Currency Exchange Rates

Basics of FX notation

- Price currency/Base currency 价格/商品

- The price of the base currency expressed in terms of the price currency.

- Spot exchange rate: currency exchange rates for immediate delivery.

- Forward exchange rate: currency exchange rates for an exchange to be done in the future.

- Bid price and offer price

- Bid price买入价: the price that a dealer做市商愿意买入右币的价格 will pay per base currency unit.

- Offer price卖出价: the price that a dealer做市商愿意卖出右币的价格 will sell a unit of base

currency. - The offer price is always higher than the bid price.

- The counterparty of a dealer is to have either hit the bid(sell the base currency 毕业生美元换人民币) or paid the offer (buy the base currency 留学生人民币换美元).

- The bid-offer spread: The difference between the offer and bid price.

- Spreads are often stated as 'pips', except yen.

Example: the USD/EUR could be quoted as $1.4124~1.4128.The spread is $0.0004(4 pips). - The bid-offer spread a dealer provides to its clients is typically wider than the bid-offer spread in the interbank market.

- The spread quoted by a dealer to its clients depends on:

bid-ask spread quoted in the interbank market. 与interbank的spread联动

size of the transaction. 单笔交易量越大,风险越高,spread越大

relationship between the dealer and client. - Interbank spreads depend on:

currency pair involved.

time of day.

market volatility.

- Spreads are often stated as 'pips', except yen.

FX Caculation

- Cross rate calculation

\begin{aligned} & \left(\frac{\mathrm{A}}{\mathrm{B}}\right)_{b i d}=\left(\frac{\mathrm{A}}{\mathrm{C}}\right)_{b i d}\left(\frac{\mathrm{C}}{\mathrm{B}}\right)_{b i d} \\ & \left(\frac{\mathrm{~A}}{\mathrm{~B}}\right)_{a s k}=\left(\frac{\mathrm{A}}{\mathrm{C}}\right)_{a s k}\left(\frac{\mathrm{C}}{\mathrm{B}}\right)_{a s k} \\ & \left(\frac{\mathrm{~A}}{\mathrm{~B}}\right)_{b i d}=1/\left(\frac{\mathrm{B}}{\mathrm{A}}\right)_{a s k} \\ & \left(\frac{\mathrm{~A}}{\mathrm{~B}}\right)_{a s k}=1/\left(\frac{\mathrm{B}}{\mathrm{A}}\right)_{b i d}\end{aligned}- 计算原则为使结果的左右差值最大化,即左为小除以大或小乘以小,右为大除以小或大乘以大

- Triangular arbitrage

- Triangular arbitrage: If identical financial products are priced differently, then market participants will buy the cheaper one and sell the more expensive one until the price difference is eliminated.

- The bid quoted by a dealer in the interbank market cannot be higher than the current interbank offer. The offer quoted by a dealer in the interbank market cannot be lower than the current interbank bid. Interbank和Dealer的报价区间不重合就能套利, 间隔就是单位套利值

- The cross-rate bids (offers) posted by a dealer must be lower(higher) than the implied cross-rate offers (bids) available in the interbank market. 根据Interbank市场计算交叉汇率,与Dealer报价比较

- 将汇率写成回环格式,如A/B=...,B/C=...,C/A=...。若左汇率之积大于1,则可以使用任意右币利用左汇率依次兑换实现套利; 若右汇率之积小于1,则可以使用任意左币利用右汇率依次兑换实现套利

- Forward Exchange Rate

- At a forward premium: 远期升水更升值; a forward discount: 远期贴水更贬值

升贴水形式:左高右低贴水(如30/20),左低右高升水(如20/50)

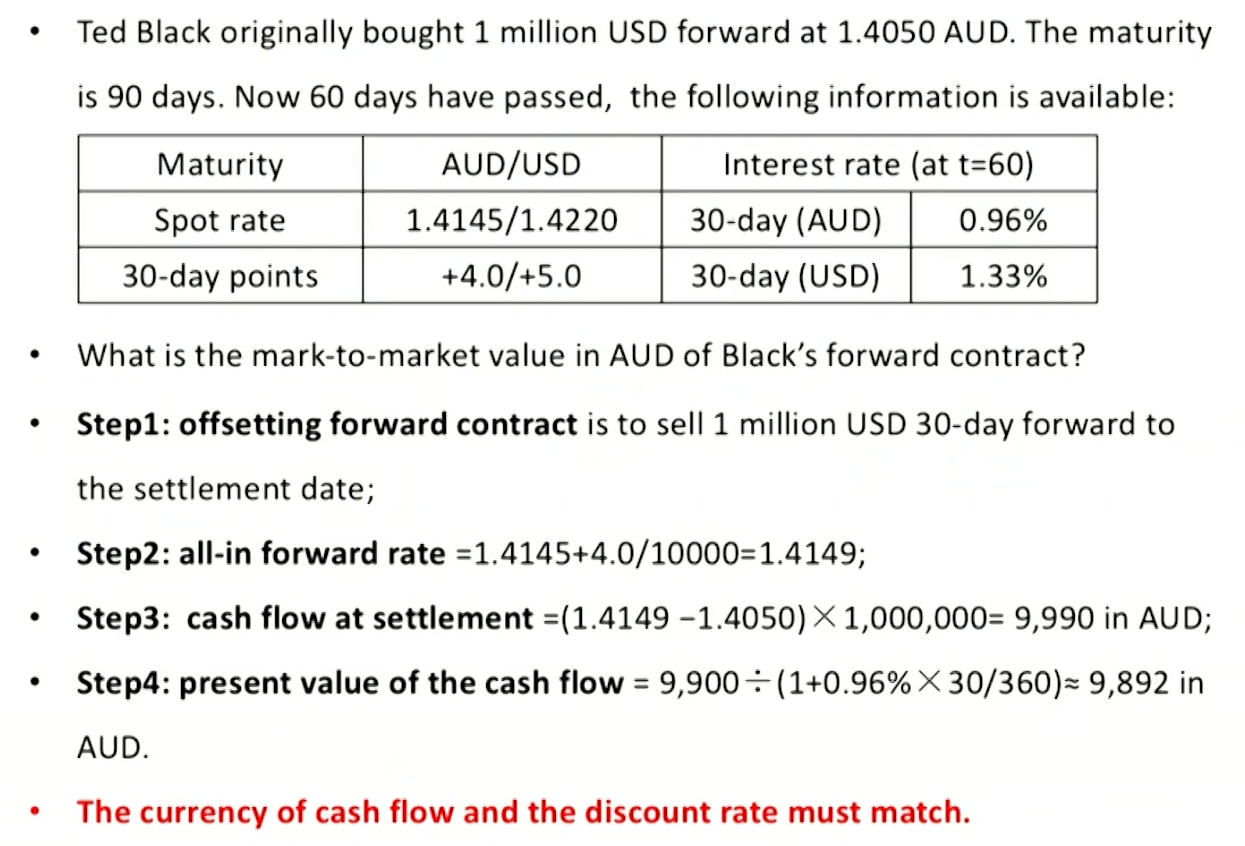

计算方式:使得结果的左右差值最大化,即贴水时小减大,升水时大加大 - Mark-to-market value盯市价值: the profit (or loss) that would be realized from closing out the position at current market prices.

To close out a forward position, we must offset it with an equal and opposite forward position using the spot exchange rate and forward points available in the market when the offsetting position is created. - The process for marking to market a forward position:

Step1: Create an offsetting forward position that is equal to the original forward position.

Step2: Determine the appropriate all-in forward rate for this new, offsetting forward position.

Step3: Calculate the cash flow at the settlement day.

Step4: Calculate the present value of this cash flow at the future settlement date.The currency of the cash flow and the discount rate must match. - example

- At a forward premium: 远期升水更升值; a forward discount: 远期贴水更贬值

International parity

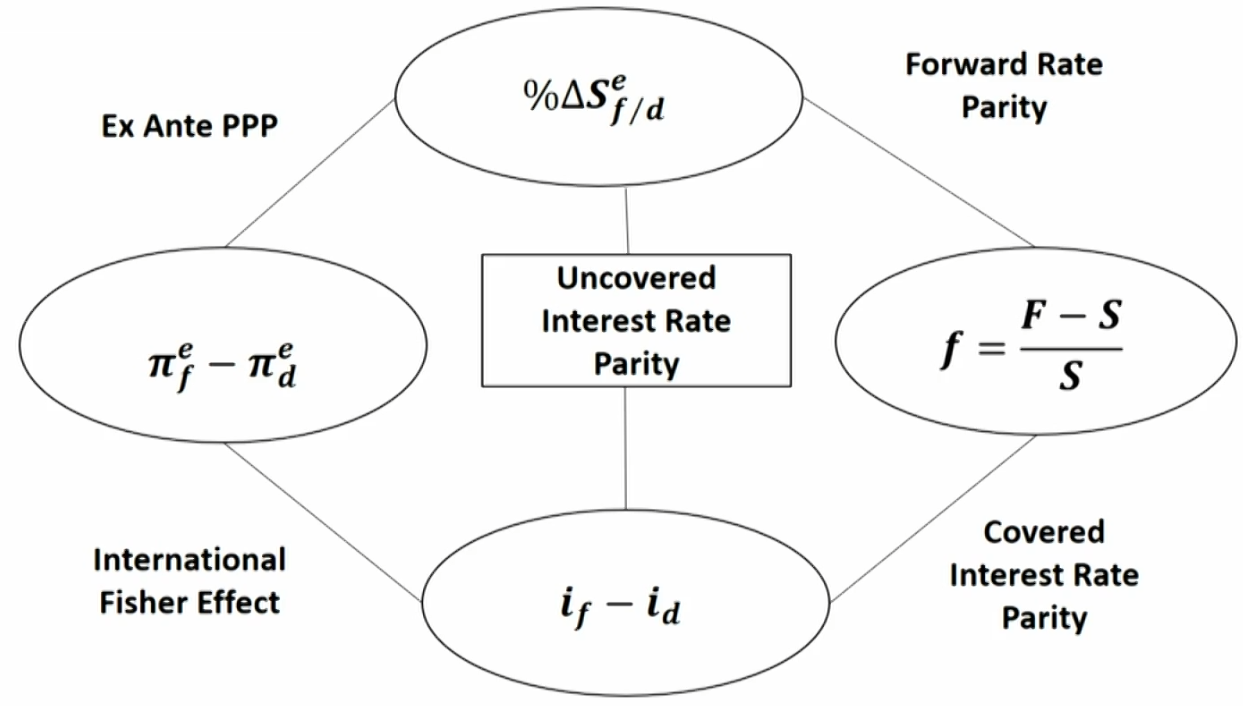

Overview of key international parity conditions

Interest rate parity

- Covered interest rate parity(CIRP): an investment in a foreign money market instrument that is completely hedged against exchange rate risk should yield exactly the same return as an otherwise identical domestic money market investment.

F_{f/d}=S_{f/d}\times\frac{1+i_{f}\times\frac{\text{days}}{360}}{1+i_{d}\times\frac{\text{days}}{360}}- The domestic currency will trade at a forward premium if the foreign risk-free interest rate exceeds the domestic risk-free interest rate

- Uncovered interest rate parity(UIRP): the change in spot rate over the investment horizon should, on average, equal the differential in interest rates between the two countries.

\begin{align} &S^e_{f/d}=S_{f/d}\times\frac{1+i_{f}\times\frac{\text{days}}{360}}{1+i_{d}\times\frac{\text{days}}{360}} \\ &\%\Delta S^e_{f/d}\approx (i_{f}-i_{d})\times\frac{\text{days}}{360} \end{align}- The investor is assumed to be risk-neutral

- The expected appreciation/depreciation of the exchange rate just offsets the yield differential.

- FX carry trade

- When UIRP does not hold, in a FX carry trade, an investor invests in a higher yielding currency using funds borrowed in a lower yielding currency(funding currency, d).

- During periods of low volatility, carry trades tend to generate positive returns, but they are prone to significant crash risk in turbulent times.

- Forward rate parity

- Forward rate parity (FRP): the forward exchange rate will be an unbiased predictor of the future spot exchange rate if both covered and uncovered interest rate parity hold. 预期汇率是远期汇率的无偏估计

- CIRP must hold because it is enforced by arbitrage.The question of whether FRP holds is thus dependent upon whether UIRP holds.

Purchasing power parity

- Absolute PPP: the equilibrium exchange rate between two countries is determined entirely by the ratio of their national price levels.

S_{f/d}=\frac{P_f}{P_d}- In practice, absolute PPP might not hold because the weights of the various goods in the two economies may not be the same(e.g., people eat more potatoes in Russia and more rice in Japan)

- Relative PPP: the percentage change in the spot exchange rate will be completely determined by the difference between the foreign and domestic inflation rate.

\%\Delta S_{f/d}=\frac{\pi_f-\pi_d}{\pi_d+1}\approx \pi_f-\pi_d - Ex-ante version of PPP asserts that the expected changes in the spot exchange rate are entirely driven by expected differences in national inflation rates.

\%\Delta S^e_{f/d}\approx \pi^e_f-\pi^e_d- Countries that are expected to run persistently high inflation rates should expect to see their currencies depreciate over time.

International Fisher effect

- Fisher effect

i={r}+\pi^{{e}} - International Fisher effect(If UIRP and ex-ante PPP both hold)

i_f-i_d=\pi_f^e-\pi_d^e- r_f=r_d is called real interest rate parity(RIRP).

Summary

- According to CIRP, arbitrage ensures that nominal interest rate spreads equal the percentage forward premium (or discount).

- According to UIRP, the expected percentage change of the spot exchange rate should, on average, be reflected in the nominal interest rate spread.

- If both CIRP and UIRP hold, then the forward exchange rate will be an unbiased predictor of the future spot exchange rate.

- According to the ex ante PPP, the expected change in the spot exchange rate should equal the expected difference between domestic and foreign inflation rates.

- Assuming the Fisher effect and RIRP hold in all markets, then the international Fisher effect holds.

- If ex ante PPP and the international Fisher effect hold, then UIRP holds

FX and BOP

Overview of BOP flows

- Over the long term, countries that run persistent current account deficits (net borrowers) often see their currencies depreciate because they finance their acquisition of imports through the continued use of debt. 经常账户影响长期

- However, investment/financing decisions are usually the ominant factor in determining exchange rate movements, at east in the short to intermediate term. 资本账户影响短期

Influence of current account on exchange rates

- Current account influences the path of exchange rates through the following mechanisms:

- The flow supply/demand channel

- The portfolio balance channel

- The debt sustainability channel

- Flow supply/demand channel 顺差 -> 外币增加 -> 外币需求减少 -> 外币贬值

- Country with persistent current account surpluses (deficits) would see their currencies appreciate (depreciate) over time.

- The amount by which exchange rates must adjust to restore current accounts to balanced positions depends on:

The initial gap between imports and exports.

The response of import and export prices to changes in the exchange rate.

The response of import and export demand to the change in import and export prices.

- Portfolio balance channel 顺差 -> 外币增加 -> 减持其它外币资产 -> 外币贬值

- Current account imbalances shift financial wealth from deficit nations to surplus nations.

- Nations running large current account surpluses versus the United States might find that their holdings of US dollar-denominated assets exceed the amount they desire to hold in a portfolio context. Actions they might take to reduce their dollar holdings to desired levels could then have a profound, negative impact on the dollar's value.

- Debt sustainability channel 逆差 -> 借债 -> 本币贬值

- If a country runs a large and persistent current account deficit over time, eventually it will experience an untenable rise in debt owed to foreign investors.

- If such investors believe that the deficit country's external debt is rising to unsustainable levels, they are likely to reason that a major depreciation of the deficit country's currency will be required at some point.

Influence of capital account on exchange rates

- As capital flows into (out) a country, demand for that country's currency increases (decreases), resulting in appreciation (depreciation).

- Global capital flows have helped fuel boom-like conditions in emerging market economies for a while before, suddenly and often without adequate warning, those flows reversed.

- Excessive emerging market capital inflows often plant the seeds of a crisis by contributing to:

- An unwarranted appreciation of the currency

- A huge buildup in external indebtedness

- An asset bubble

- A consumption binge消费狂热 that contributes to explosive growth in domestic credit and/or the current account deficit

- An overinvestment in risky projects and questionable activities

- Equity market trends and exchange rates

- Increasing equity prices can also attract foreign capital.

- Instability in the correlation between exchange rates and equity markets makes it difficult to form judgments on possible future currency moves based solely on expected equity market performance.

FX and monetary/fiscal policy

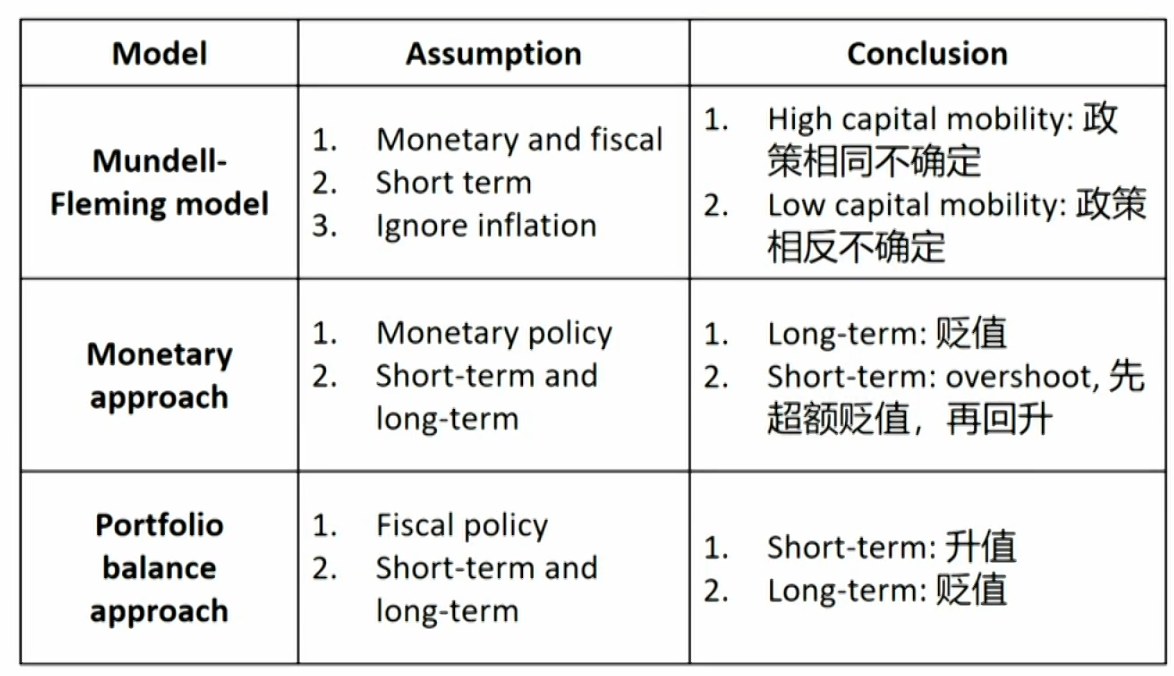

Mundell-Fleming model

- It describes how changes in monetary and fiscal policy within a country affect interest rates and economic activity, which in turn leads to changes in capital flows and trade and ultimately to changes in the exchange rate.

- Assume inflation plays no role.

- Mundell-Fleming approach focuses on the short-term implications of monetary and fiscal policy.

- Monetary-fiscal policy mix with high capital mobility高资金流动

- Expansionary monetary policy → interest rate decrease → investments and spending increase → capital flows to high-yielding countries → depreciation pressure

- Expansionary fiscal policy → spending increase or tax decrease → interest rate increase → capital flows being attracted from low-yielding countries → appreciation pressure

- Monetary-fiscal policy mix with low capital mobility

- Expansionary monetary policy → boost spending and import → worsen trade balance → depreciate pressure

- Expansionary fiscal policy → increase import → create trade deficit → depreciate pressure

Monetary approach

- Assume that output is fixed, so that monetary policy primarily through the price level and the rate of inflation.

- Pure monetary model: assuming that purchasing power parity holds, a money supply-induced increase (decrease) in domestic prices relative to foreign prices should lead to a proportional decrease (increase) in the domestic currency's value. 宽松货币政策 -> 立刻通胀 -> 本币贬值(长期)

- Dornbusch overshooting超调 model

- Assumes prices have limited flexibility物价黏性 in the short run but are fully flexible in the long run.

- Under an expansionary monetary policy, in the short term, exchange rates overshoot the long-run PPP implied values. The depreciation of currency is greater than the depreciation implied by PPP. In the long term, exchange rates gradually increase toward their PPP implied values. 宽松货币政策 -> 利率立刻下降并回升、通胀开始 -> 本币超额贬值(短期)再回升

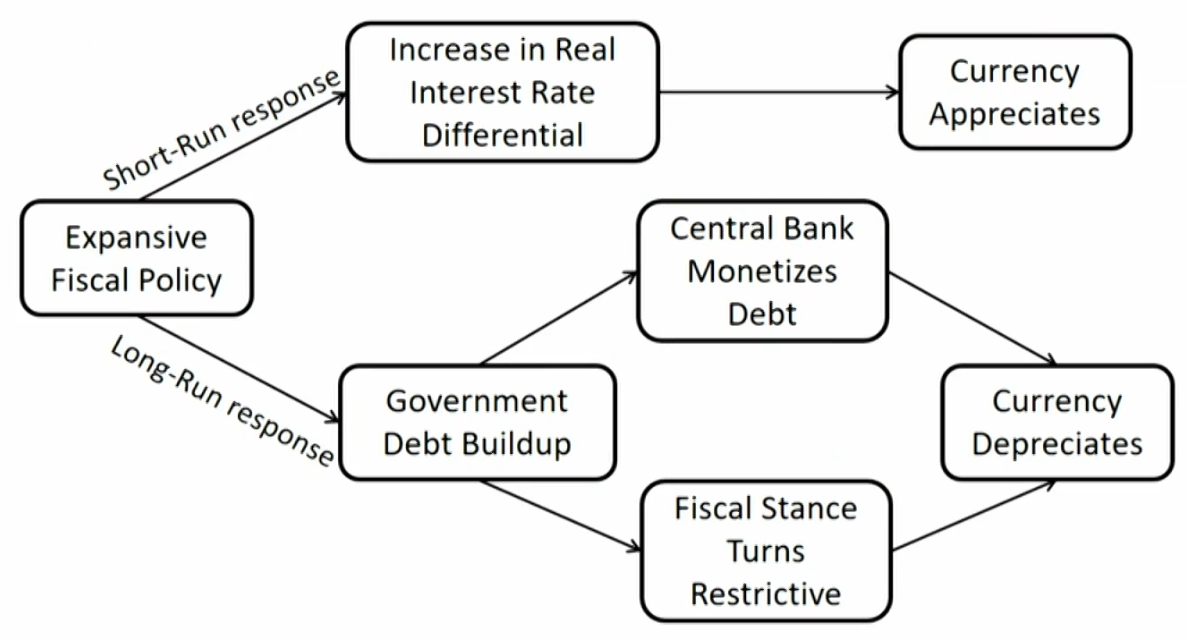

Portfolio Balance Approach

- Portfolio balance model focuses on the long-term implications of fiscal policy on currency values.

- Continued increases in fiscal deficits are unsustainable and investors may refuse to fund the deficits. The government will have to monetize its debt (i.e., print money), leading to currency depreciation.

- In the long term, the government has to reverse course (tighter budgetary policy) leading to depreciation of the domestic currency.

FX Management and Currency Crisis

Government intervention and capital controls

- Capital flows can be both a blessing and a curse. Governments resist excessive inflows and currency bubbles by using capital controls and direct intervention (selling their currency) in the foreign exchange market.

- Key issue for policymakers:

- preventing currencies from appreciating too strongly

- reducing the aggregate volume of capital inflows

- enabling monetary authorities to pursue independent monetary policies

- Effectiveness of direct government intervention

- The effect of intervention in developed market economies is limited.

- Emerging market central banks appear to be in a stronger position than their developed market counterparts to influence the level and path of their exchange rates.

Warning signs of a currency crisis

- Prior to a currency crisis, the capital markets have been liberalized to allow the free flow of capital.

- There are large inflows of foreign capital (relative to GDP) in the period leading up to a crisis, with short- term funding denominated in a foreign currency being particularly problematic.

- Currency crises are often preceded by(and often coincide with) banking crises.

- Countries with fixed or partially fixed exchange rates are more susceptible to currency crises than countries with floating exchange rates.

- The ratio of exports to imports (known as "the terms of trade, ToT") often deteriorates before a crisis.

- In the period leading up to a crisis, the currency has risen substantially relative to its historical mean.

- Inflation tends to be significantly higher in pre-crisis periods compared with tranquil periods.

- Foreign exchange reserves tend to decline precipitously as a crisis approaches.

- Broad money growth and the ratio of M2(a measure of money supply) to bank reserves tend to rise prior to a crisis.

Economic Growth

Importance of economic growth

- Some of the key institutions and requirements for growth

- Savings and investment

- Financial markets and intermediaries

- Political stability, rule of law, and property rights

- Education and health care systems

- Tax and regulatory systems

- Free trade and unrestricted capital flows

- Why potential growth matters to equity investors

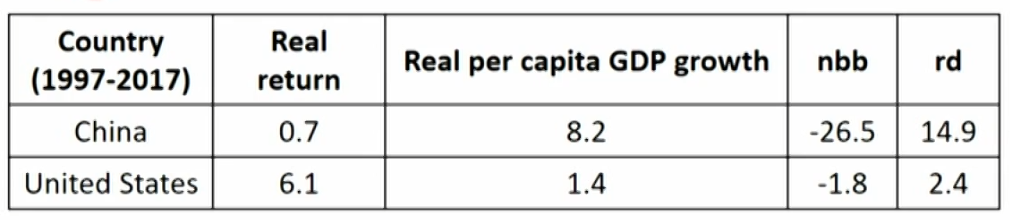

- Relationship between economic growth and equity return: Grinold-Kroner(2002)

E(Re)

= dividend yield + expected capital gain

= dividend yield + expected repricing + earnings growth per share

= dividend yield + expected repricing + inflation rate + real economic growth + change in shares outstanding

= dy + ∆(P/E) + i + g + ∆S - E(Re) = dy + ∆(P/E) + i + g + ∆S, overtime:

dy: the dividend yield, fairly stable

∆(P/E): the expected repricing term, volatility in the market's P/E ratio over market cycles.

i+g+∆S: Earnings growth per share can be expressed as a function of inflation, real economic growth, and change in the number of shares traded in the market.

∆S: Net buybacks (nbb, 回购减增发,越大则E(Re)越大) + relative dynamism (rd, 中小型非上市公司数量,越小则E(Re)与g越相关)

- Economic growth does not guarantee that existing equity investors capture the new wealth created.

- Relationship between economic growth and equity return: Grinold-Kroner(2002)

- Why potential growth matters to fixed income investors

- Higher rates of potential GDP growth translate into higher real interest rates and higher expected real asset returns in general.

- Potential GDP and its growth rate also affect:

general credit quality of fixed income securities.

the likelihood of a change in central bank policy.

credit risk of sovereign debt or government- issued debt.

the budgetary balance that would exist.

Production function

Cobb-Douglas production function

- Production Function

- Two-factor production function: Y = AF(K, L)

- Cobb-Douglas production function: Y=AK^a L^{1-a}

- A is total factor productivity, a is the share of GDP paid out to the suppliers of capital.

- Two important properties:

- Constant returns to scale规模报酬不变: increasing all inputs by a fixed percentage leads to the same percentage increase in output.

- Diminishing marginal productivity边际报酬递减: at some point the extra output obtained from each additional unit of the input will decline, keeping the other inputs unchanged.

- Output per worker or labor productivity:

Y / L=\left(A K^\alpha L^{1-\alpha}\right) / L=A(K / L)^\alpha\Rightarrow y=Ak^\alpha- A value of a close to zero means diminishing marginal returns to capital are very significant and the extra output made possible by additional capital declines quickly as capital increases. A越小,边际递减越明显

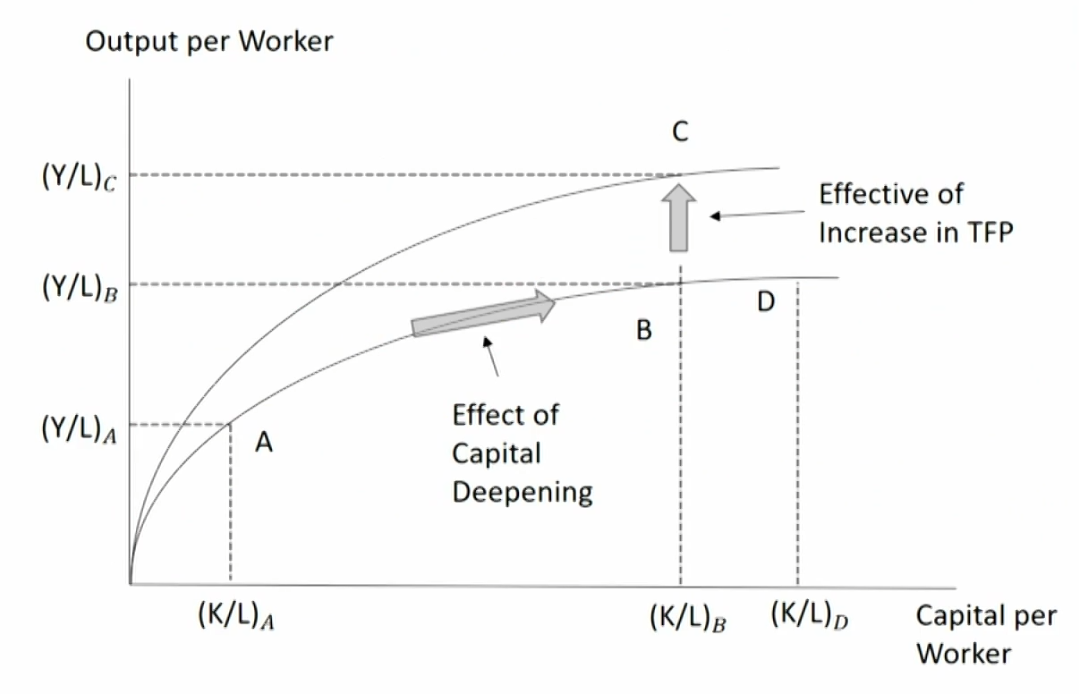

- Capital deepening vs. technological progress

- Capital deepening, an increase in the capital-to-labor ratio, is reflected in the exhibit by a move along the production function from point A to B.

- From B to D, further additions to capital have relatively little impact on per capita output

- Economy reaches steady state, where the marginal product of capital equals its marginal cost, capital deepening is useless.

- From B to C, an improvement in TFP causes a proportional upward shift in the entire production function.

Solow's growth accounting equation

- Growth accounting

- Solow's growth accounting equation

\frac{\Delta Y}{Y}=\frac{\Delta A}{A}+\alpha\frac{ \Delta K}{K}+(1-\alpha)\frac{\Delta L}{L} - Growth rate in potential GDP = long-term growth rate of technology + α(long-term growth rate of capital) +(1-α)(long-term growth rate of labor)

- α is the elasticity of output with respect to capital.

- Rate of technological change is not directly measured and must therefore be estimated.

- Solow's growth accounting equation

- Labor productivity growth accounting equation

\frac{\Delta Y}{Y}=\frac{\Delta y}{y}+\frac{ \Delta L}{L}- Growth rate in potential GDP = long-term growth rate in labor productivity + long-term growth rate of labor.

- It avoids the need to estimate the capital input and the difficulty associated with computing total factor productivity.

Extending the production function

- A more complete specification of the production function expands the list of inputs to include the following:

Y=A F\left(N, L, H, K_{I T}, K_{N T}, K_P\right)- N: Raw materials

- L: Quantity of labor

- H: Human capital

- A: Technological knowledge

- K_{IT}: ICT capital

- K_{NT}: Non-ICTcapital

- K_{P}: Publiccapital

- Natural Resources

- Natural resources includes renewable resources and non-renewable resources.

- Ownership and production of natural resources is not necessary for a country to achieve a high level of income.

- Dutch disease: where currency appreciation driven by strong export demand for resources makes other segments of the economy, in particular manufacturing, globally uncompetitive.

- Labor Supply

- Population growth (fertility出生 and mortality死亡 rates, the age mix of the population).

- Labor force participation

- Net immigration

- Average hours worked

- Human Capital劳动力素质

- Human capital is the accumulated knowledge and skills that workers acquire from education, training, or life experience.

- Education may have a spillover or externality impact溢出效应,对其它因素有正面效果

- Education encourages growth through innovation.

- ICT and Non-ICT Capital

- Impact of investment spending on available capital depends on the existing physical capital stock.

- The composition of investment spending and the stock of physical capital matters for growth and productivity.

ICT investment: spending on information, computers, and telecommunications equipment. Network externalities: the more people in the network,the greater the potential productivity gains.

Non-ICT investment: includes non-residential construction,transport equipment, and machinery. - Although diminishing marginal productivity will eventually limit the impact of capital deepening, investment-driven growth may last for a considerable period of time.

- Technology

- Technology allows an economy to overcome limits imposed by diminishing marginal returns and results in an upward shift in the production function.

- Technological change can be embodied in human capital and ICT and non-ICT capital, hence investments are important.

- infrastructure

- Roads, bridges, municipal water, dams, and, in some countries,electric grids are all examples of public capital.

- As with R&D spending, the full impact of government infrastructure investment may extend well beyond the direct benefits of the projects because improvements in the economy's infrastructure generally boost the productivity of private investments.

Theories of growth

Classical growth theory(by Thomas Malthus)

- The key assumption underlying the classical model is that population growth accelerates when the level of per capita income rises above the subsistence income, which is the minimum income needed to maintain life边际效用导致产出增加落后于人口增加,因此增长有上限

- Technological advances → labor productivity↑ → higher population growth → diminishing marginal returns of labor → per capita income↓

- The classical model predicts that in the long run, the adoption of new technology results in a larger but not richer population.

- Thus, the standard of living is constant over time even with technological progress, and there is no growth in per capita output.最终人均产出恒定不变

Neoclassical growth theory(by Robert Solow)

- The objective of the neoclassical growth model is to determine the long-run growth rate of output per capita and relate it to:

- savings/investment rate

- rate of technological change

- population growth

- Attempt to find the equilibrium position toward which the economy will move.长期稳态

- This equilibrium is the balanced or steady-state rate of growth that occurs when the output-to-capital(Y/K) ratio is constant. Growth is balanced in the sense that capital per worker and output per worker grow at the same rate(g^\ast). Assuming that \theta is the growth rate of TFP:

\begin{align}&y=A k^a \Rightarrow \Delta y / y=\Delta A / A+\alpha \Delta k / k \\& \Delta y / y=\Delta k / k \Rightarrow \Delta k / k=\Delta A / A+\alpha \Delta k / k \\& g^*=\Delta y / y=\Delta k / k=\frac{\Delta A / A}{1-\alpha}=\frac{\theta}{1-\alpha}\end{align} - Sustainable growth rate of output (G^\ast) is equal to the sustainable growth rate of output per capita, plus the growth of labor. Assuming n is the growth rate of labor:

\begin{align}&Y=y \mathrm{~L} \Rightarrow \Delta Y / Y=\Delta y / y+\Delta L / L \\ &{G}^*=\Delta {Y} / {Y}=\frac{{\theta}}{1-\alpha}+\Delta L / L=\frac{{\theta}}{1-\alpha}+{n}\end{align}

- This equilibrium is the balanced or steady-state rate of growth that occurs when the output-to-capital(Y/K) ratio is constant. Growth is balanced in the sense that capital per worker and output per worker grow at the same rate(g^\ast). Assuming that \theta is the growth rate of TFP:

- In closed economy, investment must be funded by domestic saving: I = sY,

- s is the fraction of income (Y) that is saved.储蓄率

- Physical capital stock depreciates at a constant rate \delta.

- In the steady state, the output-to-capital ratio is constant

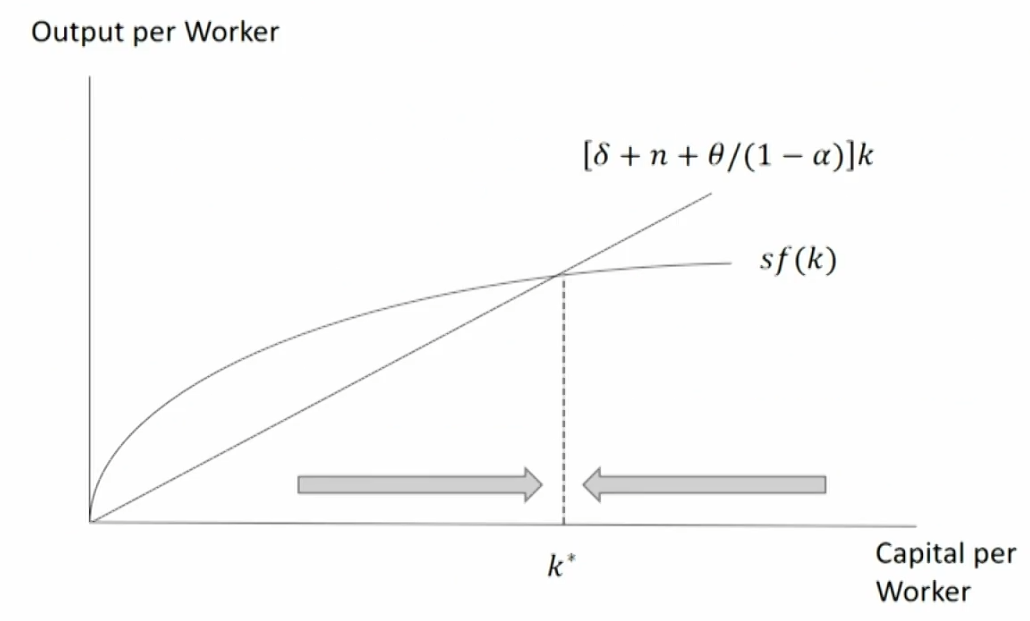

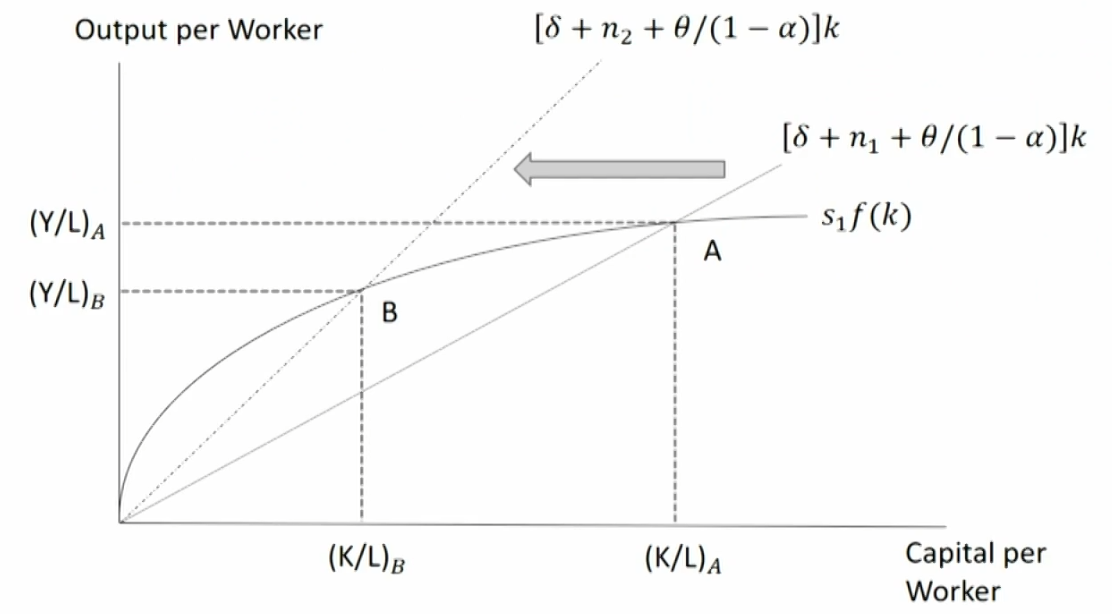

Y / K=\frac{1}{s}\left[\frac{\theta}{1-\alpha}+\delta+n\right] \equiv \psi - Reform

s y=sf(k)=\left[\frac{\theta}{1-\alpha}+\delta+n\right] k - Steady state equilibrium occurs at the point where savings and actual gross investment per worker (sy) are sufficient to:

Provide capital for new workers entering the workforce at rate n.

Replace plant and equipment wearing out at rate n.

Deepen the physical capital stock at the rate \theta/(1-\alpha).

- Steady state in the Neoclassical model:

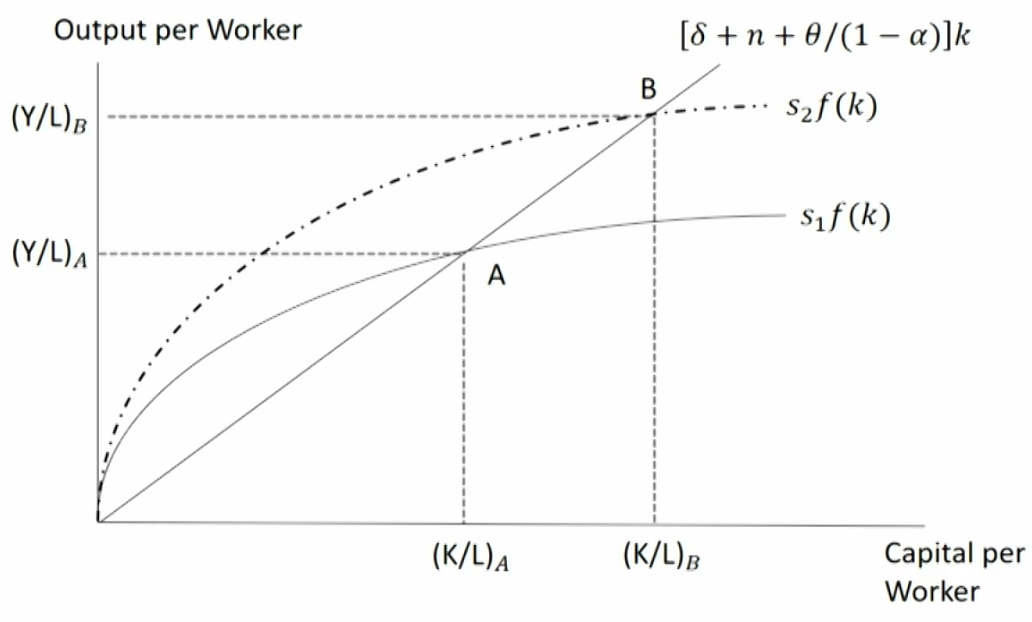

- Impact on the steady state: Increase in the saving rate

储蓄率增加使得人均资本和人均产出增加,但增速不变g^\ast=\theta/(1-\alpha)

- Impact on the steady state: Increase in labor force growth

- Impact on the steady state: Increase in the saving rate

- Implications of the model

- Capital accumulation

Capital accumulation affects the level of output but not the growth rate in the long run. 增加资本投入可以增加产出,但产出增长率不变

Regardless of its initial capital-to-labor ratio or initial level of productivity, a growing economy will move to a point of steady-state growth.最终达到稳态

In a steady state, the growth rate of output equals n+\theta/(1-\alpha) - Capital deepening vs.technology

Rapid growth that is above the steady-state rate occurs when countries first begin to accumulate capital; but growth will slow as the process of accumulation continue资本投入对产出的促进作用会逐渐减小

Because of diminishing marginal returns to capital, the only way to sustain growth in potential GDP per capita is through technological change or growth in total factor productivity.提升科技对产出的促进作用可持续 - Effect of savings on growth

The initial impact of a higher saving rate is to temporarily raise the rate of growth in the economy. The economy moves to a higher level of per capita output.储蓄率提高可以短期内刺激产出的增速

Once an economy achieves steady-state growth, the growth rate does not depend on the percentage of income saved or invested. Higher savings cannot permanently raise the growth rate of output.长期会达到稳态无法刺激增速

- Capital accumulation

Endogenous growth theory

- Unlike the neoclassical model, there are no diminishing marginal returns to capital for the economy as a whole in the endogenous growth models.认为资本投入不会边际递减

- Capital accumulation is the main factor accounting for long-run growth.产出的长期增长依赖资本投入

- R&D expenditures have potentially large positive externalities or spillover effects.资本投入中最重要的是研发

- In the endogenous growth model, the economy does not reach a steady growth rate.不存在稳态

- Instead, saving and investment decisions can generate self-sustaining growth at a permanently higher rate.高产出增速是可维持的

- A higher saving rate(s) implies a permanently higher growth rate.储蓄促进产出增速

Convergence debate

- Absolute convergence绝对趋同: developing countries, regardless of their particular characteristics, will eventually catch up with the developed countries and match them in per capita output.发展中国家与发达国家人均产出会趋同

- The neoclassical model assumes that all countries have access to the same technology, this implies convergence of per capita growth rates among all countries.

- The neoclassical model does not imply absolute convergence.新古典经济增长模型认为人均产出增速趋同而不是人均产出趋同

- Conditional convergence条件趋同: convergence is conditional on the countries having the same saving rate, population growth rate,and production function.

- If these conditions hold, the neoclassical model implies convergence to the same level of per capita output and the same steady state growth rate.满足这些条件后新古典经济增长模型认为能够实现趋同

- Club convergence俱乐部趋同: only rich and middle-income countries that are members of the club are converging to the income level of the richest countries in the world.相似国家之间趋同

- Poor countries can join the club if they make appropriate institutional changes. 制度改革才能进入不同club

- Countries may fall into a non-convergence trap if they do not implement necessary institutional reforms.

- If convergence, and especially club convergence, does occur,investing in countries with lower per capita incomes that are members of the club should, over long periods, provide a higher rate of return than investing in higher-income countries.

- Convergence between developed and developing countries can occur in two ways:

- Convergence through capital accumulation and capital deepening

- Convergence through imitating or adopting technology from developed countries.

- In contrast to the neoclassical model, the endogenous growth model makes no prediction that convergence should occur. 内生增长理论认为趋同不会实现

- The endogenous growth model allows for countries that start with high per capita income and more capital to grow faster and stay ahead of the developing countries.

Opening up

- Opening up the economy can affect growth rate because:

- A country can borrow or lend funds in global markets.

- Countries can shift resources into industries in which they have a comparative advantage.

- Companies have access to a larger, global market for their products.

- Countries can import technology.

- Global trade increases competition in the domestic market.

- Extension of the Neoclassical model

- According to the neoclassical model, convergence should occur more quickly if economies are open and there is free trade and international borrowing and lending.

- Extension of the Endogenous model

- In contrast to the neoclassical model, endogenous growth models predict that a more open trade policy will permanently raise the rate of economic growth.