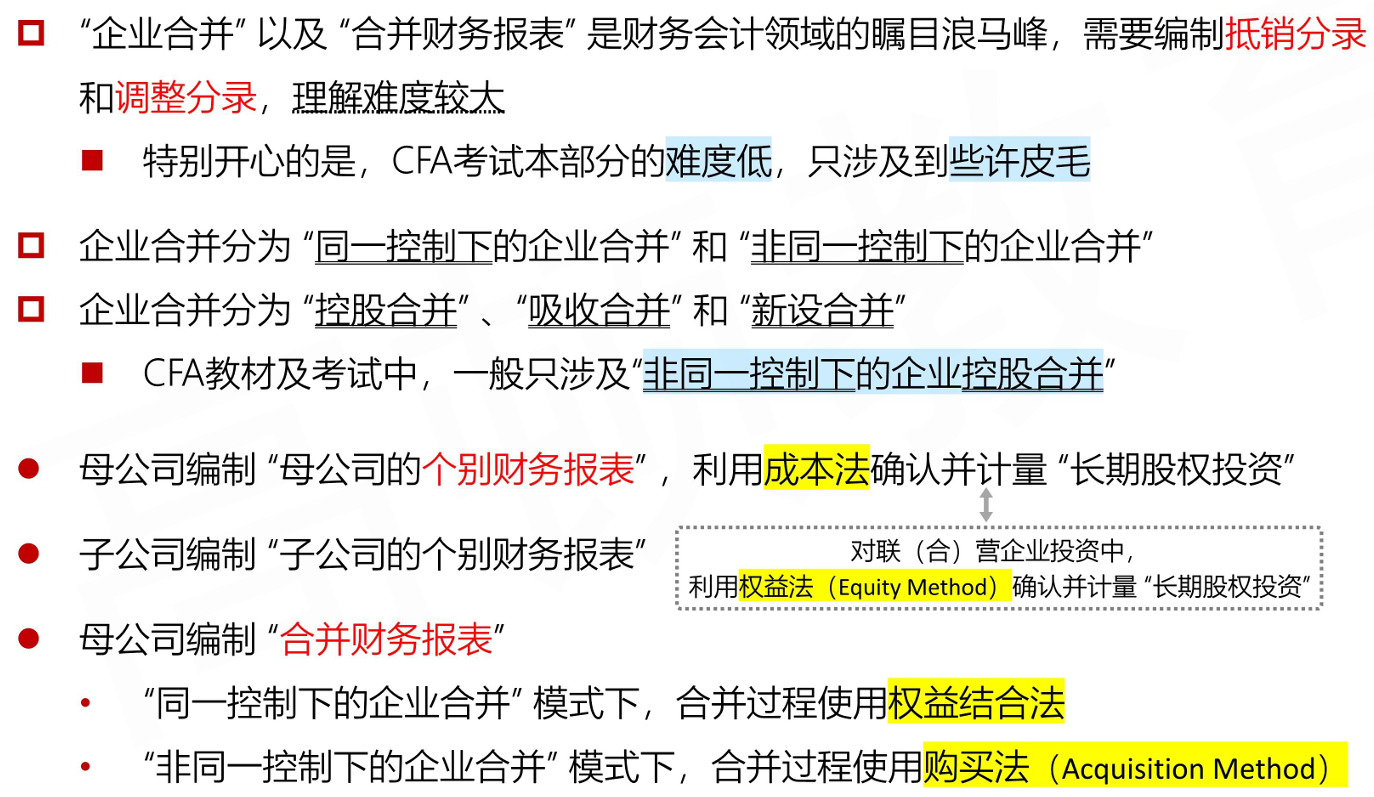

Business Combinations

Basic Concepts about Combinations

Concepts of "Control"

- Under IFRS, the control is present when:

- The investor has the ability to exert influence on the financial and operating policy of the entity

- The investor is exposed, or has rights, to variable returns可变回报 from its involvement with the investee

- US GAAP uses a two-component consolidation model that includes both a variable interest component and a voting interest (control) component

Business Combinations

- Business combinations (controlling interest investments) involve the combination of two or more entities into a larger economic entity

- Under Us GAAP, the business combinations are categorized as merger, acquisition, or consolidation based on the legal structure after the combination

- Acquisition控股合并: Company A + Company B =(Company A + Company B)

- Merger吸收合并: Company A + Company B = Company A

- Consolidation新设合并: Company A + Company B = Company C

Acquisition Method

- Under both IFRS and US GAAP, business combinations are accounted for using the acquisition method购买法

- In the past, business combinations could be accounted for either as a purchase transaction or as a uniting (or pooling) of interests

- However, the use of the pooling accounting method for acquisitions is no longer permitted (for business combination not involving enterprises under common control)

- IFRS and US GAAP now require that all business combinations be accounted for in a similar manner: the acquisition method replaces the purchase method

Consolidation Process

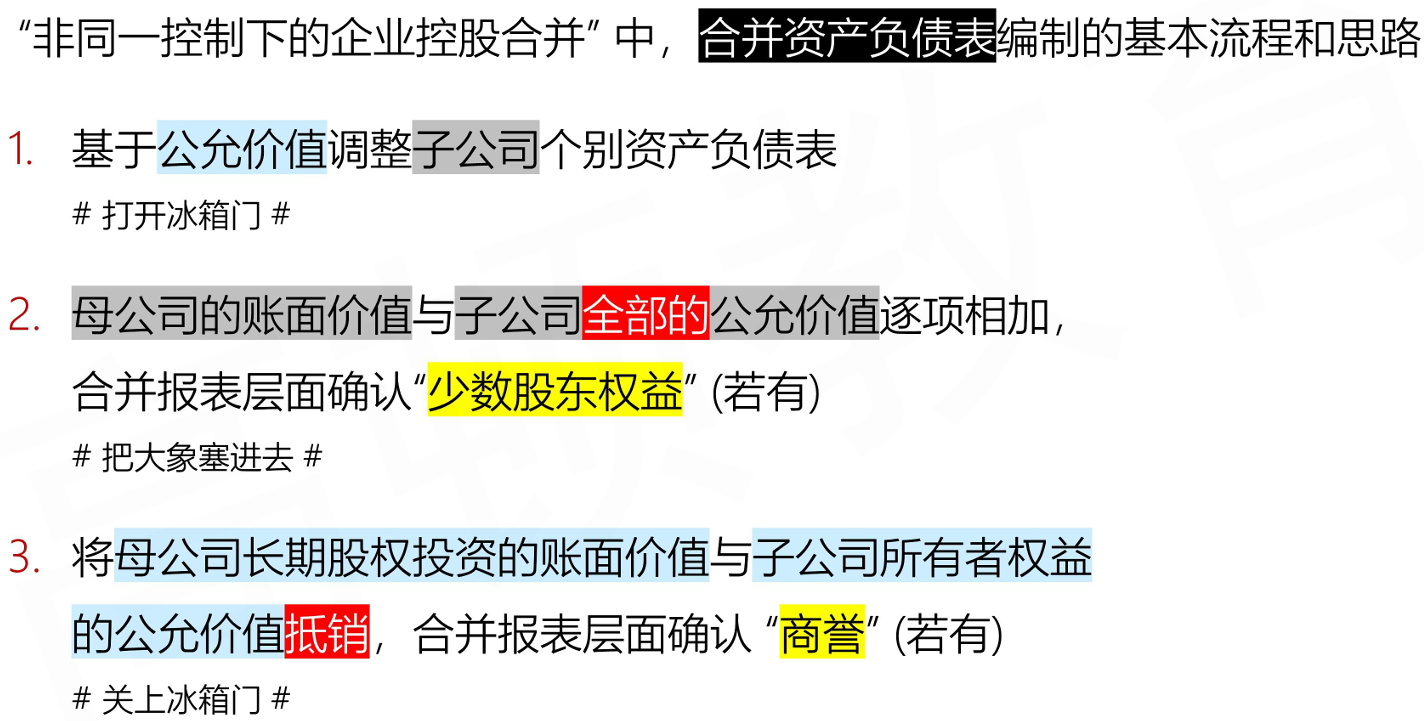

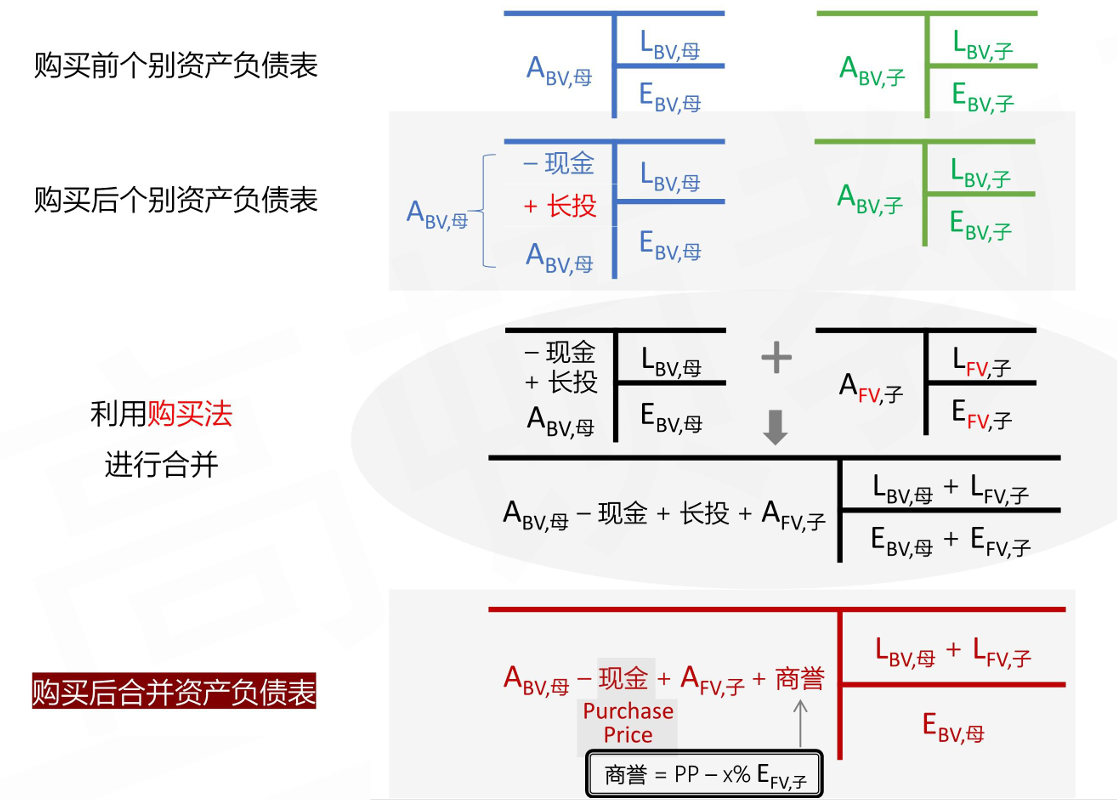

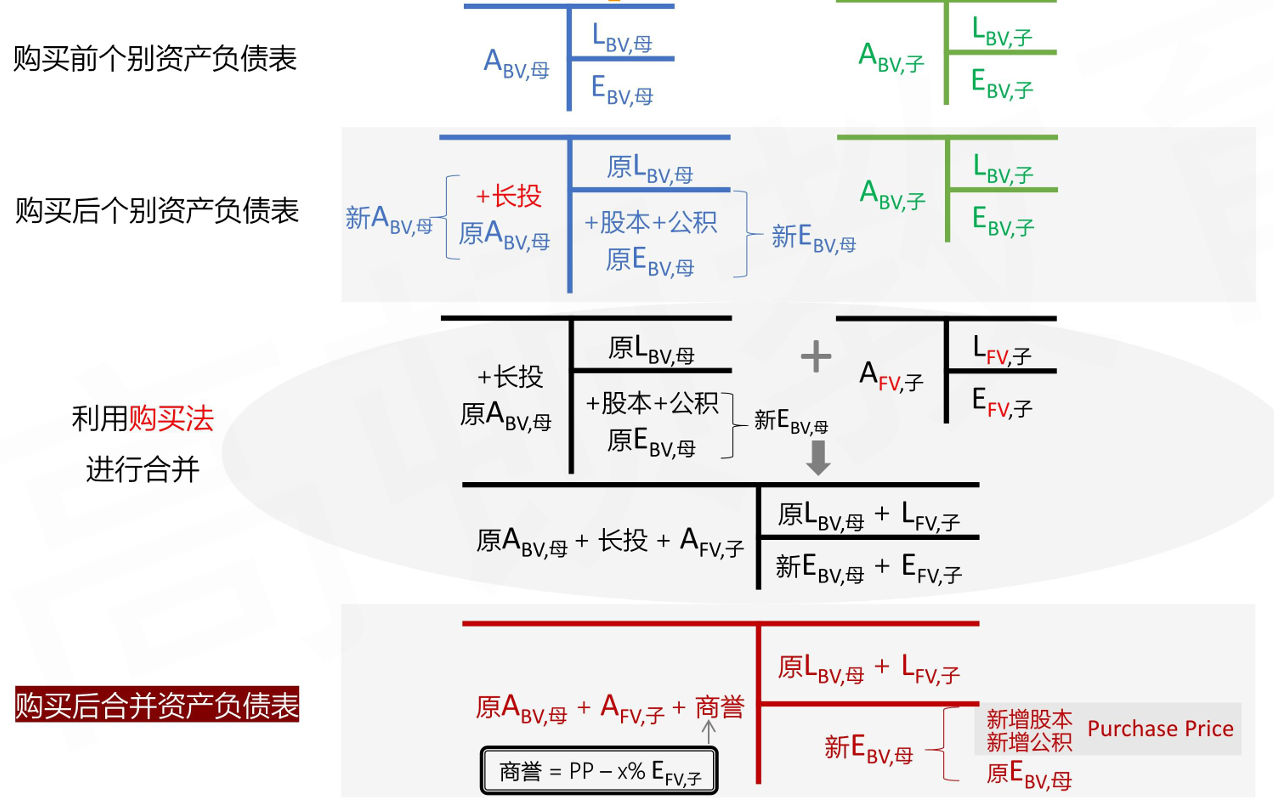

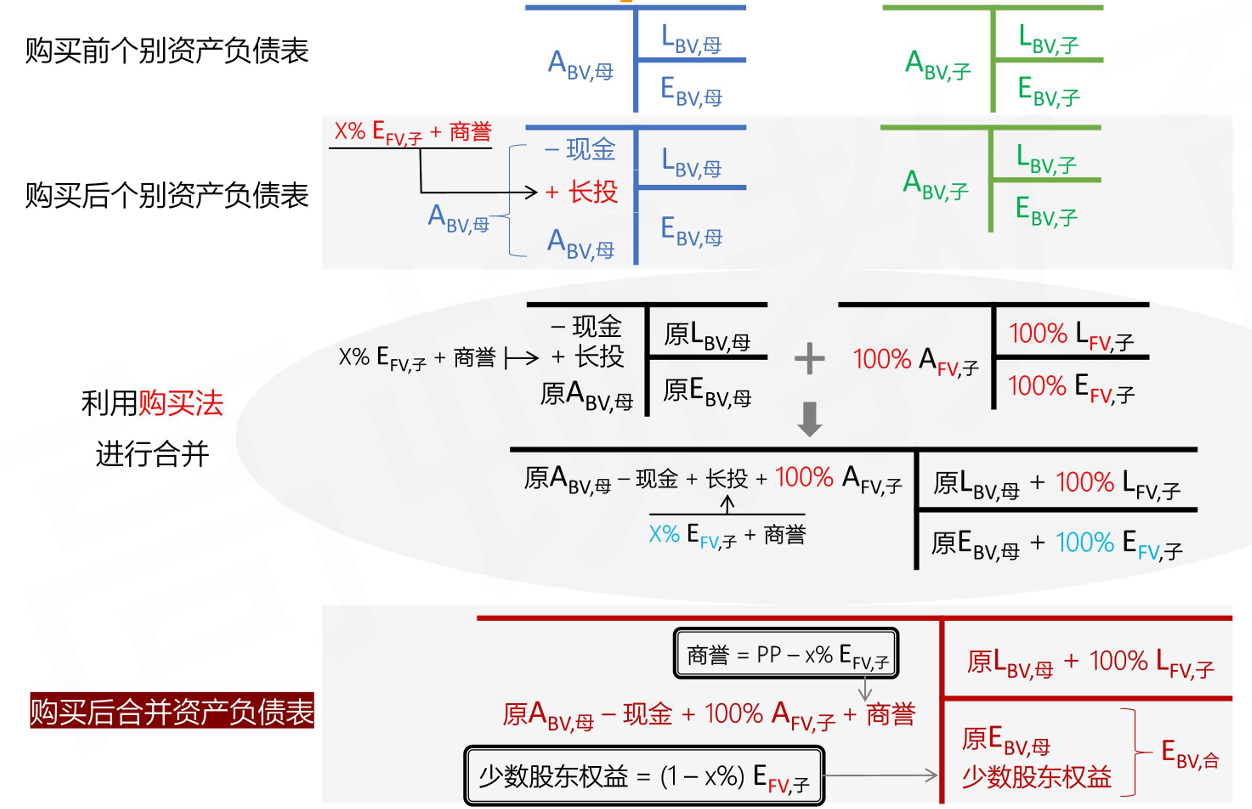

合并步骤

- 合并资产负债表

- 支付现金方式购买子公司100%股权

- 发行股份方式购买子公司100%股权

- 现金方式购买子公司X%(小于100%)股权

- 支付现金方式购买子公司100%股权

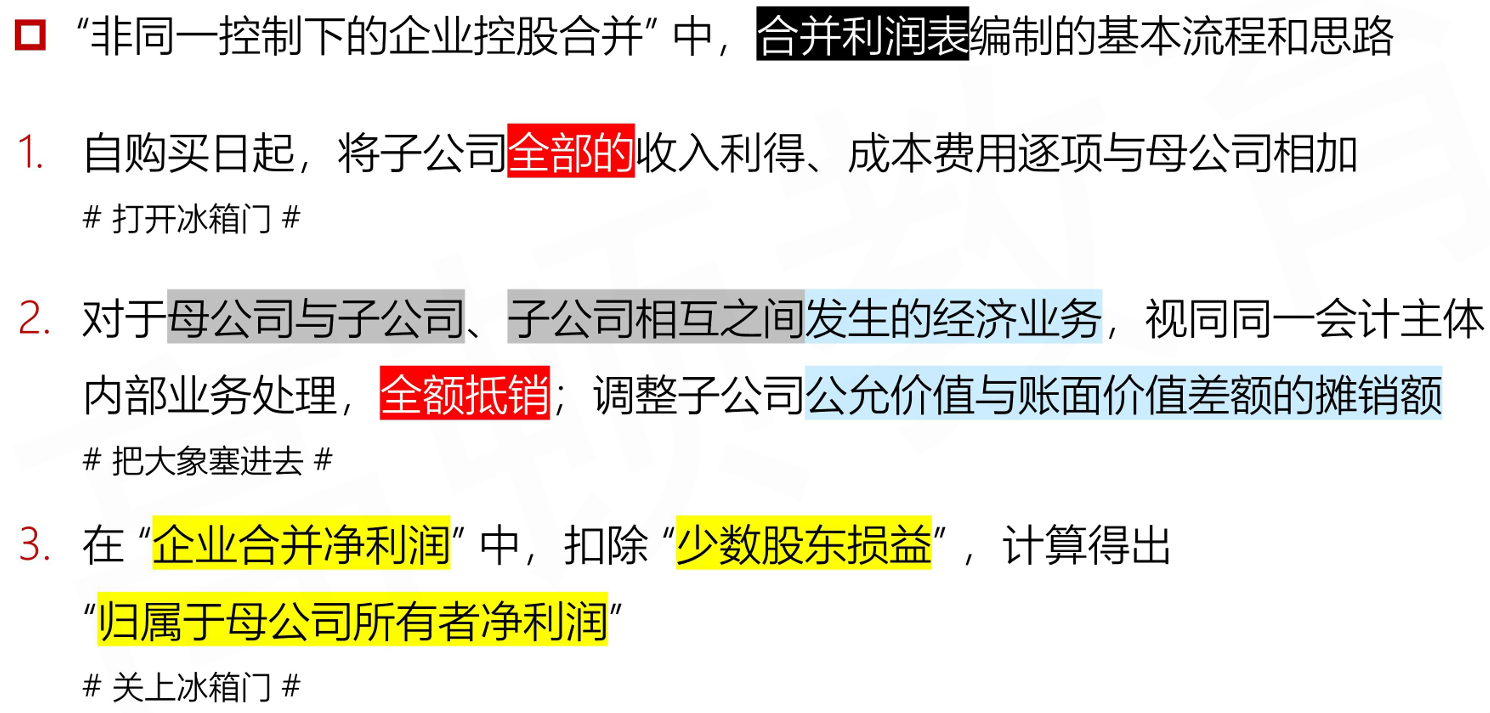

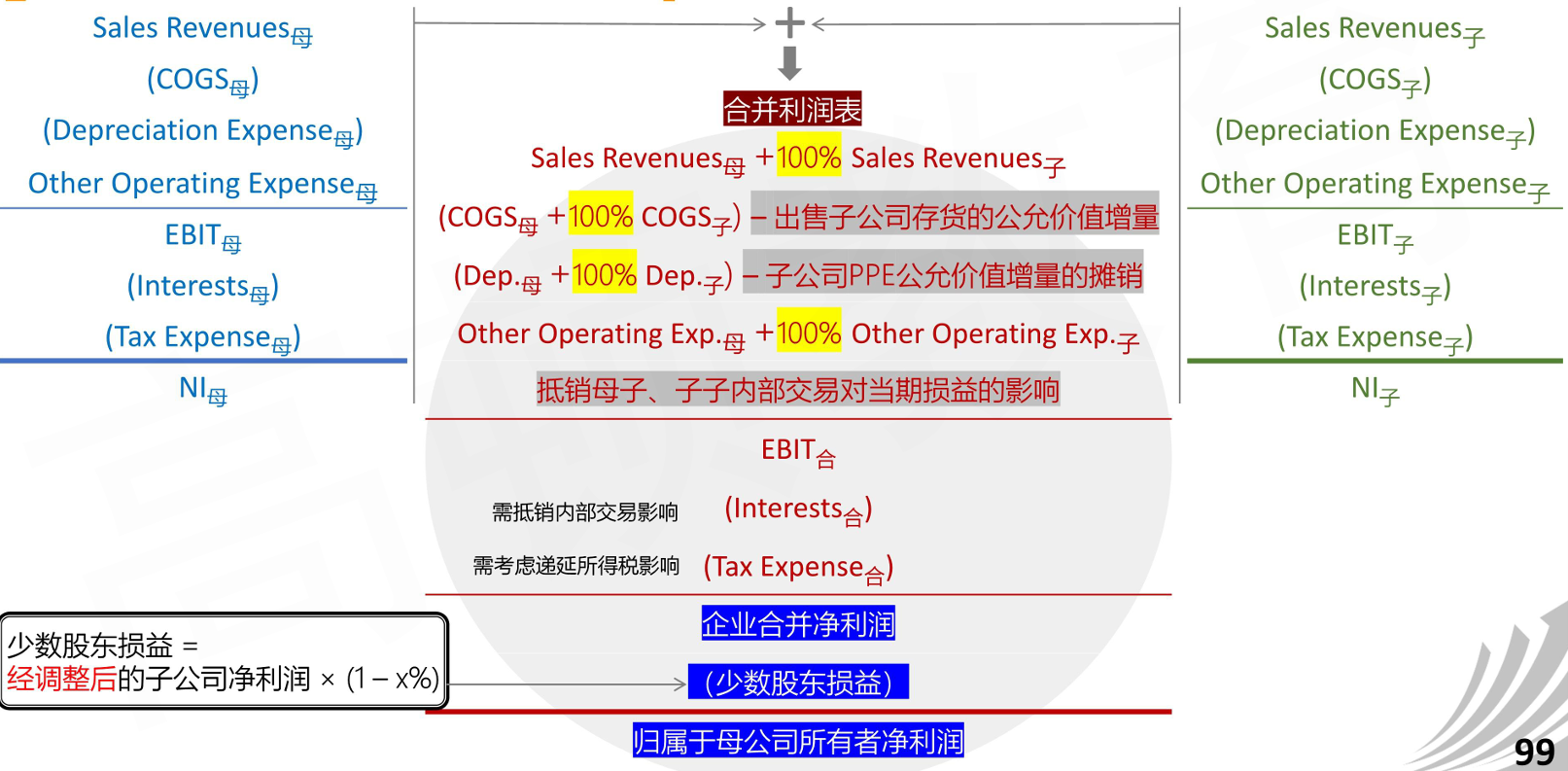

- 合并利润表

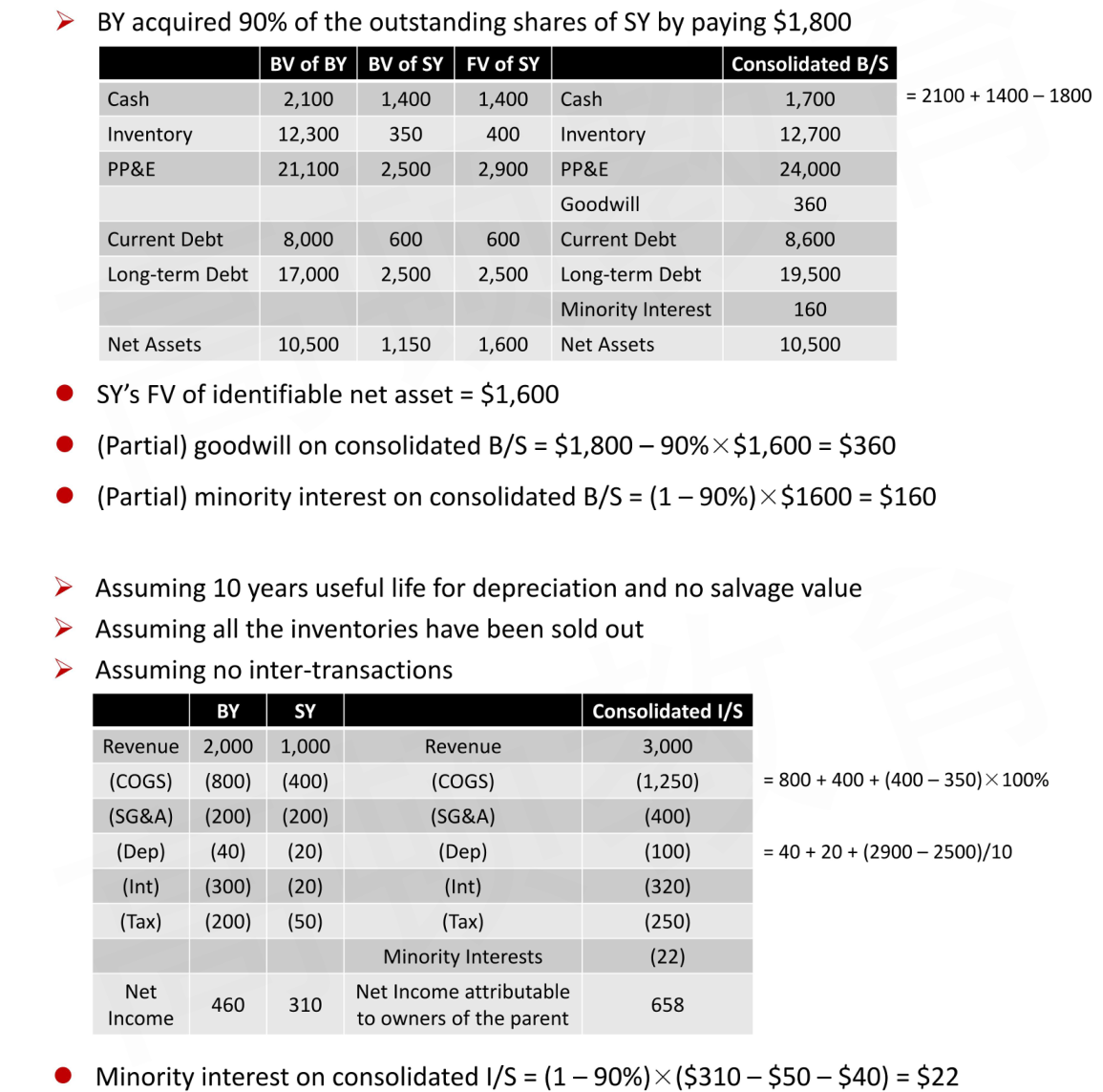

- 合并非全资子公司利润表(母公司持股X%)

- 合并非全资子公司利润表(母公司持股X%)

- example

Minority Interests

- Balance Sheet

- Non-controlling interests are created when the parent acquires less than a 100% controlling interest in a subsidiary

- A non-controlling (minority) interest is the portion of the subsidiary's equity (residual interest) that is held by third parties(i.e., not owned by the parent)

- IFRS and US GAAP have similar treatment for how non-controlling interests are classified

- Non-controlling interests are presented on the consolidated balance sheet as a separate component of stockholders' equity

- Income Statement

- Each line item includes 100% of the parent and the subsidiary transactions after eliminating any upstream(subsidiary sells to parent) or downstream(parent sells to subsidiary) intercompany transactions

Intercompany transactions, if any, are eliminated in full

I/S of the subsidiary is included in consolidated I/S from the date of acquisition - The portion of income accruing to non-controlling shareholders is presented as a separate line item (minority interests) on the consolidated income statement

- Each line item includes 100% of the parent and the subsidiary transactions after eliminating any upstream(subsidiary sells to parent) or downstream(parent sells to subsidiary) intercompany transactions

Additional Issues In Business Combinations

- Direct costs

- Direct costs of the business combination, such as professional and legal fees, valuation experts, and consultants, are expensed as incurred直接费用不算在合并成本,而是费用化

- Restructuring costs

- IFRS and US GAAP do not recognize restructuring costs that are associated with the business combination as part of the cost of the acquisition重组成本不算在合并成本

- They are recognized as an expense in the periods the restructuring costs are incurred

- Under acquisition method, the fair value of the consideration given by the acquiring company is the appropriate measurement for acquisitions and also includes the acquisition-date fair value of any contingent consideration或有对价,例如包含对赌协议的收购

- In subsequent periods, changes in the fair value are recognized in the consolidated income statement

- Both IFRS and US GAAP do not remeasure "equity classified contingent consideration"

- Recognition and measurement of identifiable assets and liabilities

- The acquirer measure the identifiable tangible and intangible assets and liabilities of the acquiree at fair value as of the date of the acquisition

- The acquirer may also recognize any assets and liabilities that the acquiree had not previously recognized as assets and liabilities in its financial statements合并时可能把子公司没有确认的资产或负债确认

- Contingent assets and contingent liabilities

- Under IFRS

Contingent liabilities are recorded separately as part of the cost allocation process, provided that their fair values can be measured reliably合并财务报表要体现或有负债, value is max(initially recognized, best estimate of amount required to settle)

Contingent assets are not recognized合并财务报表不能包含或有负债 - Under US GAAP

Contractual contingent asset and liability are recognized and recorded at their fair values, non-contractual contingent asset and liability also be recognized and recorded only if it is "more likely than not" they meet the definition of an asset or a liability有合同的一定确认,没有的可能确认

Contingent liability = max (initially recognized , best estimate of amount of the loss)

Contingent asset = min (initial fair value , best estimate of future settlement amount)

- Under IFRS

- In-process R&D

- We should recognize in-process research and development acquired in a business combination as a separate intangible asset and measure it at fair value子公司的研发确认为单独的无形资产

- In subsequent periods, this research and development is subject to amortization if successfully completed, or to impairment if failed

Accounting Treatment of Goodwill

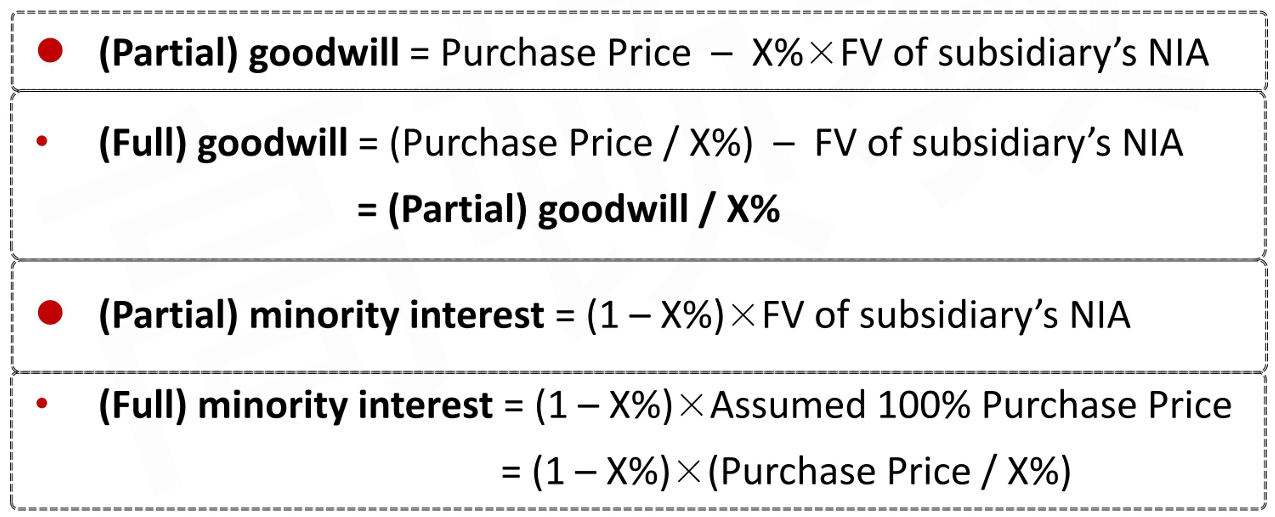

Partial Goodwill and Full Goodwil

- Partial goodwill is measured as the fair value of the acquisition less the acquirer's share of the fair value of all identifiable tangible and intangible assets, liabilities, and contingent liabilities acquired

- Full goodwill is measured as the fair value of the entity as a whole less the fair value of all identifiable tangible and intangible assets, liabilities,and contingent liabilities假设全部收购时的商誉

- US GAAP views the entity as a whole and requires full goodwill method, IFRS allows two options for recognizing goodwill at the transaction date

- The goodwill option is on a transaction-by-transaction basis

- 当从部分商誉变成整体商誉时,通过增加少数股东权益实现配平

Bargain Purchase

- Bargain purchase acquisition is an acquisition where the purchase price is less than the acquirer's share of fair value of the acquiree's net identifiable asset

- IFRS and US GAAP require the difference between the fair value of the acquired net assets and the purchase price to be recognized immediately as a gain确认一笔营业外收入

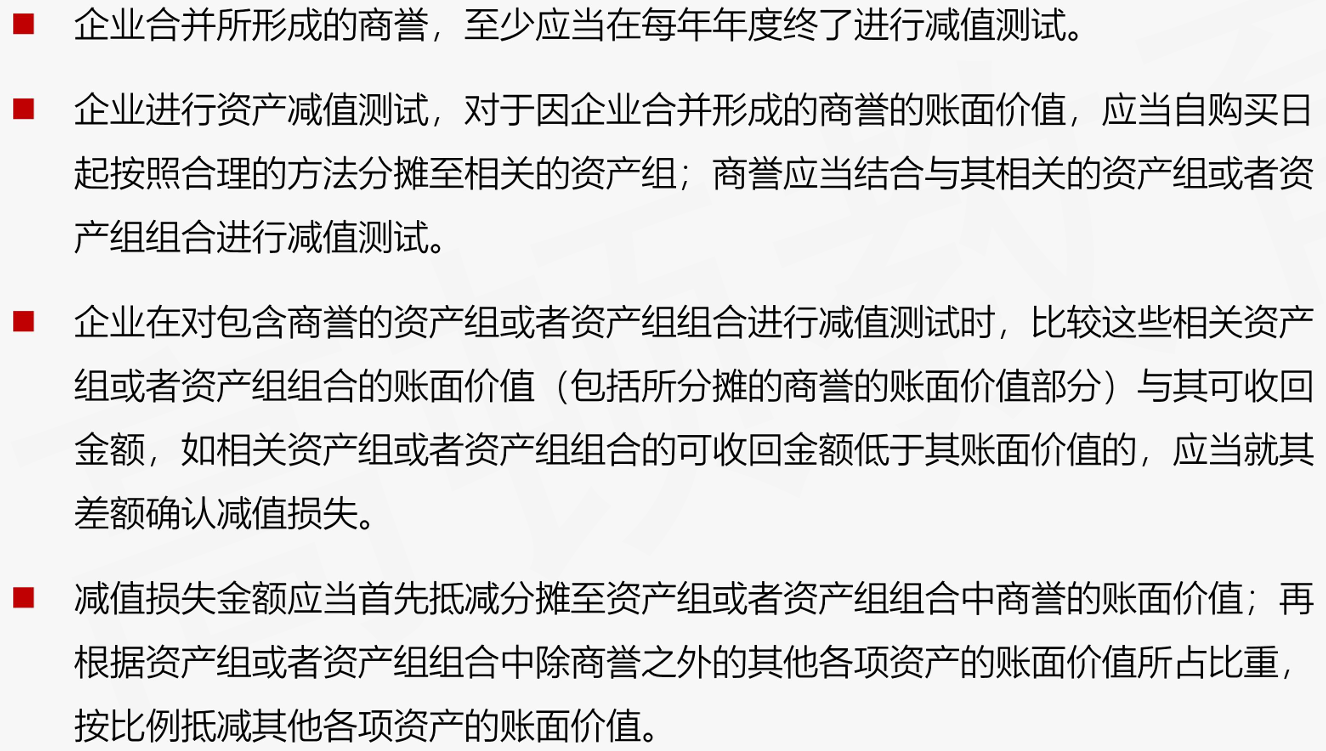

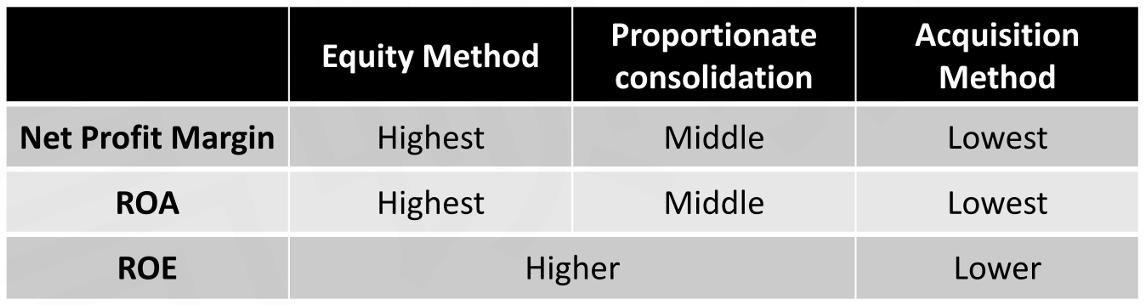

Goodwill Impairment

- Although goodwill is not amortized, it must be tested for impairment at least annually or more frequently if events or changes in circumstances indicate that it might be impaired

- Under both IFRS and US GAAP, once written down, goodwill cannot be later restored

- IFRS and US GAAP differ on the definition of the levels at which goodwill is assigned and how goodwill is tested for impairment

- IFRS: One-Step Approach

- Under IFRS, at the time of acquisition, the total amount of goodwill recognized is allocated to each of the acquirer's cash-generating units资产组

A cash-generating unit represents the lowest level within the combined entity at which goodwill is monitored for impairment purposes - An impairment loss is recognized if the recoverable amount of the cash-generating unit is less than its carrying value资产组的可收回金额小于账面价值则需要减值

- The impairment loss (the difference between these two amounts) is first applied to the goodwill that has been allocated to the cash generating unit减值部分先由商誉吸收

Once this has been reduced to zero, the remaining amount of the loss is then allocated to all of the other non-cash assets in the unit on a pro rata basis商誉归零后再按账面价值比例由各资产吸收

- Under IFRS, at the time of acquisition, the total amount of goodwill recognized is allocated to each of the acquirer's cash-generating units资产组

- US GAAP: Two-Step Approach

- Under US GAAP, at the time of acquisition, the total amount of goodwill recognized is allocated to each of the acquirer's reporting units报告分布

- Goodwill impairment testing is conducted under a two-step approach: 先判断是否要减值,再判断减多少

First, the carrying amount of the reporting unit (including goodwill) is compared to its fair value: if the carrying value of the reporting unit exceeds its fair value,potential impairment has been identified

The second step is to measure the impairment loss, which is the difference between the implied fair value of the reporting unit's goodwill假如是现在收购的商誉 and goodwill's carrying amount商誉的账面价值 - After the goodwill of the reporting unit has been eliminated, no other adjustments are made to the carrying values of any of the reporting unit's other assets or liabilities如果implied商誉是负数,则商誉减值到0后不再处理

- example

Joint Ventures And Spes/Vies

Joint Ventures

- Joint ventures合营企业 are undertaken and controlled by two or more parties共同控制

- Both IFRS and US GAAP require the equity method of accounting for joint ventures

- The equity method results in a single line item(equity in income of the joint venture) on the income statement and a single line item(investment in joint venture) on the balance sheet

- Only under rare circumstances will joint ventures be allowed to use proportionate consolidation method部分合并法

- On the venturer's financial statements, proportionate consolidation requires the venturer's share of the assets, liabilities, income, and expenses of the joint venture to be combined or shown on a line-by-line basis

Special Purpose Entities

- Special purpose entities(SPEs) are enterprises that are created to accommodate specific needs of the sponsoring entity设立SPEs的公司

- In most cases, the creator/sponsor of the entity retains a significant beneficial interest in the SPE, even though it may own little or none of the SPE's voting equity完全享有收益,即使持股很少

- Special purpose entities are required to be consolidated by the sponsoring entity合并时要纳入SPEs

- In the past, sponsors were able to avoid consolidating SPEs on their financial statements because they did not have "control, but IFRS revised the definition of control to encompass many special purpose entities

Variable Interest Entities

- The FASB used the more general term variable interest entity(VIE) to more broadly define an entity that is financially controlled by one or more parties that do not hold a majority voting interest

- Therefore, under US GAAP, a VIE includes other entities besides SPEs

- Us GAAP requires the primary beneficiary of a variable interest entity(VIE)to consolidate the VIE regardless of its voting interests (if any) in the VIE or its decision-making authority

- The primary beneficiary (which is often the sponsor) is the entity that is expected to absorb the majority of the VIE's expected losses, receive the majority of the VlE's residual returns, or both

Analysis Issues

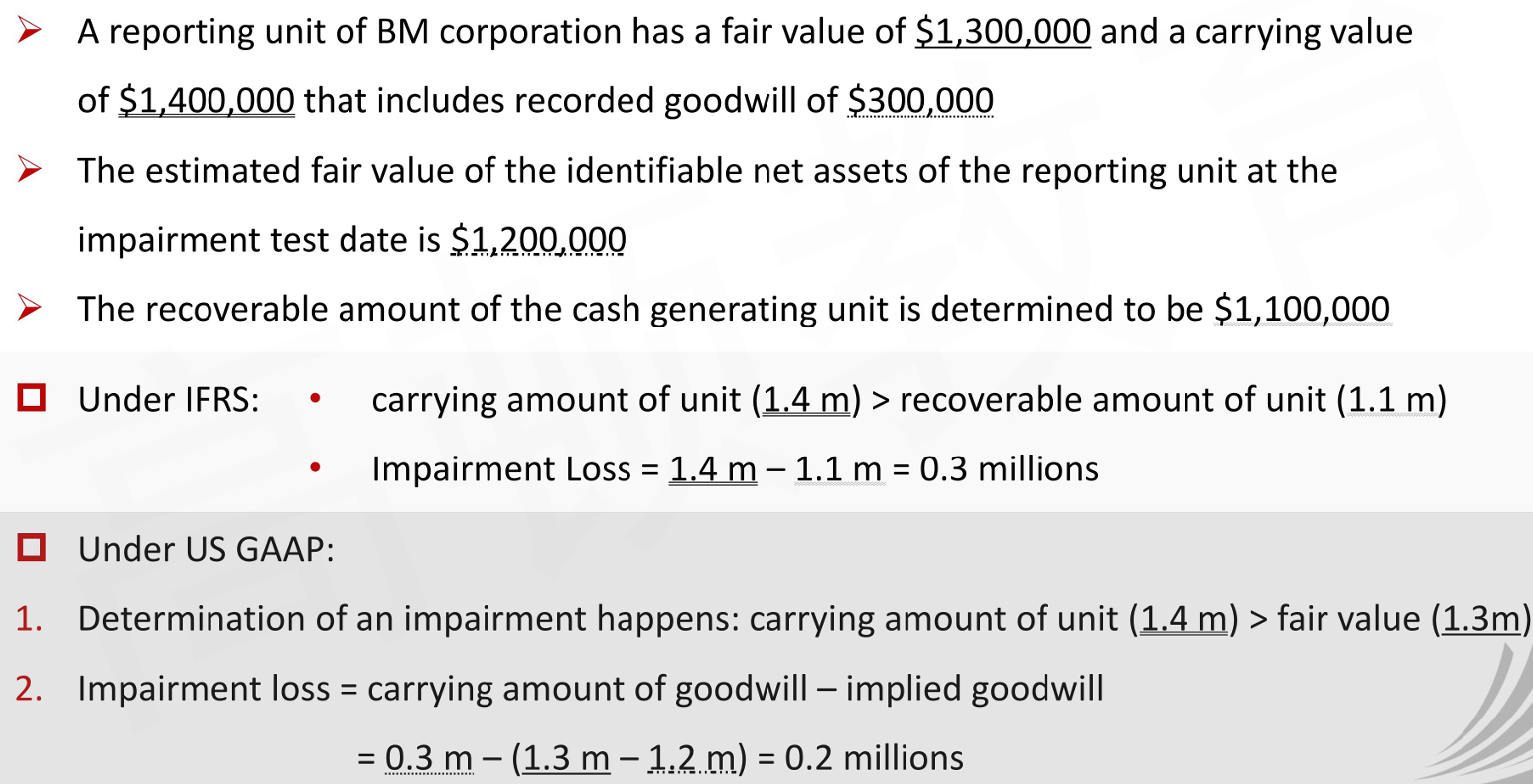

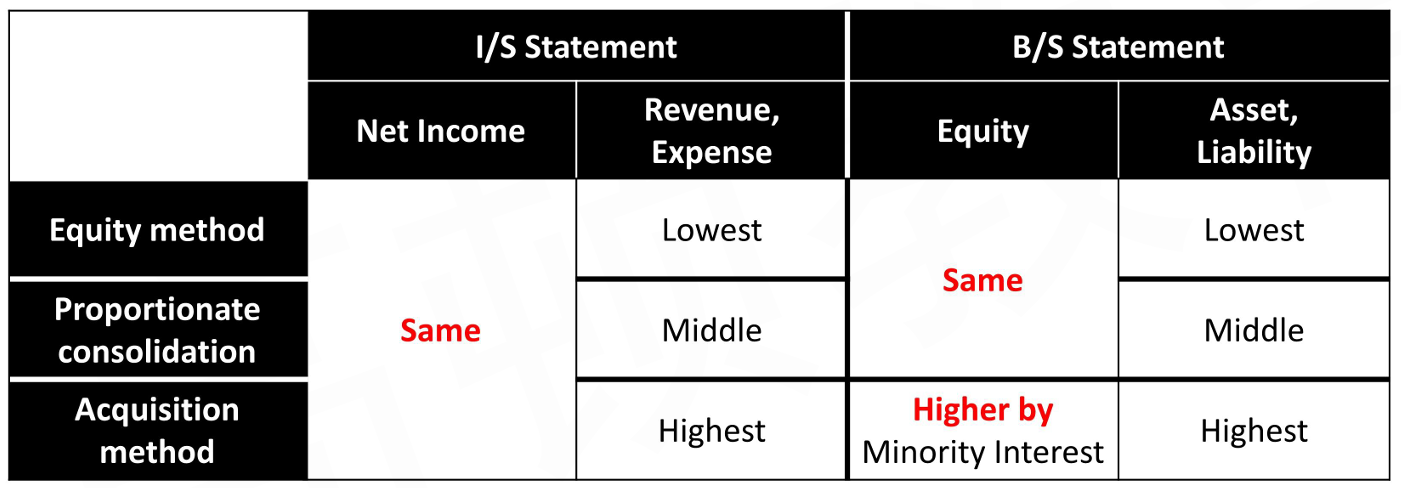

Net Income and Shareholders' Equity

- Net income is the same for the following accounting methods used to account for active investments in investee归母净利润都一样

- Equity method

- Proportionate consolidation

- Acquisition method

- The total net assets (shareholders'equity) of the investor is the same under equity method and proportionate consolidation

- If the minority interests is not treated as ""shareholders' equity",the total net asset will also be same under acquisition method例如百分百持股或少数股东权益视作负债

Two Common Analysis Frameworks

- One-line consolidation vs. line-by-line consolidation

- There can be significant differences in ratio analysis between the three methods,because of the differential effects on values for total assets, liabilities, sales,expenses,etc.

- There can be significant differences in ratio analysis between the three methods,because of the differential effects on values for total assets, liabilities, sales,expenses,etc.

- Ratio analysis before and after investment

- Case by case quantitative analysis

Full Goodwill and Partial Goodwill Method

- Net income is the not affected by the choose between full goodwill and partial goodwill method

- Although net income to parent's shareholders is the same,the impact on ratios would be different because total assets and stockholders' equity would differ

Issue for Equity Method

- Analysts should question whether the equity method is appropriate

- There can be significant assets and liabilities of the investee that are not reflected on investor's balance sheet, which will affect debt ratios

- Net margin ratios could be overstated because income for the associate is included in investor's Nl, but is not included in sales

- The analyst must consider the quality of the equity method earnings

- The equity method assumes that a percentage of each dollar earned by the investee company is earned by the investor, even if cash is not received

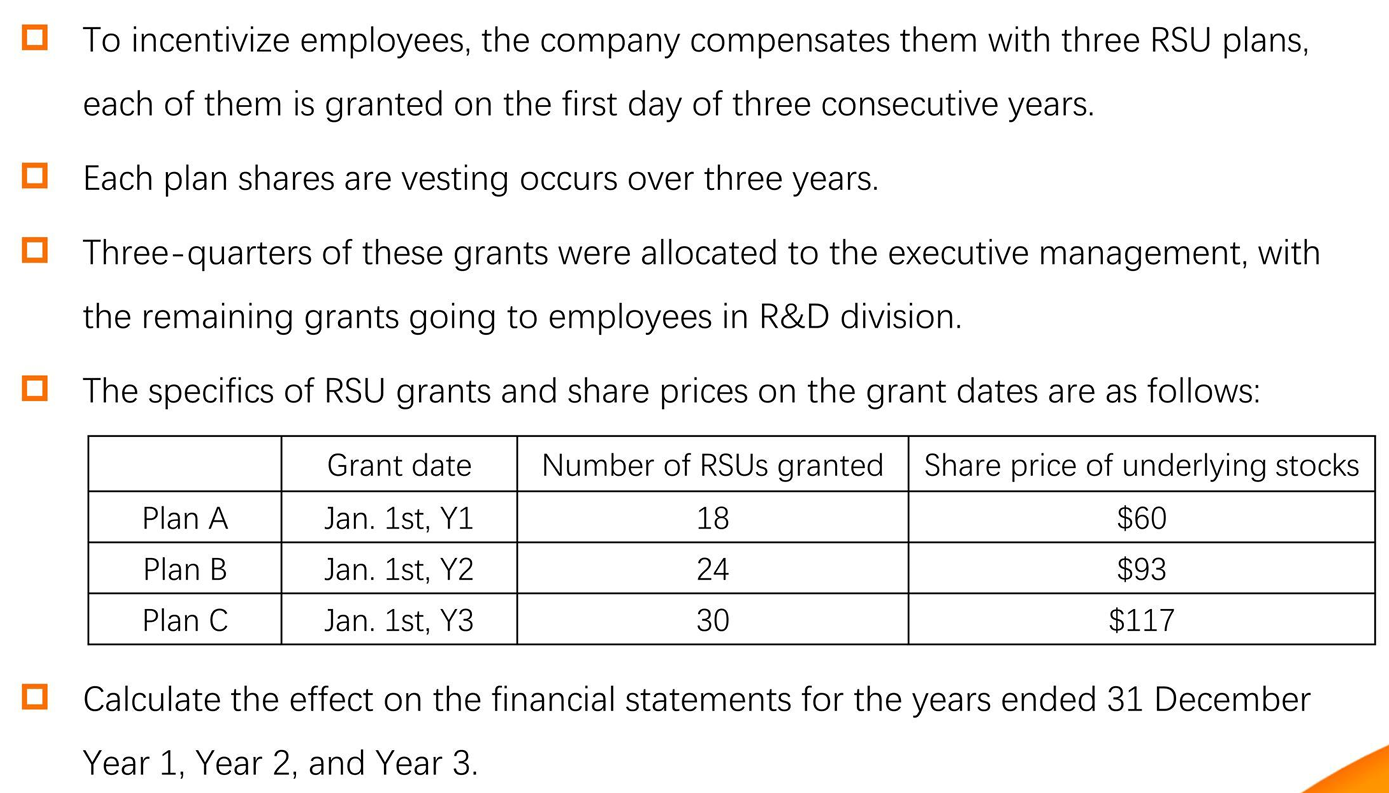

Employee Compensation

Definitions of Employee Compensation

Types of Employee Compensation

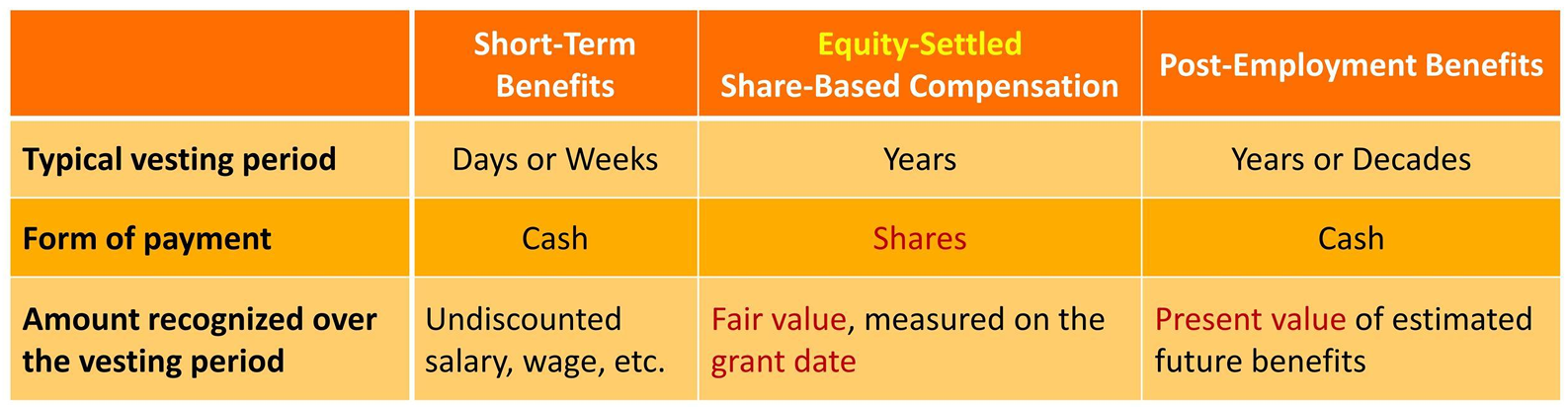

- Accounting standards divide compensation into five general types, with distinctions based on the (a) time between employee service and payment and (b) form of payment.

- Short-term benefits: compensation expected to be paid within 12 months.

- salaries and wages, annual bonuses, non-monetary benefits such as medical care

- Long-term benefits: compensation expected to be paid after 12 months.

- long-term paid leave, long-term disability benefits

- Termination benefits: compensation paid in the event of employee termination.

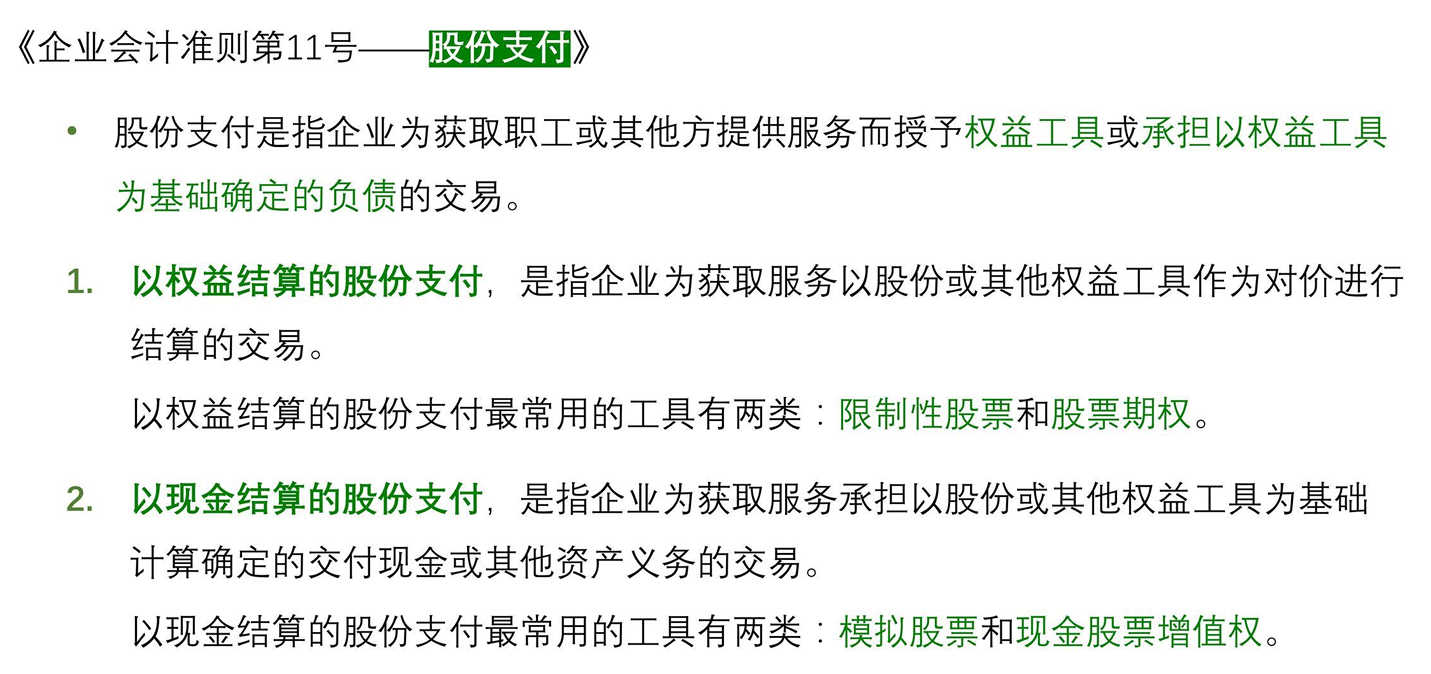

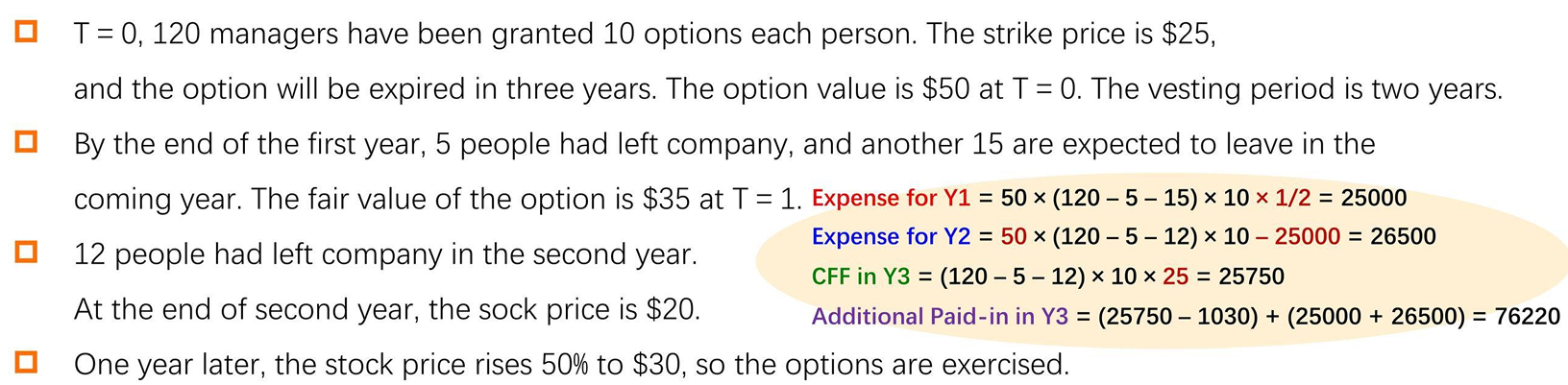

- Share-based compensation: compensation in the form of, or in reference to shares of the employer's stock.

- Post-employment benefits: compensation expected to be paid after employee retirement.

- pension and lump sum payments to retirees, retiree life insurance and medical care

Basic Terminology

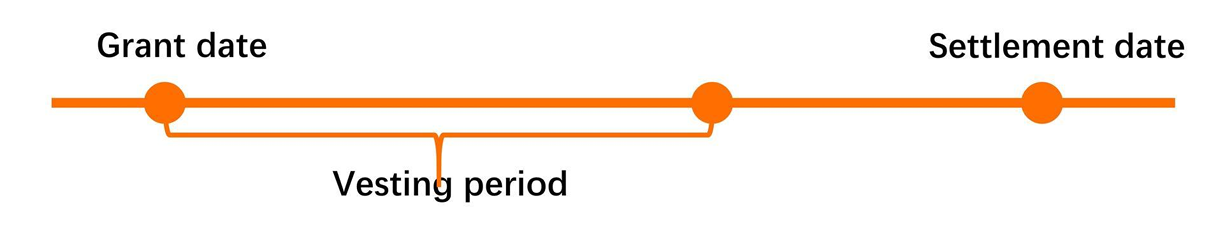

- The principle is to recognize compensation costs at fair value in the period that the employee provides services, which is typically the same period that the compensation vests费用确认在vesting period中

- Vesting refers to when an employee earns (becomes unconditionally entitled to) compensation, thereby creating an obligation for the employer to pay that compensation.

- Vesting is followed by settlement, the date the employer pays the compensation in cash or in another form,

Financial Reporting for Short-Term Benefits

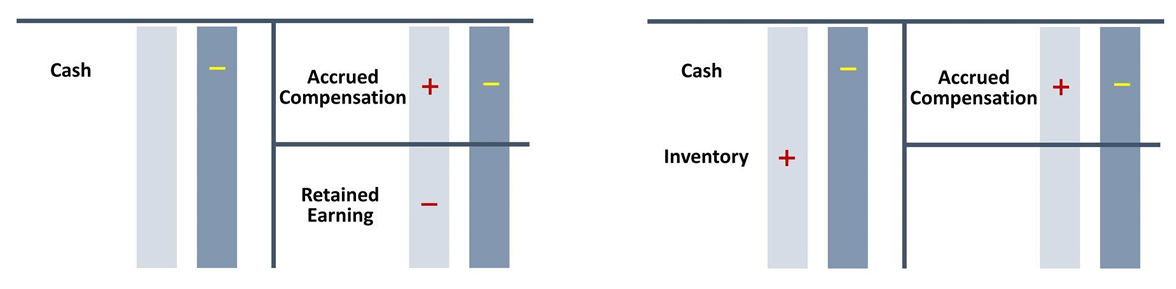

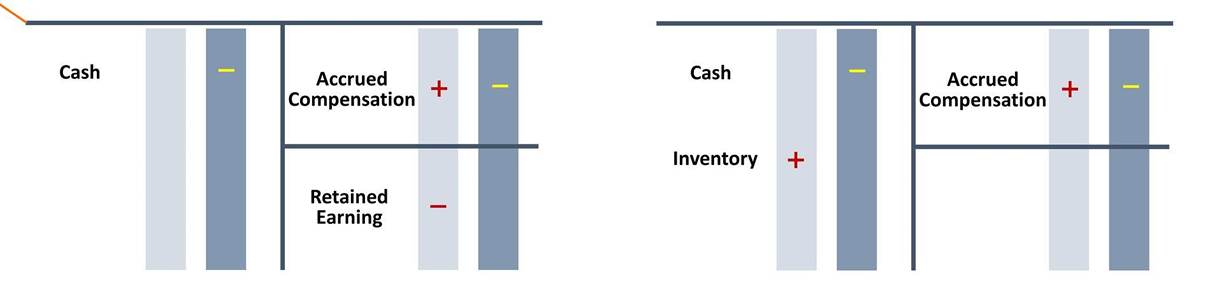

- During vesting period

- Compensation expense and a corresponding current liability are recognized as compensation vests, usually at the same time the employee performs services.

- Or, compensation costs are capitalized as an asset, with compensation expense on the income statement deferred to when the employee service is consumed.

- At settlement: cash is paid, and the liability is derecognized, and the cash compensation is an outflow in operating activities on the statement of cash flows.

Accounting Principle

- Regardless of the form of compensation, most companies aggregate and report compensation expense on the income statement based on the employee's function.

- An exception is termination benefits, which are often incurred as part of corporate restructurings, so may instead be reported on the income statement as a discrete line item such as "Restructuring Charges"

Share-Based Compensation

Introduction

Advantages and Disadvantage of Share-Based Compensation

- Share-based compensation has several advantages over cash compensation.

- It aligns employees' financial interests with those of shareholders, reducing principal-agency conflicts of interest, and can allow employees to participate in firm value creation.

- Multi-year vesting periods improves employee retention.

- Equity-settled share-based compensation requires no cash outlay, thereby preserving liquidity.

- There are disadvantages to share-based compensation.

- The recipient of the share-based compensation may have limited influence over the company's share price, so share-based compensation may not necessarily reward individual performance or influence their actions.

- The increased firm ownership may lead to suboptimal risk-taking by managers.

- Share-based compensation means that employees also lose wealth from share price declines and underperformance against alternatives.

Vesting Condition

- An important feature for any share-based award is what employees must do for the award to vest.

- Vesting can be conditioned on service and/or performance.

- A service condition服务期限 means that compensation vests on a future date, requiring the employee to remain employed until that time

- A performance condition业绩条件 is an additional criterion for vesting, such as the company meeting or exceeding a target for EPS, return on invested capital, or segment profit.

- Performance conditions can be a market condition市场条件, which relates to the employer's share price, such as requiring the company's shares to meet or exceed a total shareholder return target or outperform an index of peers' share prices.

- If an employee leaves the firm before an award vests, the unvested awards are forfeit.

Equity-Settled Share-Based Compensation

- Restricted stock involves common shares granted to employees but subject to selling and other restrictions.

- Restricted stock is also referred to as performance shares if vesting is based not only on service but also on performance conditions.

- Restricted stock generally has voting rights and dividend participation, but it is not tradeable

- Restricted stock units(RSUs) are similar to restricted stock, but rather than actual shares, they are instruments which represent the right to receive shares upon settlement.

- RSUs have neither voting rights nor dividend participation and are also not tradeable.

- Employee stock options are non-tradeable call options on the employer's stock typically issued at the money.

Financial Reporting

Fair Value at Grant Date

- For equity-settled share-based compensation, fair value is measured only once, at the grant date.

- Any subsequent change in the fair value, which we would expect as the share price changes, has no effect.

- The grant-date fair value for restricted stock and RSU awards is the market price of the underlying shares.

- For RSUs, the share price is typically adjusted downward for dividends expected to be paid over the vesting period if the RSU does not participate in dividends.

- The fair value of employee stock options on the grant date must be estimated.

- An option's fair value consists of its intrinsic value and time value.

- Option valuation models, including the Black-Scholes option pricing model and binomial model.

- Higher assumed volatility, a longer estimated life, a higher risk-free rate,and lower dividend yield increase the estimated fair value.

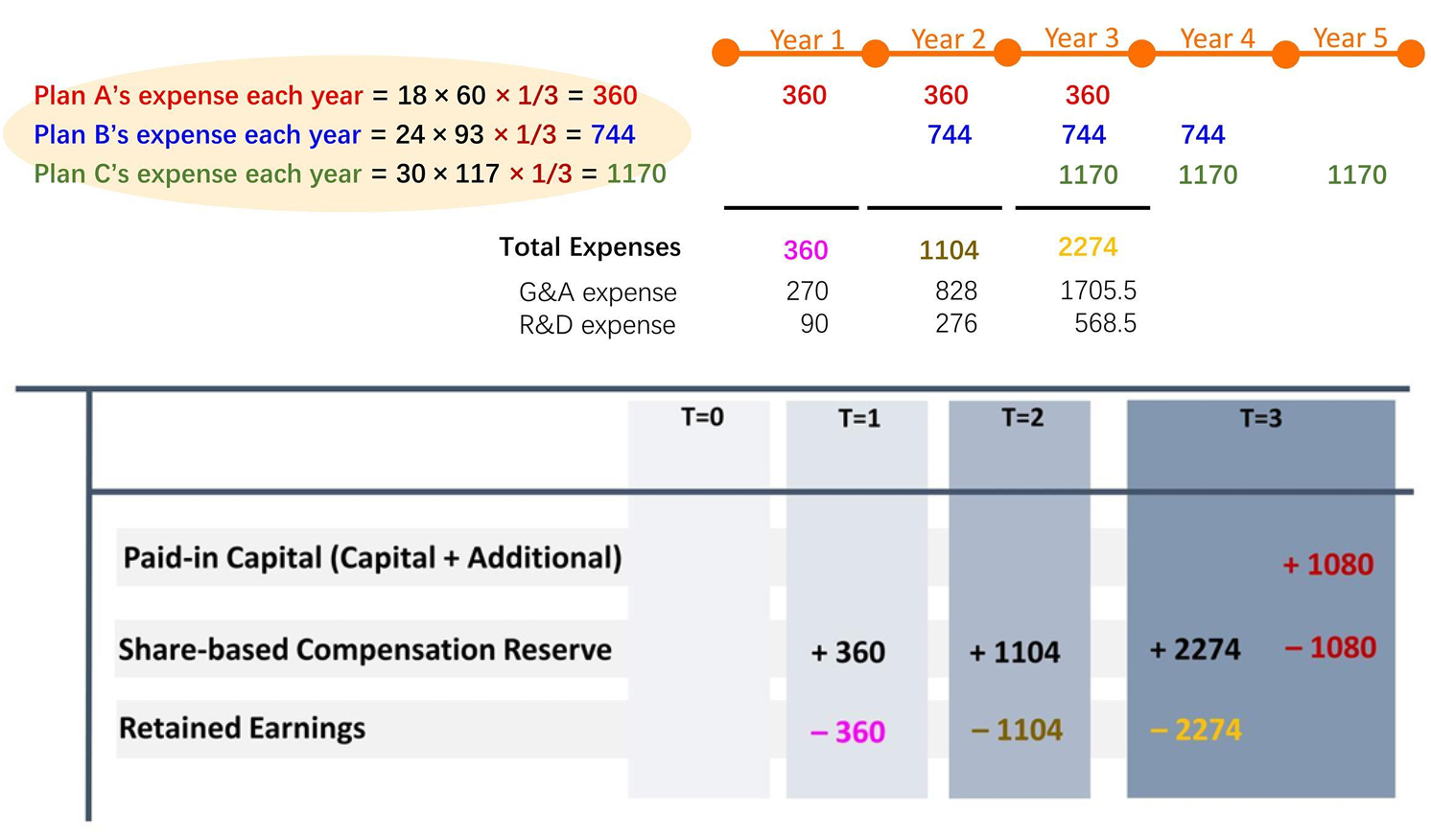

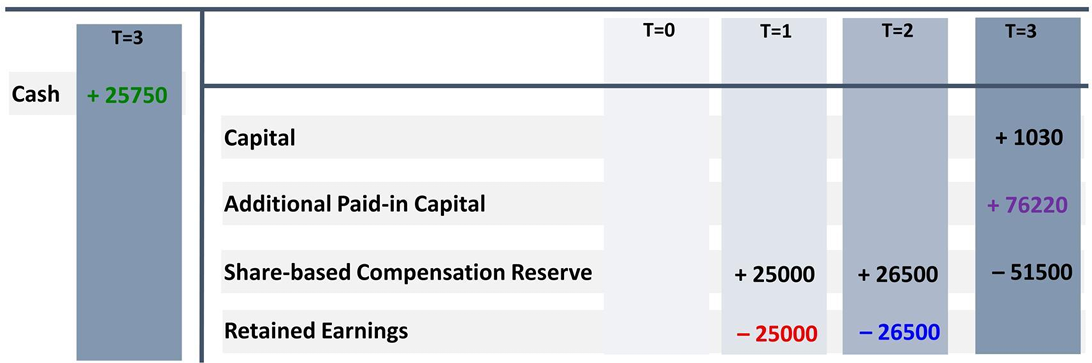

Accounting during Vesting Period & on Settlement Date

- Recognize compensation costs over the period that the employee provides services, which is typically the same period that the compensation vests.

- Besides the measurement of fair value, another difference in the accounting between RSUs and options is how they are settled

- When RSUs vest, settlement occurs automatically, converting to common stock.

The only accounting entry required is transferring amounts from the share-based compensation reserve account资本公积-其他资本公积 to common stock and paid-in capital accounts资本公积-股本溢价 on the balance sheet.同时资本公积-股本增加(假设增发股票)

- When options vest, settlement does not occur until the options are exercised,which is at the employee's discretion and depends on the share price.

At settlement, a cash inflow is recorded in financing activities on the statement of cash flows for the number of options exercised multiplied by the strike price.

- When RSUs vest, settlement occurs automatically, converting to common stock.

Impact on the Financial Statements

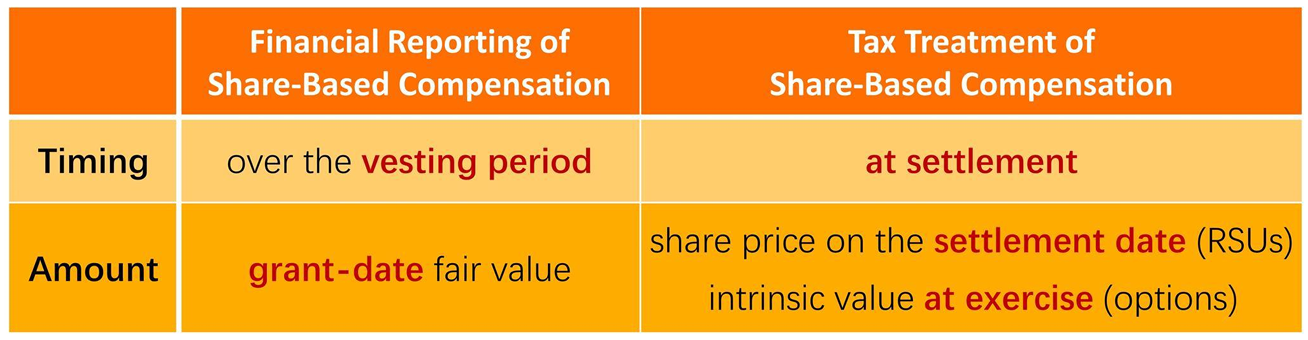

Financial Reporting vs. Tax Treatment of Share-Based Compensation

- Share-based compensation is deductible for issuers' taxable income in most jurisdictions.

- The deduction often differs in timing and size from the share-based compensation expense recognized on an income statement.

Tax Windfalls and Shortfall

- A higher share price at settlement versus the grant date

- It results in a higher tax deduction than the cumulative stock-based compensation expense.

- This is known as an excess tax benefit or tax windfall, because taxable income and tax expense are reduced.

- A lower share price at settlement versus at the grant date

- It results in a lower tax deduction than the cumulative stock-based compensation expense.

- This is known as a tax shortfall because taxable income and tax expense are increased.

- IFRS and Us GAAP treat tax windfalls and shortfalls differently on the financial statements.

Resultfor US GAAP Reporter

- The result for US GAAP reporters is that share-based compensation introduces volatility in the effective tax rate (income tax expense as a percentage of income before taxes)and may cause large differences between an issuer's effective and statutory tax rates.

- An implication of this for analysts is to closely examine the reconciliation of the statutory to effective tax rate for US GAAP reporters and not assume the historical effective tax rate will persist if the company reported a tax windfall or shortfall from share-based compensation.

- Because tax windfalls and shortfalls are recognized directly in equity for IFRS reporters, they will have comparatively more stable effective tax rates with less deviation from statutory tax rates than their US GAAP counterparts.

Basic and Diluted Shares Outstanding

- Basic shares outstanding is presented on the income statement as a weighted average for the reporting period and on the balance sheet and statement of stockholders' equity as of period end,and it increases when share-based awards settle

- Basic shares outstanding in each period does not include share-based awards that have not settled.

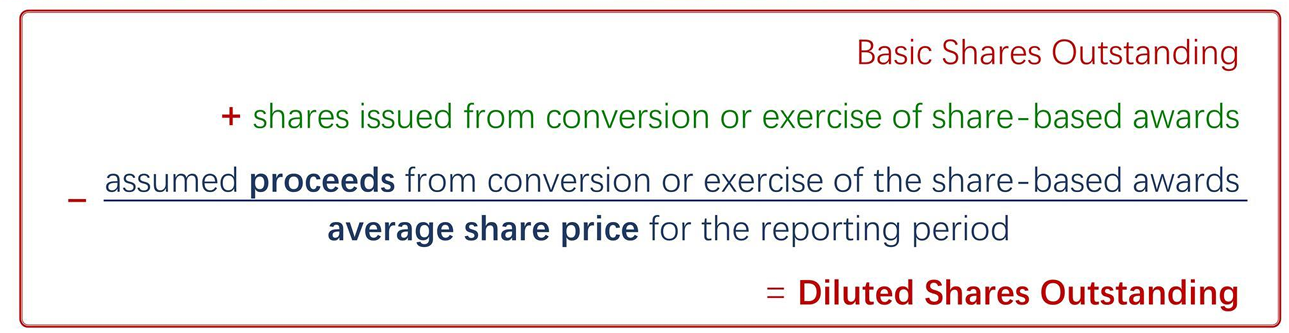

- Share-based awards that have not settled are included in diluted shares outstanding, using the treasury stock method, not simple addition.

- Treasury stock method

- The treasury stock method adds a "net" amount of potentially dilutive securities like unvested RSUs to basic shares outstanding

- Proceeds from the exercise or conversion of the potentially dilutive securities are assumed to be used to repurchase shares at the average share price for the reporting period.

- Only share-based awards that management judges as likely to vest are included in the calculation.

- In practice, awards with service vesting conditions are usually included, but awards with performance conditions that have not been met as of the end of the reporting period are excluded.

Proceeds from exercise

- Cash proceeds from exercise

- For options, this is the strike price multiplied by the number of options

- Zero for RSUs

- Unrecognized share-based compensation expense

- Unrecognized share-based compensation expense as of the end of a period is a product of the unvested awards and their grant-date fair values.

- In CFA exam, average unrecognized share-based compensation expense is used,which is simply the average of the last two period-end values.

Dilutive and Anti-Dilutive Shares Outstanding

- In-the-money options (average share price > strike price) may be dilutive and may be included in diluted shares outstanding.

- Out-of-the-money and at-the-money options are anti-dilutive and left out of diluted shares outstanding.

- RSUs are usually dilutive, except when the average stock price is materially below the stock price at the RSU grant date, and this can result in anti-dilutive RSUs.

- Rapid increases in the share price can result in more dilution(and vice versa), because the assumed number of shares that can be repurchased falls with a higher average share price.

Financial Statement Modeling

Disclosures for Share-Based Compensation

- IFRS requires companies to disclose information that enables users of the financial statements to understand:

- the nature and extent of share-based payment arrangements that existed during the period;

- how the fair value of the equity instruments granted during the period was determined;

- the effect of share-based payment transactions on the company's net income(loss) during the period and on its financial position.

- These disclosures are typically made in the notes to the financial statements in a note titled "Share-Based Payments" or similar.

- Additionally, the proxy statement or other governance reports will contain disclosures on executive management and directors' compensation, which typically have a significant share-based component

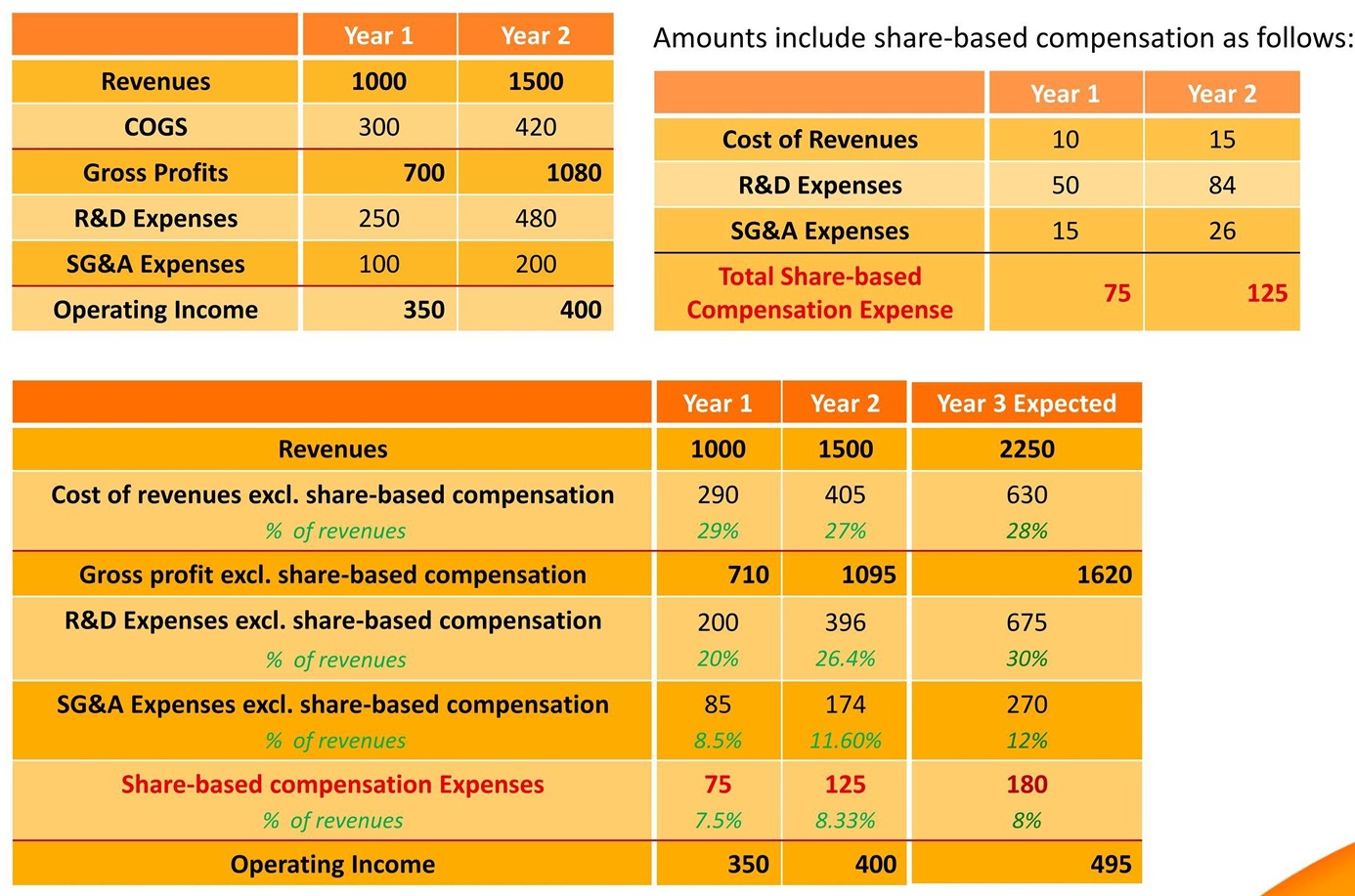

Forecasting Considerations

- Income Statement

- The common approach to forecasting share-based compensation expense is as a percentage of revenues.

- Share-based compensation tends to decline as a percentage of revenue as companies reach maturity, so for earlier stage companies, analysts should model share-based compensation discretely.

- Like other compensation costs, share-based compensation is typically not a discrete line item on the income statement: it is included in operating expenses based on the employee recipient's role at the company.

- Modeling share-based compensation expense as a discrete line item (apart from the functional costs and expenses it is reported in).

- Cash Flow Statement

- Beyond the income statement, however, forecasting share-based compensation as a discrete item is necessary for the statement of cash flows.

- If the indirect method is used for deriving cash flows from operating activities, the expense needs to be added back in reconciliation from net income on the statement of cash flows.

- Shares Outstanding with Share-Based Awards

- grants of share-based awards, net of forfeitures可能有一定无法行权的. It is typically modeled using growth rates off historical values, and should be compatible with the forecast of share-based compensation expense.

- settle****ments of awards. It can be modeled by assuming that a percentage of outstanding awards settles each period.

Valuation Considerations

- Multiples-based valuations

- If the multiple is using a non-GAAP measure such as adjusted EBITDA or adjusted EPS in the denominator that excludes share-based compensation, such measures overstate profits. (share-based compensation is a real cost)

- It is important for multiples is transparency and consistency: if an analyst is analyzing multiples for several companies as well as industry and sector averages, all of them should be based on GAAP measures or all of them should be based on the same non-GAAP measure.

- Some analysts ignore share-based compensation in valuation, believing it irrelevant to value because it is not a cash expense.

This is flawed because share-based compensation is a transfer of value from an issuer to its employees and dilutes existing shareholders. Second, many companies offset the dilution from share-based compensation by repurchasing shares in an equivalent amount on the open market,which effectively results in share-based compensation behaving like a cash expense.

- Discounted free cash flow(DCF) model

- Since share-based compensation is non-cash, discounted cash flow mode used to value companies and their equity do not account for it by default Accordingly, we need to modify the model to account for the effect of: dilution from outstanding but unvested share-based awards; dilution from future share-based awards.

- The most pragmatic method to account for the second effect in a discounted cash flow valuation is to deduct share-based compensation from free cash flow.

Post-Employment Compensation

Introduction

Defined Contribution Plan

- Post-employment benefits are classified as either defined contribution(DC) or defined benefit (DB).

- Post-employment benefits include cash (pension) benefits and non-monetary benefits for retired employees.

- In DC plans, the employer sponsor makes agreed-upon contributions to the plan.

- After the employer makes agreed-upon contributions, it has no further obligation: the employer is not obligated to make future contributions, gains or losses related to plan investments accrue to the employee.

- Employees may choose how to invest their plan funds from designated options, and the employee bears the investment risk of assets not being sufficient to meet future needs and actuarial risks精算风险 such as outliving assets.

FinanciaI Reporting for DC Plans

- Employers' plan contributions are recognized as an expense on the income statement,grouped with other functional costs in the relevant operating expense category.

- As with share-based compensation, pension expense is typically not a discrete line on the income statement

- The only balance sheet effect is a current liability for vested but not-yet-settled contributions.

- Plan contributions are a cash outflow in operating activities on the statement of cash flows.

Defined Benefit Plan

- DB plans are commitments to pay a defined amount after an employee's retirement.

- Benefits can be lump sum or periodic pension payments until death.

- DB plans typically have criteria in terms of years of service that qualify an employee to receive future benefits.

- The amount of benefit is usually based on a formula with parameters such as the employee's years of service and compensation before retirement.

- Employers bear the investment risk of DB plan investment performance not meeting expectations and the actuarial risks associated with retirement ages, life expectancies, and future salaries deviating from expectations.

- Along with the shift to DC plans, many DB plans have been closed and/or frozen.

- A closed DB plan means that new employees can no longer enter the plan.

- A frozen DB plan means that current beneficiaries no longer accrue additional benefits from service, so their future benefit payments are fixed.

Other Post-Employment Benefits

- Other post-employment benefits(OPEB) refer to DB plans that pay non-monetary benefits, such as life insurance and medical care for retirees.

- Companies are often not required by regulations to pre-fund OPEB plans.

- Therefore, many OPEB plans are unfunded or have no specific assets set aside to meet future payments.

- OPEB does obligate the employer to pay benefits in the future and thus exposes them to investment and actuarial risks.

Financial Reporting for DB Plans

Pension Obligation

- DB pension plans are essentially promises by the employer to pay a defined amount of pension in the future.

- The future pension payments represent a liability (obligation) of the employer.

- As part of total compensation, the employee works in the current period in exchange for a pension to be paid after retirement.

- Both IFRS and US GAAP measure the pension obligation as the present value of future benefits earned by employees for service provided to date.

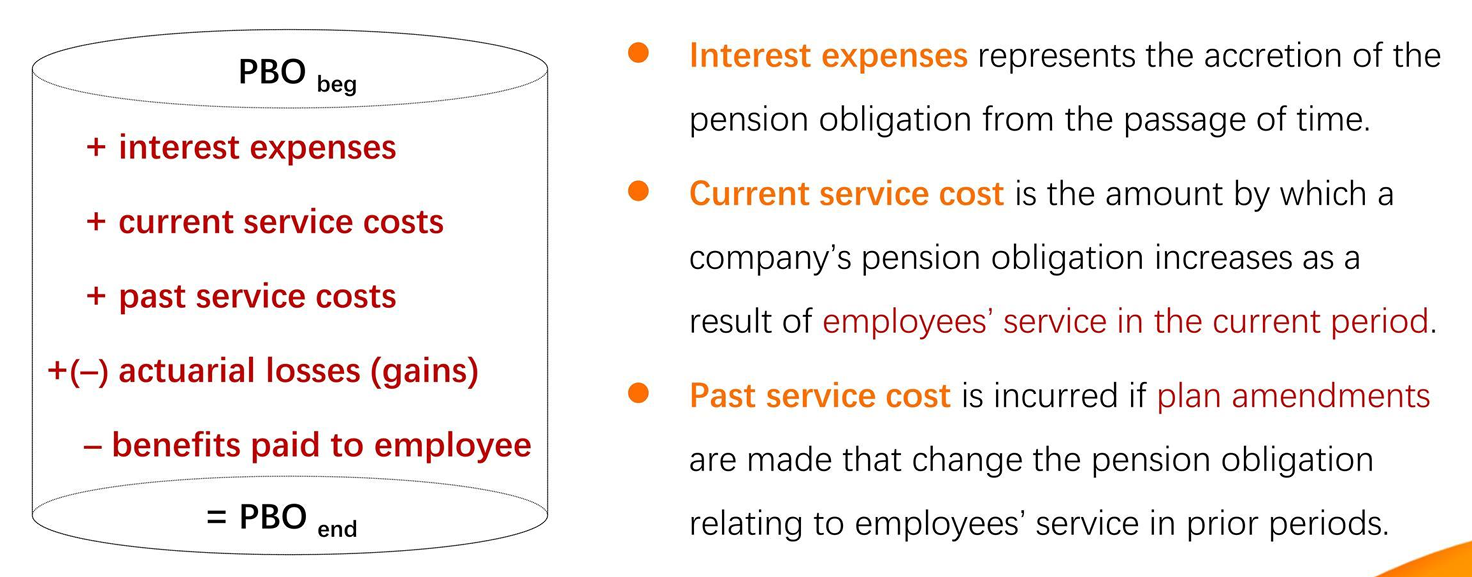

- The obligation is called the present value of the defined benefit obligation(PVDBO) under IFRS and the projected benefit obligation(PBO) under US GAAP

- The obligation is called the present value of the defined benefit obligation(PVDBO) under IFRS and the projected benefit obligation(PBO) under US GAAP

- Estimating the pension obligation involves making many actuarial assumptions(e.g., salary growth rates, retirement dates, mortality).

- The discount rate used in the pension obligation calculation is the yield on investment grade corporate bonds(or government bonds in the absence of a liquid market in corporate bonds) denominated in the same currency as the benefits.

Plan Assets

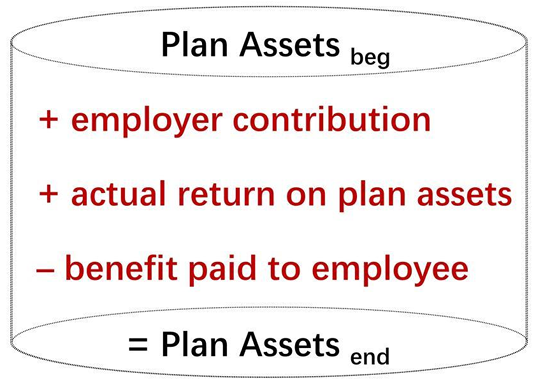

- The sponsoring company is responsible for making contributions to the plan, and ensure that there are sufficient assets in the plan to pay the ultimate benefits promised to plan participants.

- Employers make contributions to plan assets to meet regulatory minimum funding levels or on a discretionary basis to ensure that future benefits can be paid.

- In many jurisdictions, employers' plan contributions are tax deductible,so contribution decisions are made with tax planning considerations.

- Plan assets are the property of the plan, not the sponsoring company,so once the employer makes a contribution, it cannot be withdrawn.

- Plan assets are also protected (i.e., legally isolated) from the sponsor in the event of its bankruptcy.

- The plan is a separate legal entity that prepares its own financial statements: payments of benefits from the plan to employees are not reported on the company's financial statements.

Funded Status

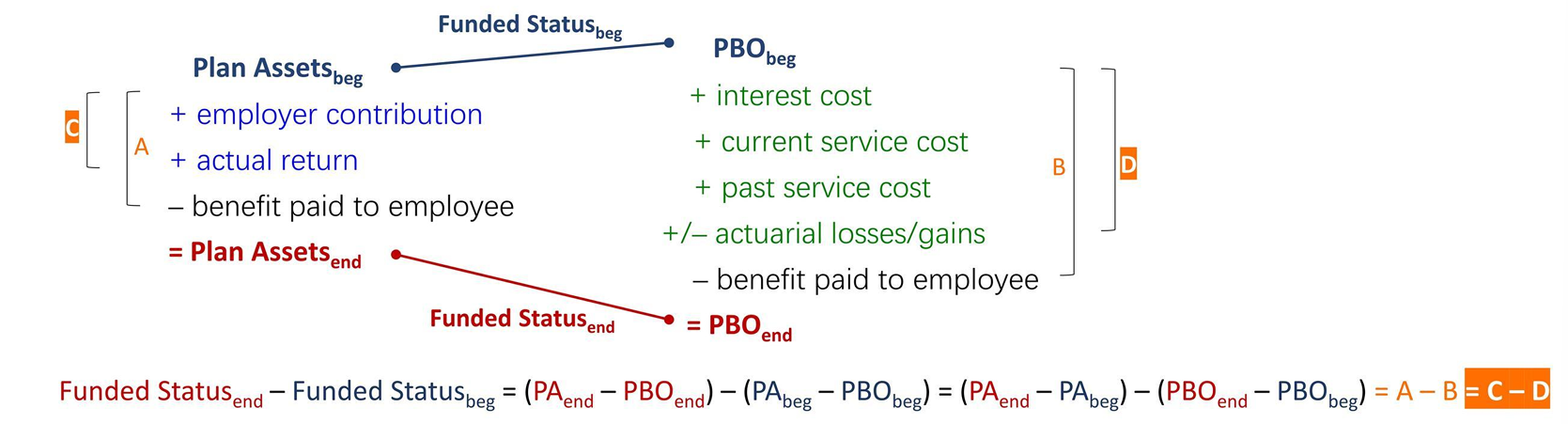

- Both IFRS and US GAAP require a DB plan's funded status to be reported on the balance sheet.

- Funded Status = fair value of plan assets - pension obligation

- Fair value of plan assets are measured at the price that would be received in an orderly sale. (quoted market prices are used if they are available)

- This is one of the rare instances where accounting standards permit a "net" rather than "gross"" presentation on the financial statements.

- However, different plans' funded statuses cannot be netted.

- If the pension obligation exceeds the pension plan assets (funded status is negative),the plan has a deficit, the plan is an underfunded plan and the funded status is reported on the balance sheet as a net pension liability.

- The net pension asset or liability may not be reported as a discrete item on the balance sheet but presented as part of "Other non-current liabilities"or "Other non-current assets'with more detailed disclosures in the notes to financial statements.

- If the plan assets exceed the pension obligation (funded status is positive),the plan has a surplus, the plan is an overfunded plan and the funded status is reported on the balance sheet as a net pension asset.

- The amount of reported assets is subject to a ceiling defined as the present value of future economic benefits, such as refunds from the plan or reductions of future contributions.

Logic of Financial Reporting for DB Plans

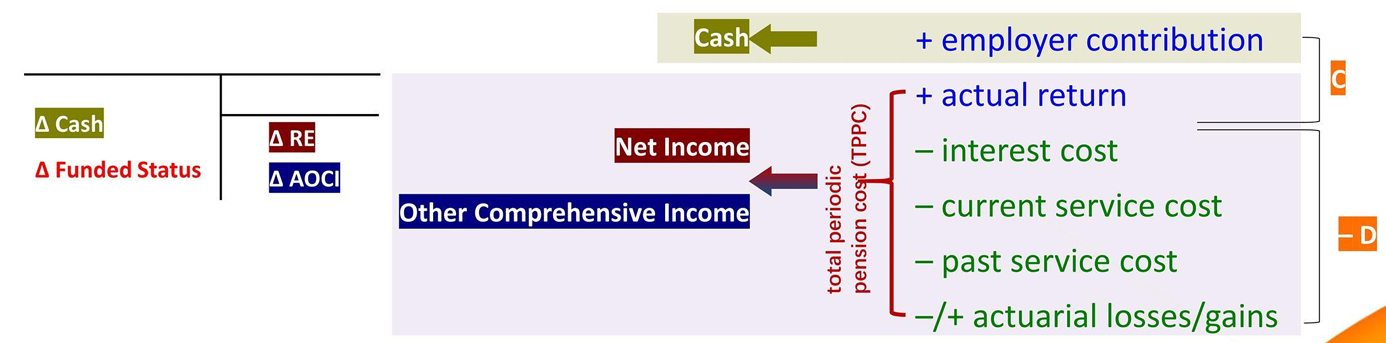

- Notice that the pension expense does not include employer's contributions to the plan (nor the settlement of benefits via payments to retirees)

- Plan contributions are recognized on the statement of cash flows,typically in operating activities.

- Total periodic pension cost (TPPC) of a company's DB pension plan

- TPPC = PPCin I/S + PPC in OCI

- TPPC = ending funded status - beginning funded status - employer contributions

Financial Reporting for DB Plans: IFRS

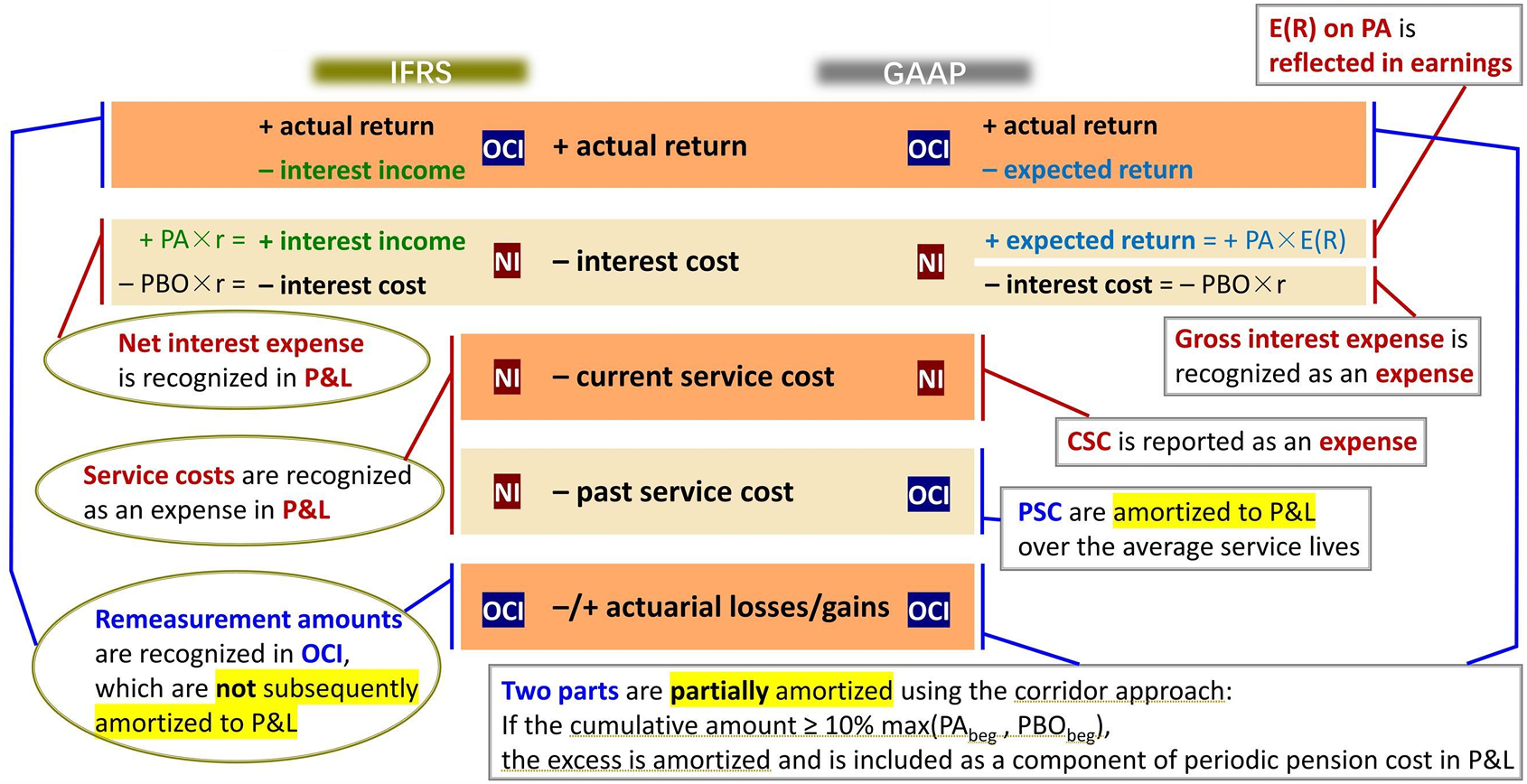

- Under IFRS, the total periodic pension cost (TPPC) has three components, two recognized on the income statement and one recognized in other comprehensive income(OCI).

- Service cost, which has two sub-components: current service cost and past service cost, are recognized as an operating expense on the income statement, generally grouped with other compensation costs in the relevant functional category.

- Net interest expense/income is recognized below the operating income line on the income statement, along with other financing costs like interest cost on debt.

- It is calculated by multiplying the net pension liability or net pension asset at the beginning of the period by the discount rate.

- Remeasurement of the net pension liability or asset are recognized in OCI, not in earnings. Remeasurement includes:

- differences between the actual return on plan assets and the amount assumed in the net interest expense/income calculation.

- actuarial gains and losses.

Financial Reporting for DB Plans: IFRS vs. GAAP

Financial Modeling and Valuation Considerations

Disclosures for Post-Employment Benefit Plans

- Disclosure requirements for DC benefits are minimal

- It only requires issuers to disclose the amount recognized as an expense,which is typically done in the notes to financial statements as part of a note titled "Employee Compensation," "Post-Employment Benefits," or similar.

- For DB plans including OPEB, it requires issuers to make numerous disclosures,the management's disclosures should accomplish several objectives:

- Explain the characteristics of its DB plans and risks associated with them.

- Identify and explain the amounts in its financial statements arising from its DB plans.

- Describe how its DB plans may affect the amount, timing, and uncertainty of the entity's future cash flows.

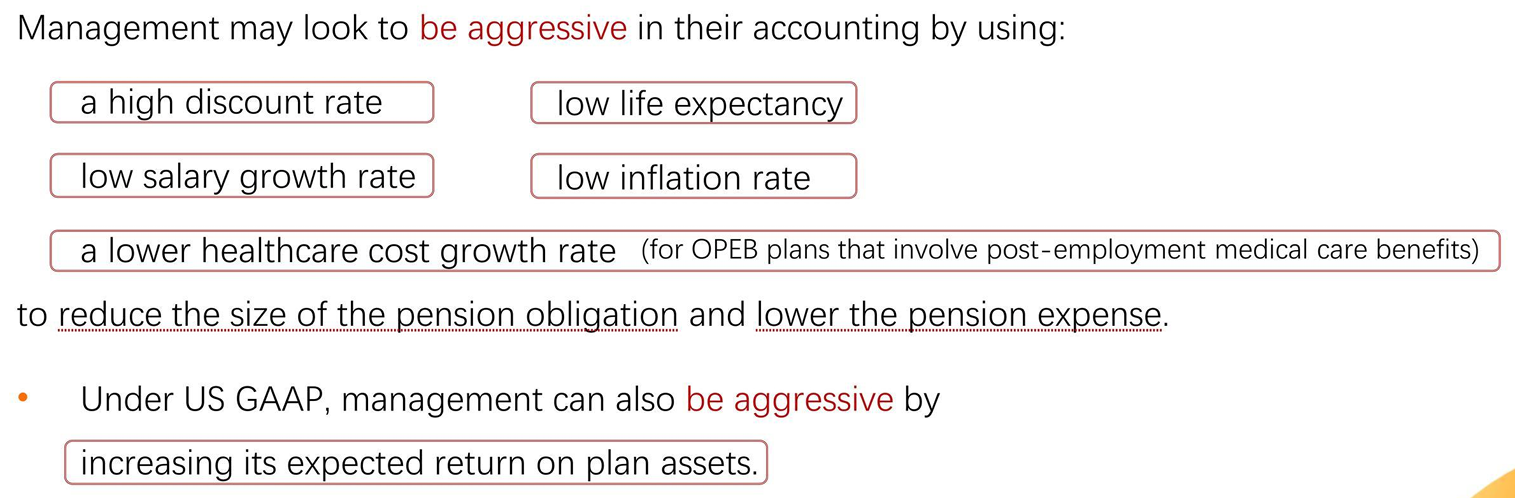

- For DB plans, analysts should check the disclosed assumptions over time and against other companies for reasonableness

- Management may look to be aggressive in their accounting by using:

- Management may look to be aggressive in their accounting by using:

Financial modeling for Post-Employment Benefit Plans

- Financial modeling for DC plan expenses is straightforward and typically done implicitly by making operating expense forecasts (i.e., by modeling SG&A expenses,DC plan expenses for employees in those functions is implicitly modeled).

- There are generally no problems with this approach because DC plan expenses are often structured as percentages of salaries and made in cash, so they share the same drivers as short-term benefits and other components of operating expenses.

- The general approach to modeling of DB plans, including OPEB, on the financial statements is to model service cost, net interest expense/income, remeasurements and the employer's plan contributions in future periods.

- For companies with small DB plans that are well funded (i.e., net pension liability is not more than 5% of the issuer's equity market capitalization), especially if they are also closed or frozen,analysts may not make detailed forecasts because the plan is not material to the investment case.

Valuation Considerations for DB Plans

- Plan's funded status, either a net liability of the company to plan beneficiaries or net asset if the plan is overfunded.

- Analysts apply an asymmetrical treatment of underfunded and overfunded plans.

- The funded status for an underfunded plan is considered debt in an enterprise value calculation, because it reflects the fact that an underfunded plan is a liability of a company because the company is obligated to make benefit payments regardless of the underfunding

- An overfunded plan is ignored in valuation. This is not simply conservatism,because an overfunded plan is only nominally an asset: plan assets cannot be withdrawn and distributed to shareholders or other providers of capital; plan assets are solely for paying benefits.

- Future service costs, which are future increases in the pension obligation from employee service.

- This is applicable unless the company's plans are frozen and not accruing additional benefits for service.

- Analysts should take an approach similar to that for share-based compensation: even though service costs are not cash expenses, service cost should be deducted from free cash flow in a discounted cash flow model (i.e., not added back to EBlT and therefore left expensed when computing free cash flow).

- Net interest expense/income should not be included in the discounted cash flow model as it represents the unwinding of the discounted pension obligation.

Multinational Operations

Foreign Currency Transaction

Introduction of Foreign Currency Activities

- A multinational company is likely to have two types of foreign currency activities that require special accounting treatment

- Engage in transactions that are denominated in a foreign currency → foreign currency transactions

- Invest in foreign subsidiaries that keep their books in a foreign currency → foreign currency translation

Foreign Currency Transactions

- The multinational company may engage in business transactions that are denominated in a foreign currency

- Foreign currency transactions occur when a company(1) makes an import purchase or an export sale that is denominated in a foreign currency, or (2) borrows or lends funds where the amount to be repaid or received is denominated in a foreign currency

- Because foreign exchange rates fluctuate over time, the value of foreign currency payables and receivables also fluctuates

- The major accounting issue here is how to reflect the changes in value for foreign currency payables and receivables in the financial statements

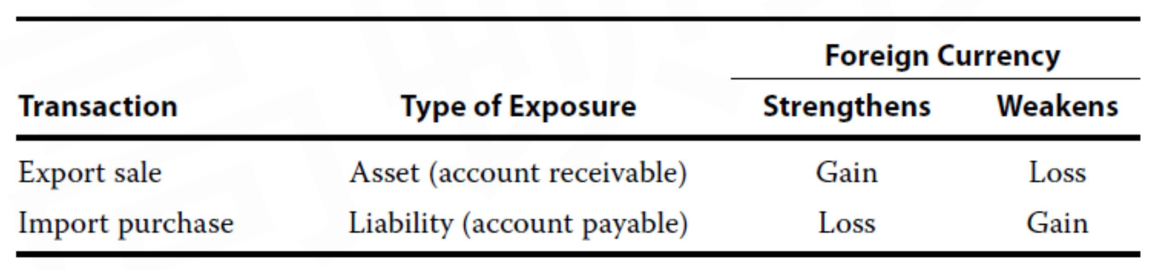

Transaction Exposure

- A foreign currency transaction exposure is an exposure to foreign exchange risk related to imports and exports

- Import purchase: the importer is exposed to the risk that from the purchase date until the payment date the foreign currency might increase in value, thereby increasing the amount that must be spent to settle the account payable

- Export sale: the exporter is exposed to the risk that from the purchase date until the payment date, the foreign currency might decrease in value,thereby decreasing the amount can be converted when it is received

Accounting for Foreign Currency Transactions

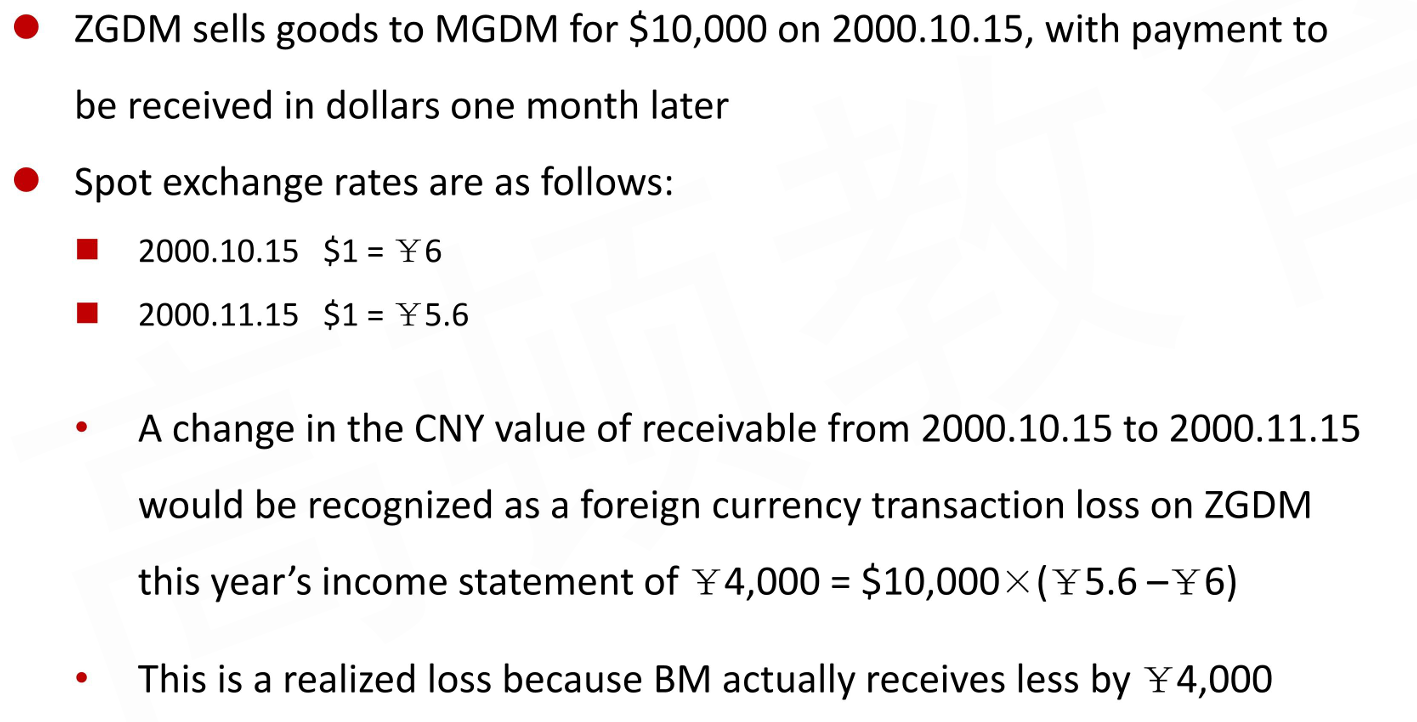

- Settlement before balance sheet date

- Foreign currency transactions are measured in the presentation (reporting) currency at the spot rate on the transaction date

- Both IFRS and US GAAP require the change in the value of the foreign currency asset (account receivable) or liability (account payable) resulting from a foreign currency transaction to be treated as a gain or loss reported on the income statement

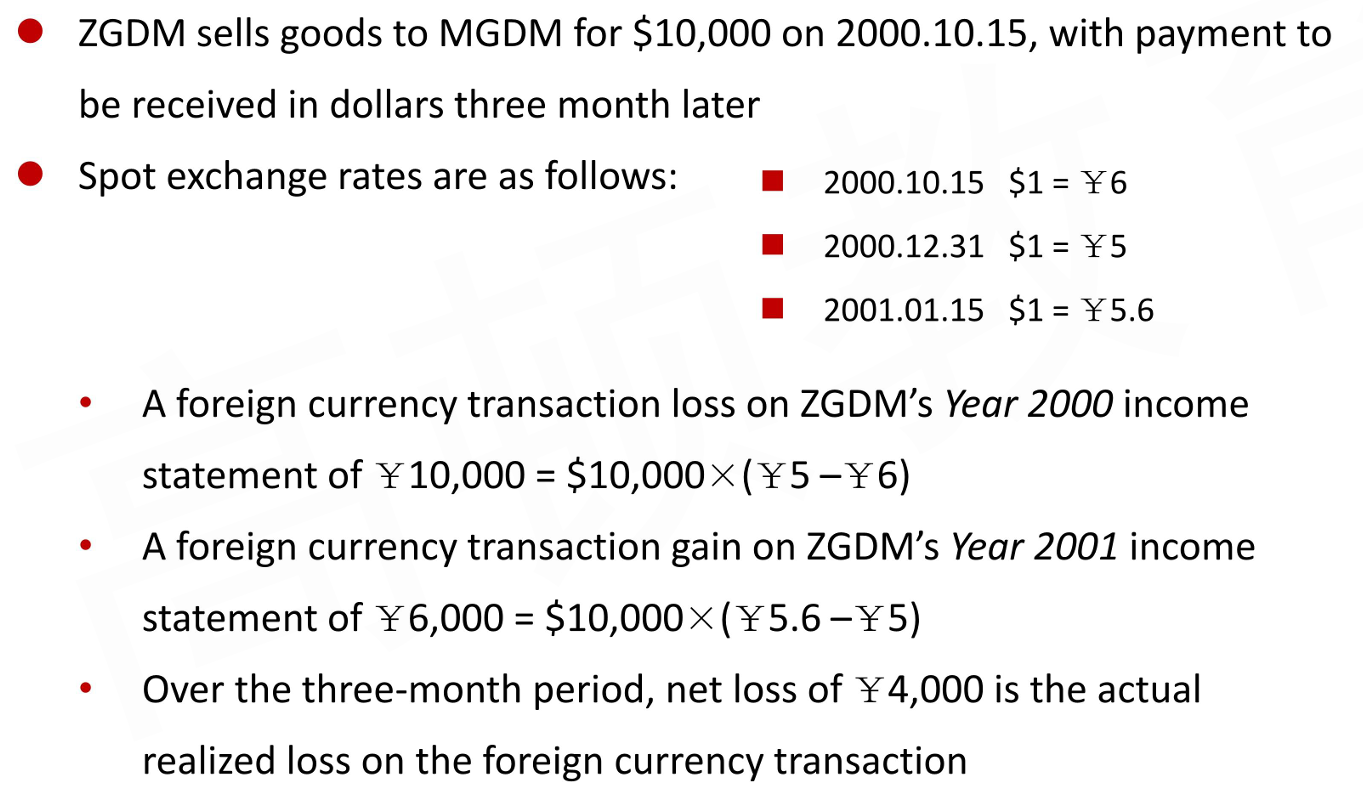

- Settlement after balance sheet date

- For foreign currency transactions whose settlement dates fall in subsequent accounting periods, both IFRS and US GAAP require adjustments to reflect intervening changes in currency exchange rates

- Foreign currency transaction gains and losses from "transaction initiation to balance sheet date" are reported on the income statement, creating one of the few situations in which accounting rules allow, indeed require,companies recognize a gain or loss in income before it has been realized

- Foreign currency transaction gains and losses from "balance sheet date to transaction settlement" are recognized on next year's income statement

- Whether a change in exchange rate results in a foreign currency transaction gain or loss (measured in local currency) depends on

- The nature of the exposure to foreign exchange risk (asset or liability)

- The direction of change in the value of the foreign currency (strengthens or weakens)

Analytical Issues

- Both IFRS and US GAAP require foreign currency transaction gains and losses to be reported in net income, but neither standard indicates where on the income statement these gains and losses should be placed

- This would distort the direct comparison of operating profit and operating profit margins

- A second issue that should be of interest to analysts relates to the fact that unrealized foreign currency transaction gains and losses are included in net income when the balance sheet date falls between the transaction and settlement dates

Foreign Currency Translation

Translation Conceptual Issues

Background of Foreign Currency Translation

- Many companies have operations in foreign countries and most operations located in foreign countries keep their accounting records and prepare financial statements in the local currency

- To prepare worldwide consolidated statements, parent companies must translate the foreign currency financial statements of their foreign subsidiaries into the parent company's presentation currency

Classification of Currency

- Presentation currency (reporting currency) is the currency in which financial statement amounts are presented母公司合并财务报表的币种

- The entity's financial statement shall be finally converted to reporting currency

- Functional currency is the currency of the primary economic environment in which an entity operates, and normally is the currency in which an entity primarily generates and expends cash子公司主要业务的币种

- The functional currency reflects the "substance" of the subsidiary economic activities

- Local currency is the national currency of the country where an entity is located子公司个别财务报表的币种

- The financial statement prepared by the entity is usually in local currency

More Details about Functional Currency

- The functional currency is the currency of the primary economic environment in which an entity operates

- Deciding the functional currency

- The currency that influences sales prices for goods and services

- The currency that influences labor, material, and other costs

- The currency from which funds are generated

- The currency in which receipts from operating activities are usually retained

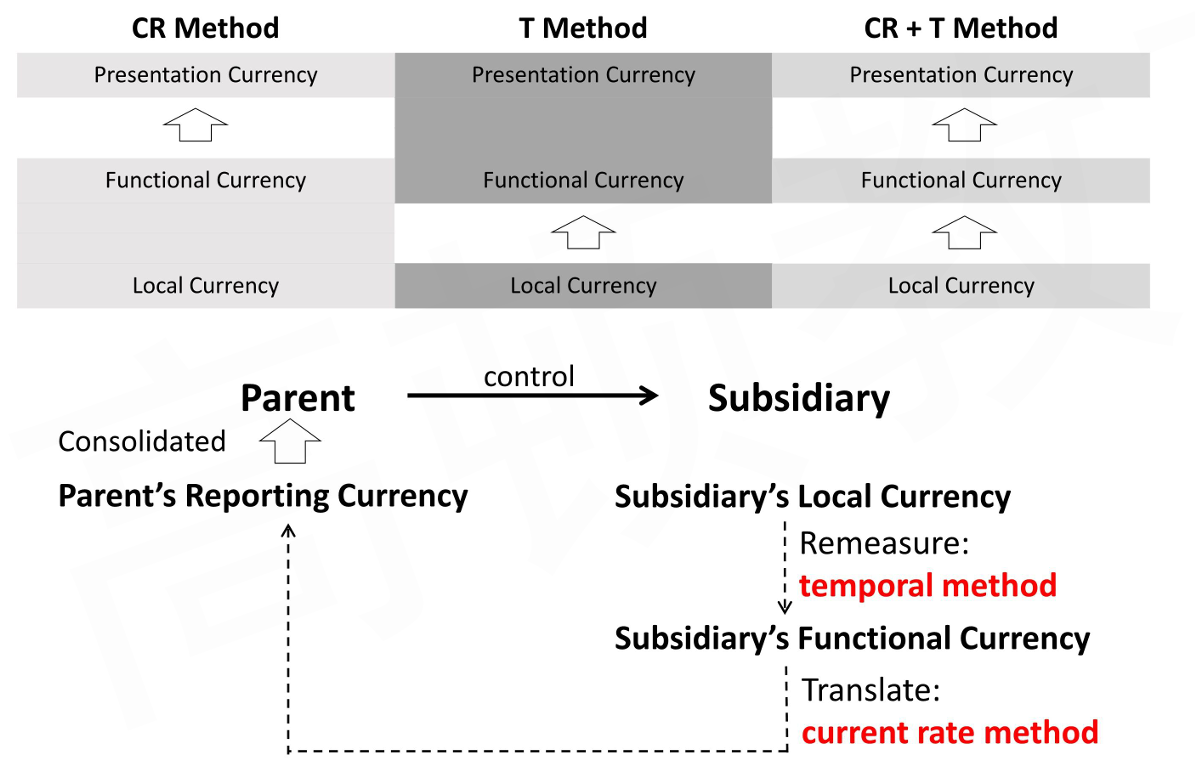

Choice of Foreign Currency Translation Method

- If the foreign local currency is the functional currency, which differs from the parent's presentation currency, the foreign entity's foreign currency financial statements are translated into the parent's presentation currency using current rate method

- If the parent's presentation currency is the functional currency, which differs from the foreign entity's local currency, the foreign entity's foreign currency financial statements are remeasured into the parent's presentation currency using temporal method

- US GAAP refer to this process as "remeasurement"

- IFRS describe this situation as "reporting foreign currency transactions in the functional currency"

Translation Methods

Translation Conceptual Issues

- In translating foreign currency financial statements into the parent company's presentation currency, two questions must be addressed:

- What is the appropriate exchange rate to use in translating each financial statement item?

- Current exchange rate

- Average exchange rate

- Historical exchange rates

- How is the balance sheet brought back into balance?

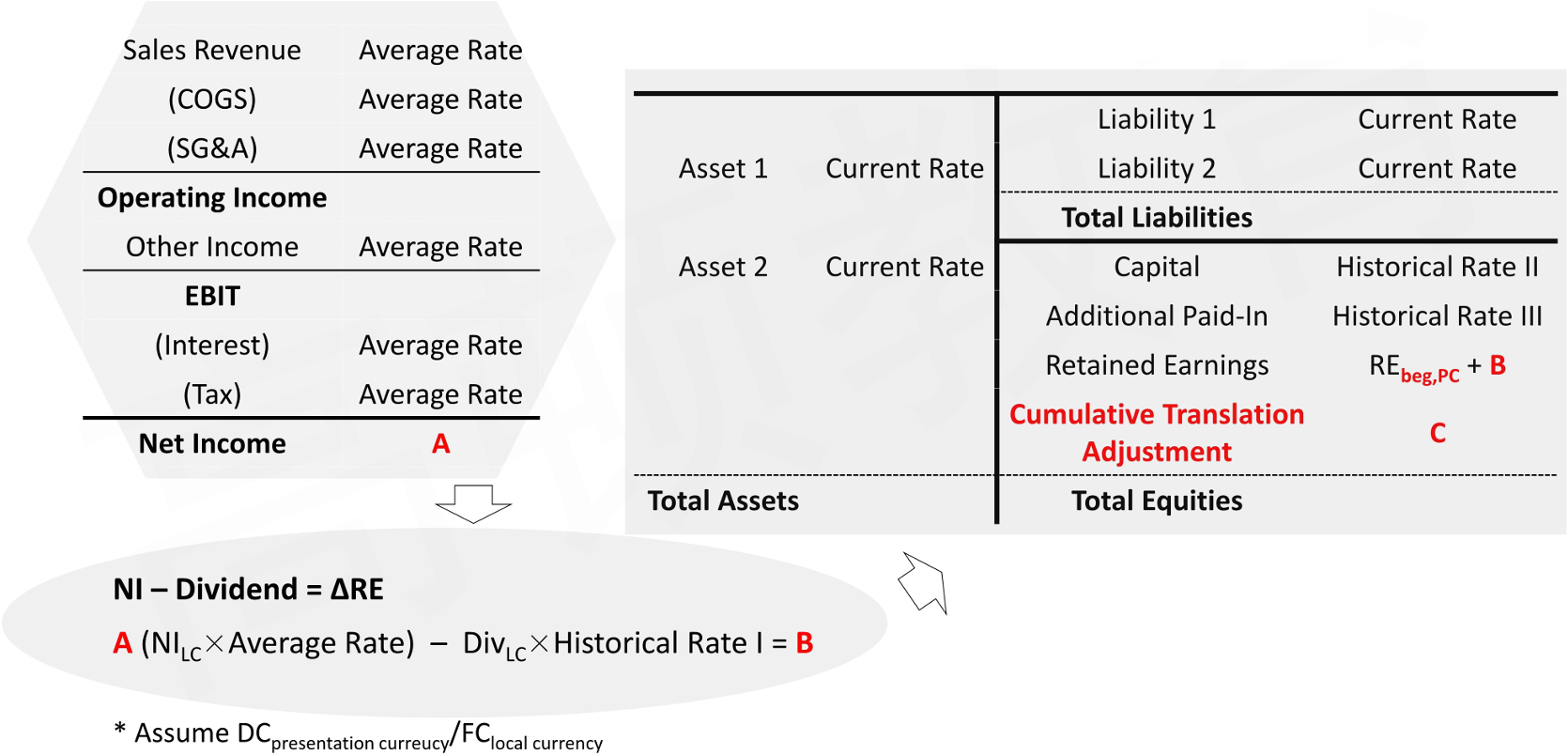

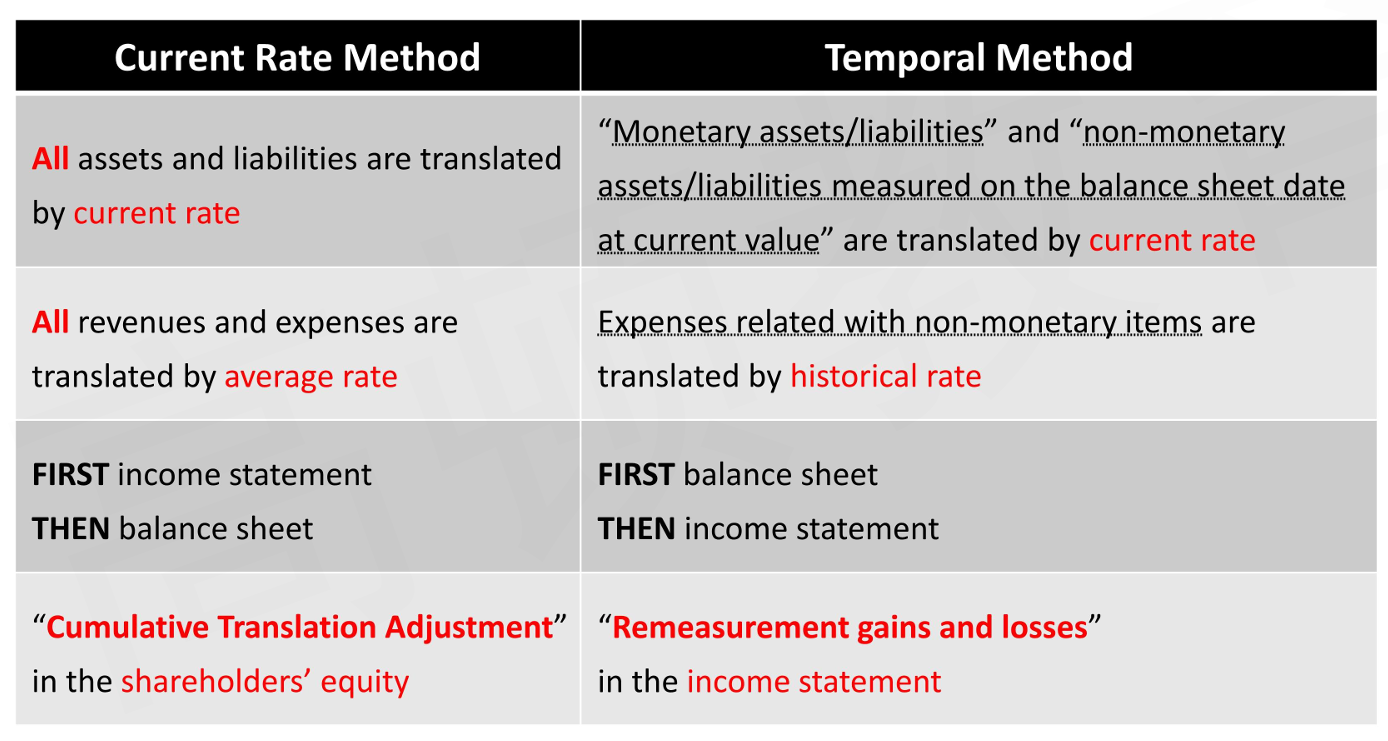

Current Rate Method

- In most cases, a foreign entity will operate primarily in the currency of the country where it is located, which will differ from the currency in which the parent company presents its financial statements

- In this situation, the current rate method should be used:

- All assets and liabilities are translated at the current exchange rate at the balance sheet date

- Stockholders' equity accounts are translated at historical exchange rates

- Revenues and expenses are translated at the exchange rate that existed when the transactions took place. For practical reasons, an average exchange rate may be used

- When the current rate method is used, the cumulative translation adjustment needed to keep the translated balance sheet in balance is reported as a separate component of stockholders' equity

Monetary and Non-Monetary Items

- Monetary items are cash and receivables (payables) that are to be received (paid) in a fixed number of currency units

- Monetary assets include cash and accounts receivable

- Non-monetary liabilities include deferred revenue

- Non-monetary assets

- Non-monetary assets measured at current value (e.g., marketable securities)

- Non-monetary assets measured at historical costs (e.g., inventory, property,plant & equipment; intangible assets)

- Monetary liabilities

- Such as accounts payable, accrued expenses, long-term debt, and deferred income taxes

- Most of liabilities are usually regarded as monetary items

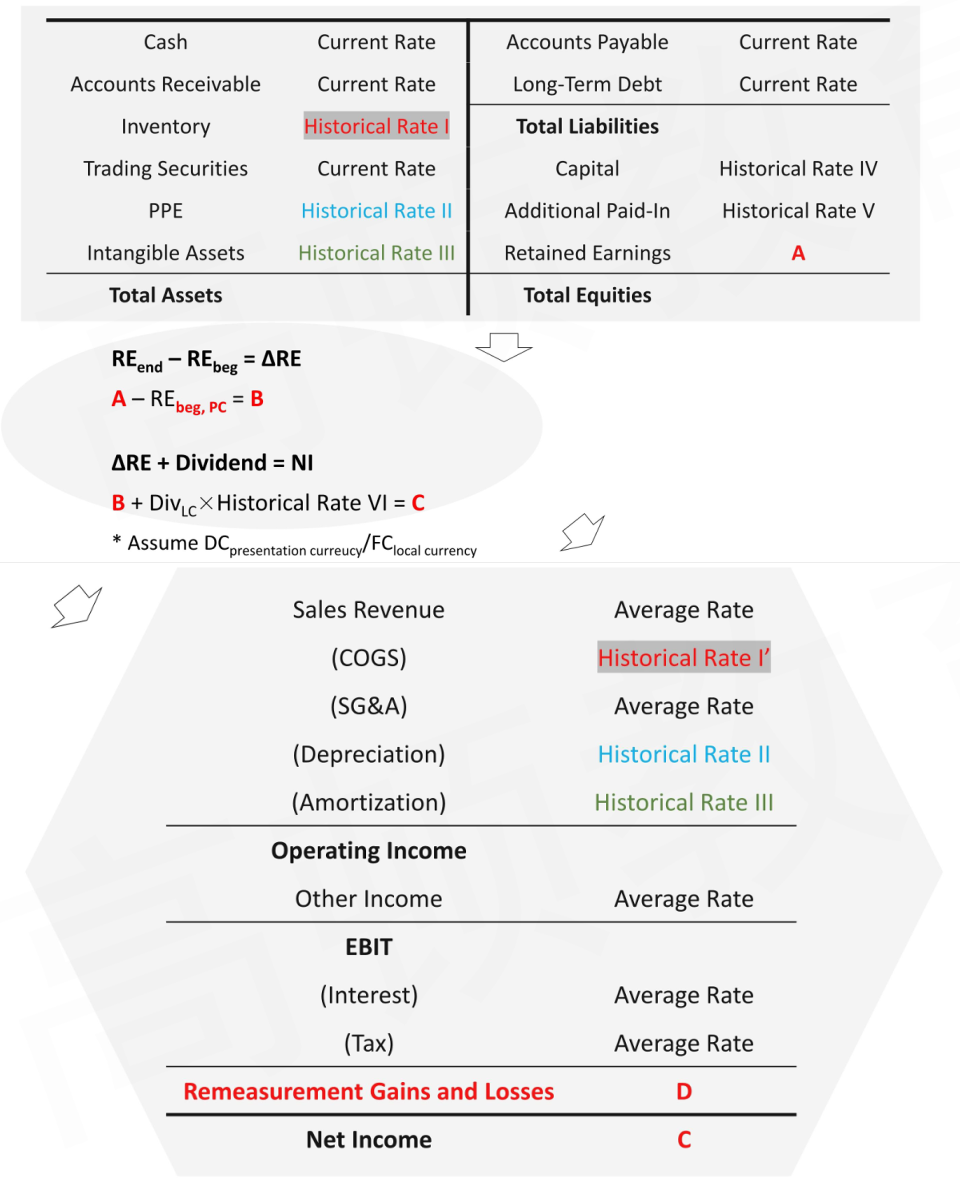

Temporal Method

- In some cases, a foreign entity might have the parent's presentation currency as its functional currency

- In this situation, the temporal method should be used:

- Monetary assets and liabilities are translated at the current exchange rate

- Non-monetary assets and liabilities measured at historical cost are translated at historical exchange rates

- Non-monetary assets and liabilities measured at current value are translated at the exchange rate at the date when the current value was determined

- Stockholders'equity accounts are translated at historical exchange rates

- Revenues and expenses, other than those expenses related to non-monetary assets are translated at the exchange rate that existed when the transactions took place. For practical reasons, average rates may be used

- Expenses related to non-monetary assets, such as cost of goods sold(inventory), depreciation (fixed assets), and amortization (intangible assets), are translated at the exchange rates used to translate the related assets

- The basic idea underlying the temporal method is that assets and liabilities should be translated in such a way that the measurement basis (either current value or historical cost) in the foreign currency is preserved after translating to the parent's presentation currency

- When the temporal method is used, the translation adjustment needed to keep the translated balance sheet in balance is reported as a gain or loss in net income

- US GAAP refer to these as "remeasurement gains and losses"

- The historical exchange rates used to translate inventory and cost of goods sold under the temporal method will differ depending on the cost flow assumption: FIFO, LIFO or average cost

- If FIFO is used, ending inventory will be translated at relatively recent exchange rates, and COGS will be translated at relatively older exchange rates

- If LIFO is used, ending inventory will be translated at relatively older exchange rates, and COGS will be translated at relatively recent exchange rates

- If weighted-average cost is used, both ending inventory and COGS will be translated at the weighted-average exchange rate for the year

Summary

Use Both Translation Methods

- Under both IFRS and US GAAP, a multinational corporation may need to use both the current rate method and the temporal method of translation at a single point in time

- As a result, a multinational corporation's consolidated financial statements can reflect simultaneously both

- a net translation gain or loss that is included in the determination of net income(from foreign subsidiaries translated using the temporal method)

- a separate cumulative translation adijustment reported on the balance sheet in stockholders' equity (from foreign subsidiaries translated using the current rate method)

Disclosures Related to Translation Methods

- Both IFRS and US GAAP require two types of disclosures related to foreign currency translation:

- The amount of exchange differences recognized in net income

- The amount of cumulative translation adjustment classified in a separate component of equity

- The amount of exchange differences recognized in net income consists of:

- Foreign currency transaction gains and losses

- Translation gains and losses resulting from application of the temporal method

- Neither IFRS nor Us GAAP require disclosure of the two separate amounts

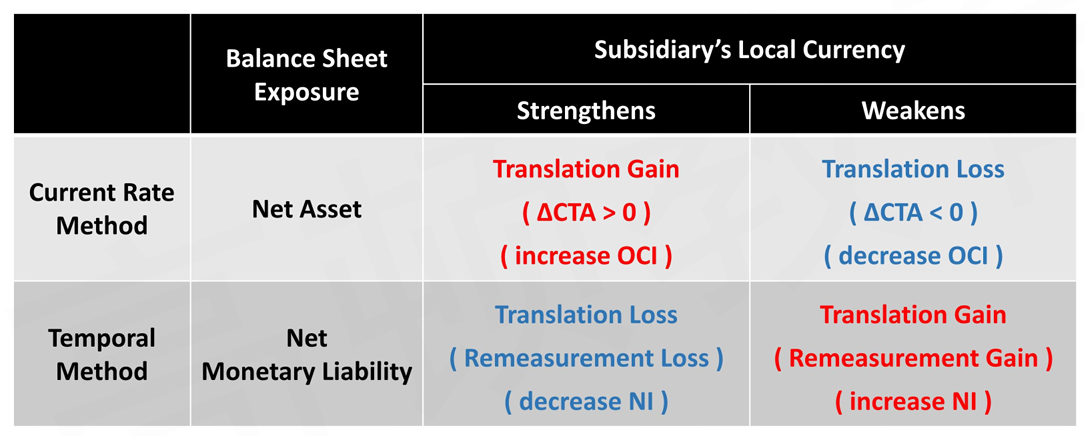

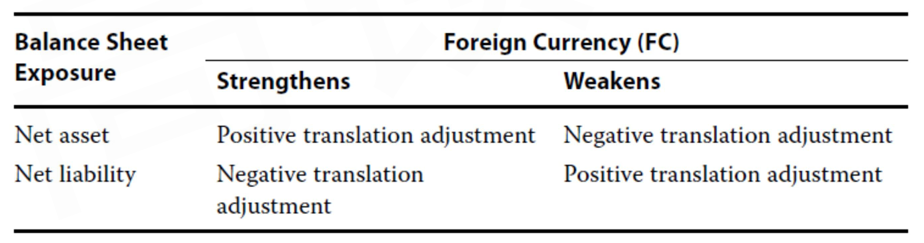

Balance Sheet Exposure

- Those assets and liabilities translated at the current exchange rate are revalued from balance sheet to balance sheet in terms of the parent company's presentation currency, and these items are said to be exposed to translation adjustment

- Balance sheet items translated at historical exchange rates do not change in parent currency value and therefore are not exposed to translation adjustment

- There is a net asset balance sheet exposure when exposed assets are greater than exposed liabilities

- A foreign operation will have a net asset balance sheet exposure when assets translated at the current exchange rate are greater than liabilities translated at the current exchange rate

- There is a net liability balance sheet exposure when exposed liabilities are greater than exposed assets

- A net liability balance sheet exposure exists when liabilities translated at the current exchange rate are greater than assets translated at the current exchange rate

- The sign (positive or negative) of the current period's translation adjustment is a function of two factors:

- The nature of the balance sheet exposure (asset or liability)

- The direction of change in the exchange rate (strengthens or weakens)

- Net Exposure Under Current Rate Method

- The current rate method results in a net asset balance sheet exposure Items

- Total assets >Total liabilities → Net asset balance sheet exposure

- When the foreign currency increases in value (i.e., strengthens), application of the current rate method results in an increase in the positive cumulative translation adjustment (or a decrease in the negative cumulative translation adjustment) reflected in stockholders' equity

- The cumulative translation adjustment will be the sum of the translation adjustments that arise over successive accounting periods

- Net Exposure Under Temporal Method

- The temporal method generates either a net asset or a net liability balance sheet exposure

- Liabilities translated at the current exchange rate (exposed liabilities) often exceed assets translated at the current exchange rate (exposed assets)

- Exposed assets < Exposed liabilities → Net liability balance sheet exposure

- When the foreign currency increases in value (i.e., strengthens), application of the temporal method results in a translation losses, which will reduce the net income for this year

Under Hyper-Inflationary Economies

Highly Inflationary Economies

- US GAAP define a highly inflationary economy as one in which the cumulative three-year inflation rate exceeds 100%(but note that the definition should be applied with judgment, particularly because the trend of inflation can be as important as the absolute rate)

- A cumulative three-year inflation rate of 100% equates to an average of approximately 26% per year

- IFRS does not provide a specific definition of high inflation, but indicates that a cumulative inflation rate approaching or exceeding 100% over three years would be an indicator of hyperinflation

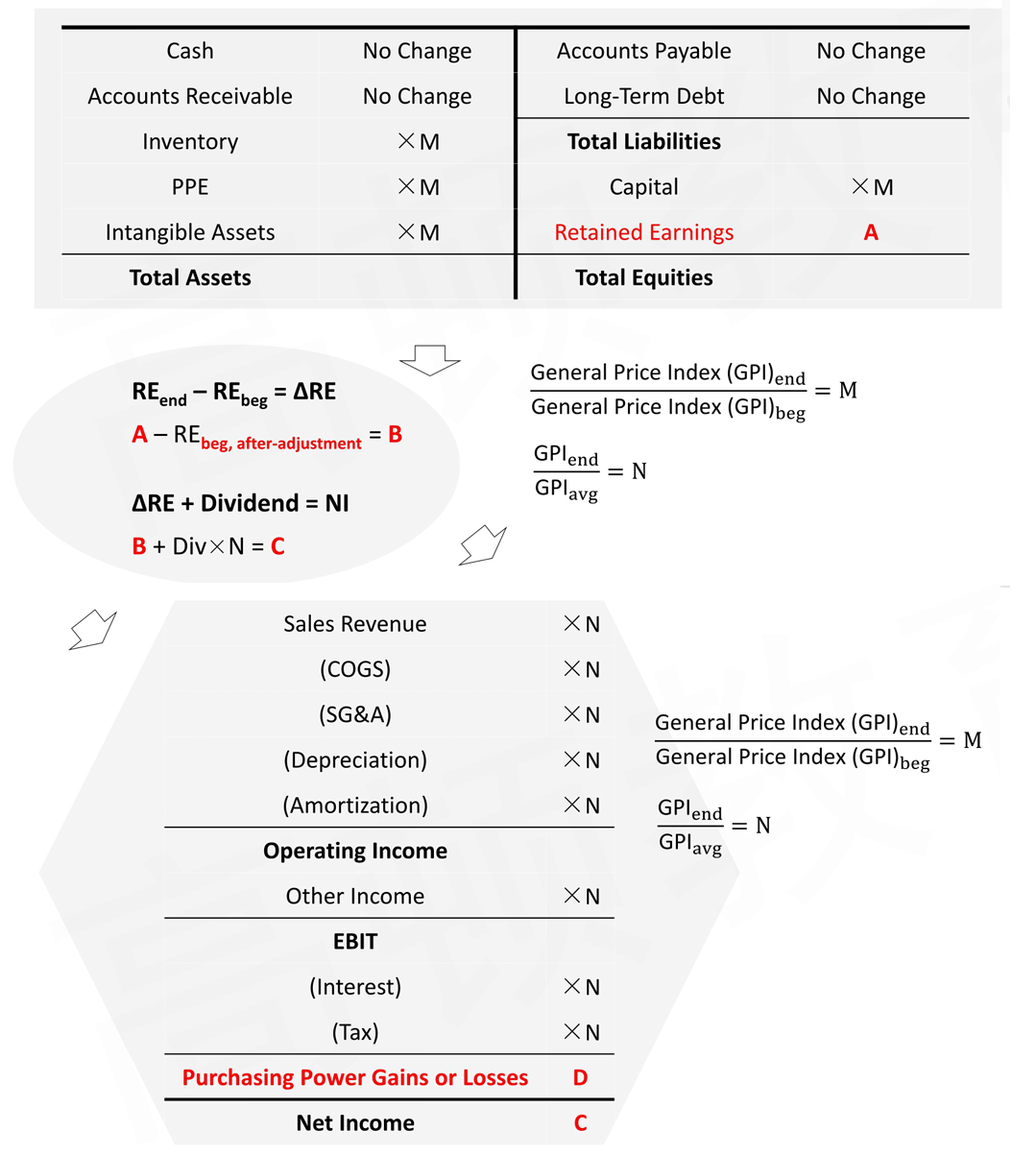

Accounting Principles for Highly Inflationary Economies

- When a foreign entity is located in a highly inflationary economy, the entity's functional currency is irrelevant in determining how to translate its foreign currency financial statements into the parent's presentation currency

- IFRS require that the foreign entity's financial statements first be restated for local inflation, and then the inflation-restated foreign currency financial statements are translated into the parent's presentation currency using the current exchange rate

- US GAAP do not allow restatement for inflation, but instead require using the temporal method

IFRS: Restated for Inflation

- IFRS require the foreign currency financial statements first to be restated for inflation using the following procedures, and then the inflation-adjusted financial statements are translated using the current exchange rate

- Balance Sheet

- Monetary assets and monetary liabilities are not restated because they are already expressed in terms of the monetary unit current at the balance sheet date

Monetary items consist of cash, receivables, and payables - Non-monetary assets and non-monetary liabilities are restated for changes in the general purchasing power of the monetary unit

Most non-monetary items are carried at historical cost, and the restated cost is determined by applying to the historical cost the change in the general price index from the date of acquisition to the balance sheet date - All components of stockholders'equity(except for retained earnings) are restated by applying the change in the general price level from the beginning of the period or, if later, from the date of contribution to the balance sheet date

Restated retained earnings are derived from all the other amounts in the restated statement of financial position

- Monetary assets and monetary liabilities are not restated because they are already expressed in terms of the monetary unit current at the balance sheet date

- Income Statement

- All income statement items are restated by applying the change in the general price index from the dates when the items were originally recorded to the balance sheet date

- The net gain or loss in purchasing power that arises from holding monetary assets and monetary liabilities during a period of inflation is included in net income

- Risk Exposure

- Only the monetary items, which are not restated for inflation, are exposed to inflation risk

- The effect of that exposure is reflected through the purchasing power gain or loss on the net monetary asset or liability position

Holding cash and receivables during a period of inflation results in a purchasing power loss

Holding payables during inflation results in a purchasing power gain

Analytical Issues

Review from the Previous Examples

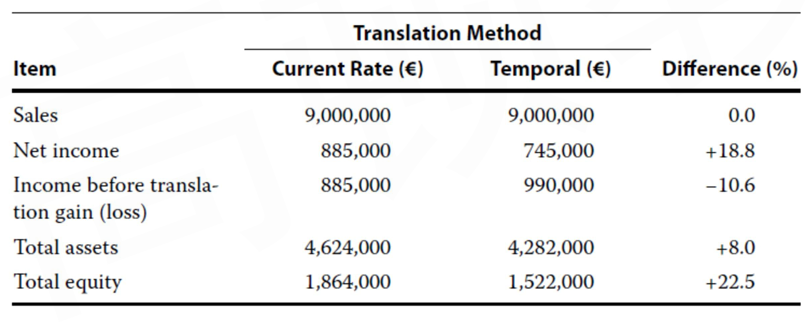

- In this particular case, the current rate method results in a significantly larger net income than the temporal method

- Part of the reason is that under the current rate method, the translation adjustment is not included in the calculation of income

- The combination of smaller net income under the temporal method and a positive translation adjustment reported on the balance sheet under the current rate method results in a much larger amount of total equity under the current rate method

- Total assets also are larger under the current rate method because all assets are translated at the current exchange rate, which is higher than the historical exchange rates at which inventory and fixed assets are translated under the temporal method

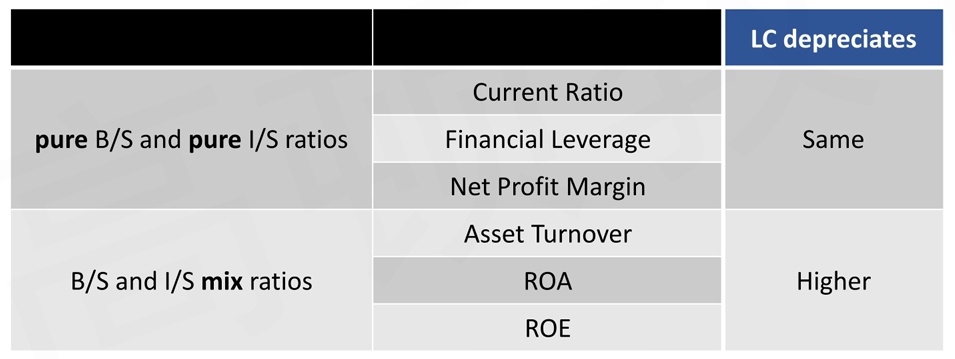

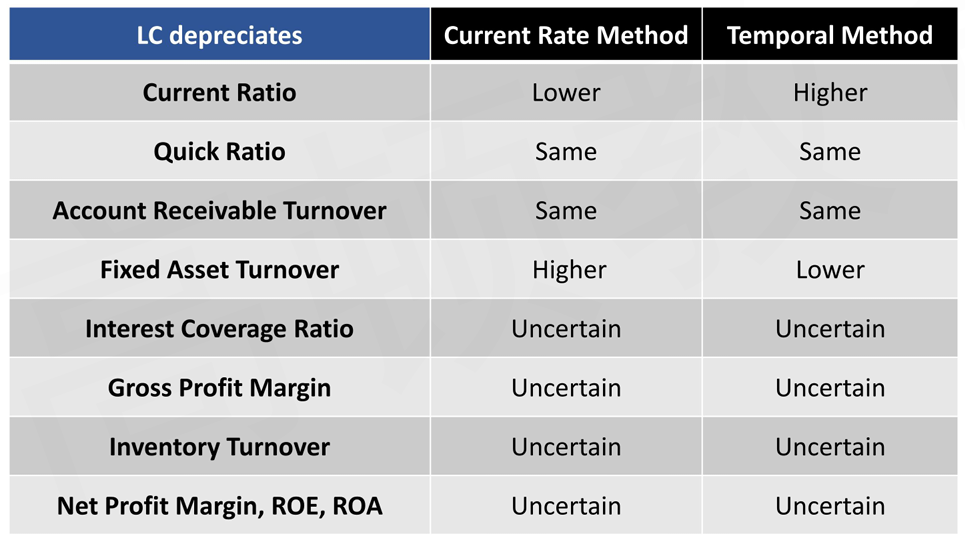

Ratio Analysis 1: Compared with Original Subsidiary's Ratio

- Financial ratios under current rate method

- Pure ratios are unaffected when translated by current rate method

- Mixed ratios should be analyzed case-by-case

- Financial ratios under temporal method: case-by-case analysis

Ratio Analysis 2: Comparison of Ratios under Two Methods

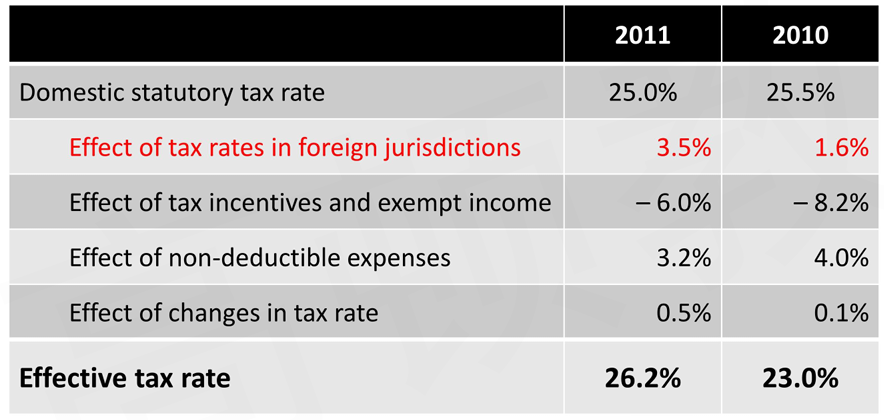

Multinational Operations and a Company's Effective Tax Rate

- An entity with operations in multiple countries with different tax rates could aim to set transfer prices such that a higher portion of its profit is allocated to lower tax rate jurisdictions

- An analyst can obtain information about the effect of multinational operations from companies' disclosure on effective tax rates

- The disclosure is presented as a reconciliation between the average effective tax rate (tax expense divided by pretax accounting profits) and the relevant statutory rate

- Changes in the effective tax rate impact of foreign taxes could be caused by 1) changes in the applicable tax rates and 2) changes in the mix of profits earned in different jurisdictions

Disclosures Related to Sales Growth

- For a multinational company, sales growth is driven not only by changes in volume and price, but also by changes in the exchange rates between the reporting currency and the currency in which sales are made

- Growth in sales that comes from changes in volume or price is more sustainable than growth in sales that comes from changes in exchange rates

- Thus, an analyst will consider the foreign currency effect on sales growth both for forecasting future performance and for evaluating a management team's historical performance

Analysis of Financial Institutions

Introduction of Financial Institutions

Introduction of Financial Institutions

- Financial institutions serve as intermediaries between providers and recipients of capital, facilitate asset and risk management, and execute transactions involving cash, securities, and other financial assets

- Types of financial institutions

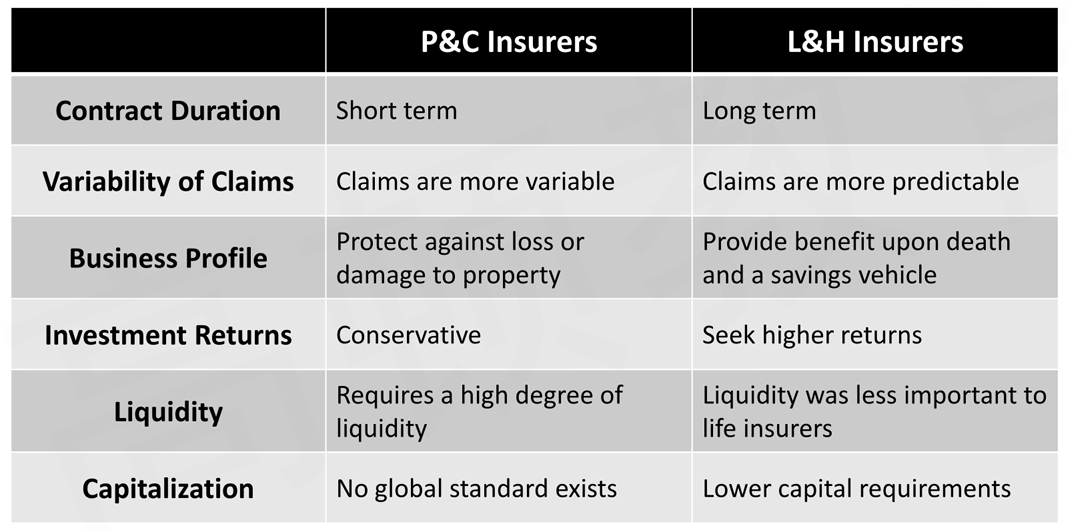

- Banks: deposit-taking, loan-making institutions

- Insurance companies: 1) life and health insurance companies 2) property and casualty insurance companies

- Others: investment banks, credit card companies, brokers, dealers,exchanges, clearing houses, depositories, investment managers,financial advisers, etc.

Features of Financial Institutions: Systemic Importance

- A distinctive feature of financial institutions is their systemic importance

- Banks are more likely to be systemically important than non-financial companies because, as intermediaries, they create financial linkages across all types of entities, including households, banks, corporates,and governments

- The network of linkages across entities means that the failure of one bank will negatively affect other financial and non-financial entities

- This is a phenomenon known as financial contagion传染病, which is a situation in which financial shocks spread from their place or sector of origin to other locales or sectors

Features of Financial Institutions: Heavily Regulated

- Because of their systemic importance, financial institutions'are heavily regulated

- Regulations address various aspects of a financial institution's operations,including the amount of capital that must be maintained, the minimum liquidity,and the riskiness of assets

- Financial regulations

- Basel Committee

- Financial Stability Board

- International Association of Deposit Insurer

- International Association of Insurance Supervisors (IAIS)

- International Organization of Securities Commissions (IOSCO)

Features of Financial Institutions:Assets and Liabilities

- The assets of banks are predominantly financial assets, such as loans and securities

- Compared to the tangible assets of non-financial companies,financial assets create direct exposure to a different set of risks, including credit risks, liquidity risks, market risks, and interest rate risks

- The liabilities of most banks are made up primarily of deposits

Analysis of Banks

Basel Committee

- The Basel Committee developed the international regulatory framework for banks known as Basel III

- The purposes of the measures contained in Basel lIll are the following

- Improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source

- Improve risk management and governance

- Strengthen banks' transparency and disclosures

Important Highlights of BaseI Accord III

- Minimum capital requirement

- Basel III specifies the minimum percentage of its risk-weighted assets that a bank must fund with capital

- This minimum capital requirement prevents a bank from assuming so much financial leverage that it is unable to withstand loan losses

- Minimum liquidity

- A bank must hold enough high-quality liquid assets to cover its liquidity needs in a 30-day liquidity stress scenario

- Stable funding

- A bank must have a minimum amount of stable funding relative to the bank's liquidity needs over a one-year horizon

Introduction of CAMELS Approach

- "CAMELS" is an acronym for the six components of a widely used bank rating approach originally developed in the United States: Capital adequacy, Asset quality, Management capabilities, Earnings sufficiency,Liquidity position, and Sensitivity to market risk

- Assign a numerical rating of 1 through 5 to each component

Rating 1: best practices in risk management and performance

Rating 5: poorest performance and risk management practices - Composite rating for the entire bank is constructed

Each component is weighted by the examiner (judgment involved)

- Assign a numerical rating of 1 through 5 to each component

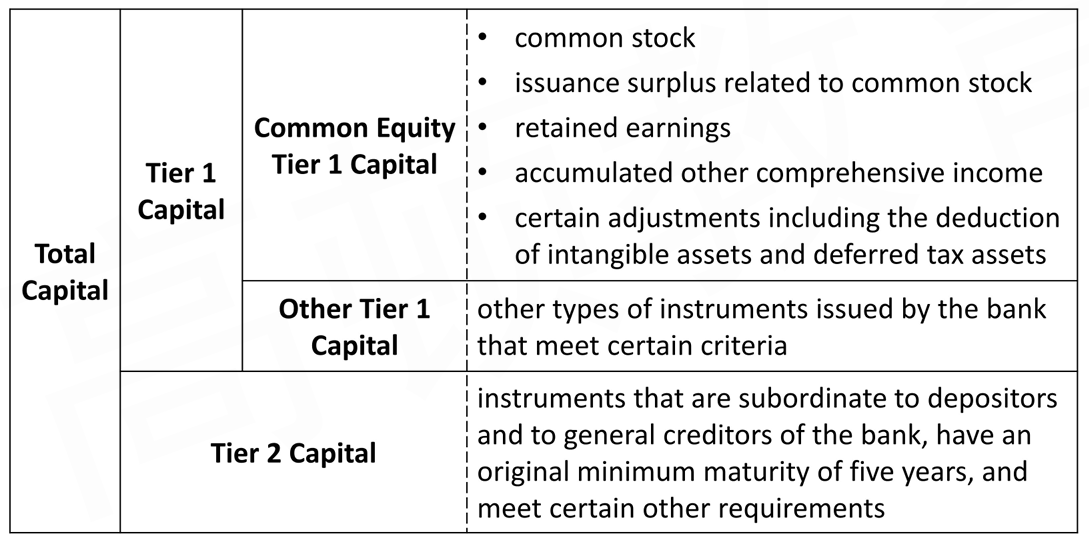

Capital adequacy

- Capital adequacy for banks is described in terms of the proportion of the bank's assets funded with capital